Masayoshi Son, who once talked with Jack Ma for 6 minutes, invested $20 million, has now fallen into trouble. This time, he fell into the hands of a global unicorn with a valuation of over 8.4 billion yuan.

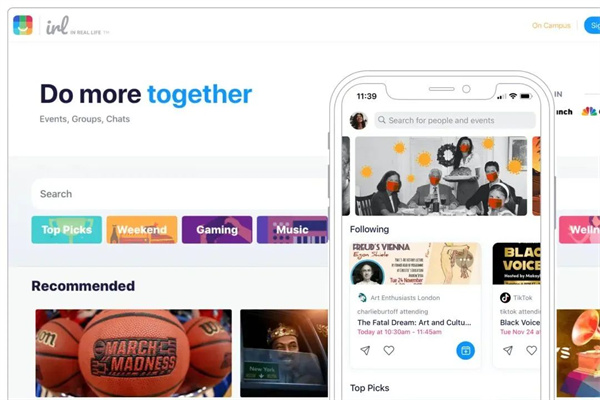

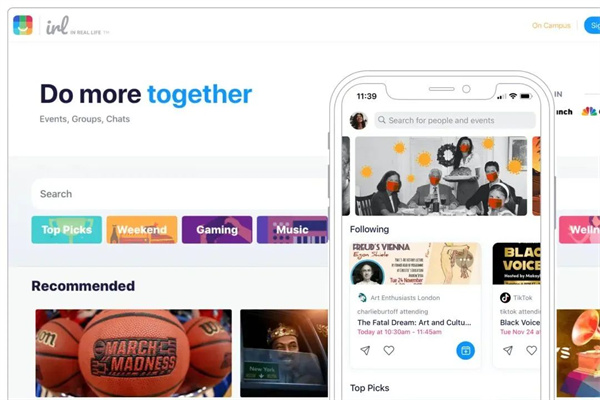

Recently, the emerging social platform IRL (IN REAL LIFE) announced that the company will be closed because up to 95% of the "20 million users" claimed by the company's founder are disguised by robots.

At present, the IRL official website has been announced to be closed.

From becoming Facebook's rival to being exposed and falsified, what happened to this company that caused Masayoshi Son to fall?

01. 20 million users, 95% are robots

As a former social platform upstart, IRL was established in 2017 and is positioned as an offline event community tool that distinguishes it from traditional social platforms such as Facebook.

It is understood that former IRL founder and CEO Abraham Shafi once publicly stated that within 15 months after the outbreak, the IRL user base achieved 400% growth, with 20 million users and 12 million monthly active users.

Based on such a unique positioning and strongly growing number of users, IRL has been favored by Masayoshi Son.

In June 2021, IRL's Series C financing was led by SoftBank Vision 2 Fund, a subsidiary of SoftBank Group, with a financing amount of US$170 million (approximately RMB 1.233 billion).

With this huge financing, IRL was in the limelight for a while and was selected into the "2021 Global Unicorn List" of Hurun Research Institute, with a valuation of US$1.17 billion (approximately RMB 8.485 billion).

But what is interesting is that at the end of 2022, IRL was suddenly exposed to lay off 25% of its employees . Under this sudden wave of layoffs, the outside world began to doubt the business conditions of IRL.

In response, Shafi said that the social software WhatsApp uses a small team of 55 people to serve 450 million users, and there are too many IRL people.

But the layoffs eventually became the fuse. IRL internal employees began to question the authenticity of IRL's 20 million monthly users. Meanwhile, the SEC began an investigation into the company's violations of securities laws and misleading investors. At the same time, the IRL board of directors has also begun to conduct internal self-inspections.

As the investigation deepened, the results were astonishing: As much as 95% of the "20 million users" Shafi mentioned were robot accounts, and there were only 1-2 million real users.

This speechless incident led to the majority shareholder's decision to close the company.

At present, the IRL official website has shown "closed at 12 noon on June 27." The IRL app has been removed from the iOS app store.

02. Reduced holdings of 240 million Alibaba stocks, and Masayoshi Son cashed in and saved himself

In 2021, SoftBank Group's net loss attributable to its parent company shareholders reached 1.7 trillion yen (approximately RMB 89.9 billion), setting a record of loss; in August 2022, SoftBank Group released its second-quarter financial report, losing more than US$23 billion (approximately RMB 155 billion) in the past three months;

There is no doubt that this is another record loss, which once again has become the biggest hole in venture capital history. On August 3 last year, Fortune magazine released the list, and among the Fortune 500 companies, SoftBank Group ranked first in the loss list.

The most shocking case is the Korean e-commerce giant Coupang, where SoftBank's floating losses in this company have reached US$2.37 billion. What is surprising is that just a year ago, Coupang was another classic investment after Alibaba.

Coupang, known as the Korean version of Alibaba, was successfully listed on the New York Stock Exchange in March 2021. In addition to the stock price rising sharply on the first day, the decline in the first quarter of last year was as high as an astonishing 40%. The latest market value was only about US$34 billion, which made SoftBank also lose money all the way.

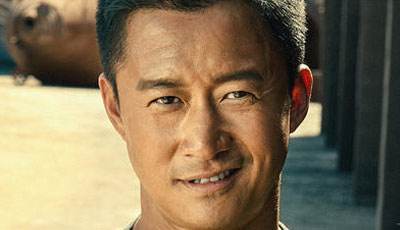

In comparison, Masayoshi Son's investment in Alibaba more than 20 years ago is SoftBank's most successful classic case so far. Masayoshi Son initially invested $20 million in Jack Ma and once claimed that he made $150 billion in investment in Alibaba.

Since Alibaba went public, whenever SoftBank Group faces a crisis, it almost chooses to sell Alibaba and cash out to "rescue itself".

In 2016, SoftBank reduced its holdings in Alibaba for the first time, cashing out more than US$10 billion to establish the world's largest venture capital fund;

In 2019, SoftBank sold 73 million shares of Alibaba's American depositary stocks again, with cashing out of over US$13 billion, and its shareholding ratio dropped to 25.8%;

SoftBank lost 1.35 trillion yen in 2020, and at the end of March that year, it said it would cash out $14 billion from Alibaba.

In 2021, SoftBank once again faced a huge debt crisis and epic losses, and reducing its holdings in Alibaba to fill the holes has become a life-saving straw for Son.

Some media said that as of 2022, SoftBank has reduced its holdings of 240 million Alibaba shares.

03. The former "investment giant" will also fail

The poor achievements of Vision Fund have made many people use "falling from the altar" to describe the current Masayoshi Son, which is in sharp contrast to the legendary genius investor in people's memory.

Looking back, Alibaba's great success almost became a masterpiece of Masayoshi Son . In the following years, due to the unprecedented development of the venture capital industry and the sharp increase in competitors, SoftBank missed many good projects, and finding the next Alibaba plan almost became a delusion.

But those who dare to spend a lot of money are indeed more likely to get rich returns than ordinary people, and the dangers are also terrifying, which is destined that SoftBank and Masayoshi Son will repeatedly experience the ups and downs of life.

But no matter what, SoftBank still has capital, and Masayoshi Son was not defeated . What will happen to such a "gambler" in the future? No one of us can draw a conclusion now, but the failure of multiple investments may give this legendary investor more inspiration...

![#Laogao E-commerce Newsletter# [E-commerce Morning News on December 15]](/update/1607993309l713372883.jpg)

EN

EN CN

CN