1. E-commerce growth data over the years

In my previous article, "The e-commerce market fell by 10.2%, the lowest since 2003", I mentioned: In April 2022, the total online retail sales nationwide fell by 10.2% year-on-year! This is the first time that the e-commerce industry has seen a sharp decline in a single month in the 19-year development history since Taobao was born in 2003.

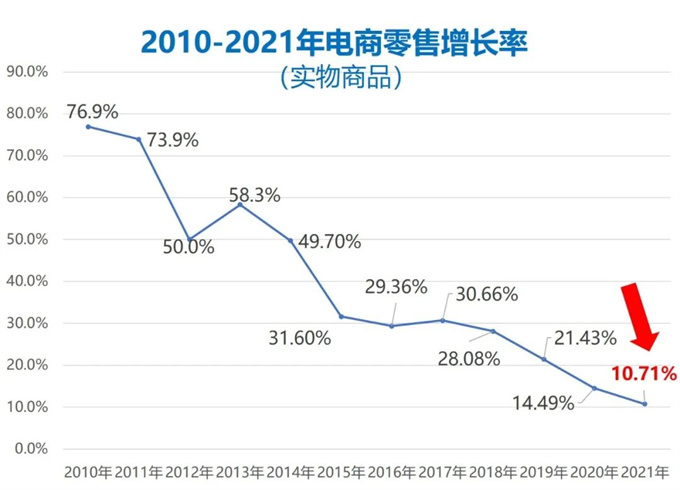

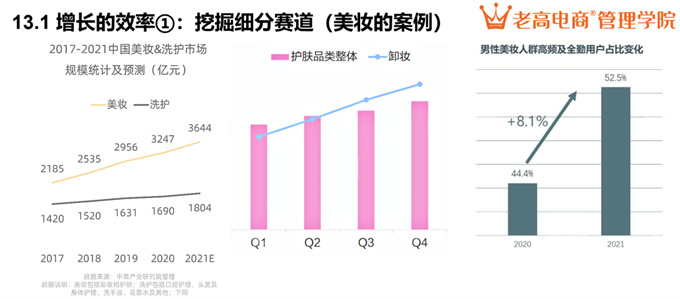

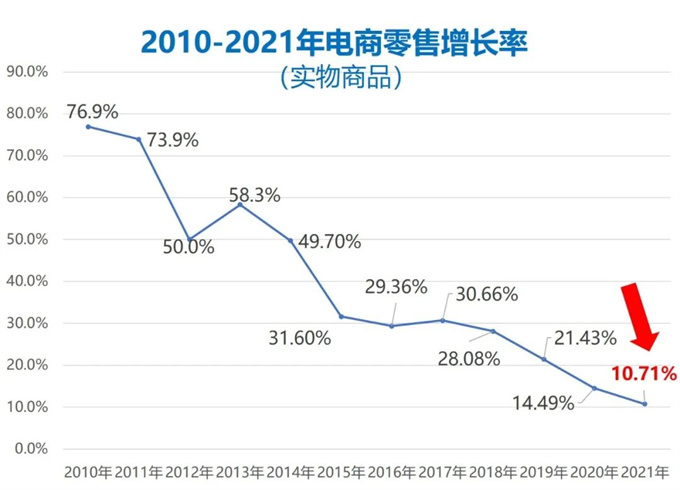

According to data from the National Bureau of Statistics, we have drawn a curve chart of the e-commerce retail growth rate from 2010 to 2021 (as shown below).

In the past 12 years of development, the growth rate of e-commerce retail has dropped from 76.9% in 2010 to 10.71% in 2021 year by year. According to the situation in the first half of this year, April and May both declined significantly year-on-year, and June-September is the recovery period, and it is estimated that it will not return to normal levels in the fourth quarter. Therefore, it is expected that the growth rate of the e-commerce market in 2022 will be lower than 10%, and may be as low as 5%-7%!

2. Employment and consumption winter

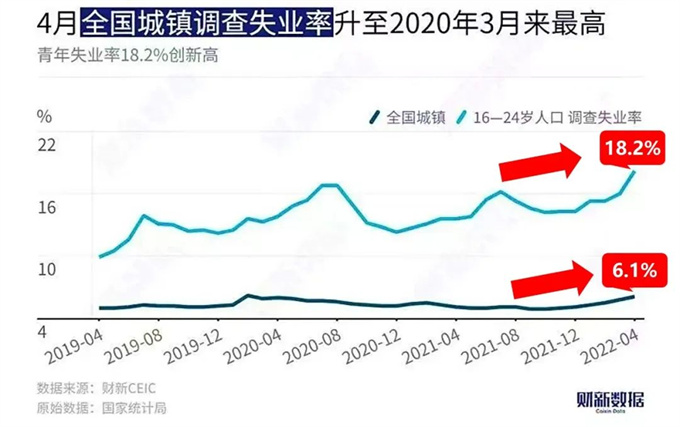

At the beginning of this year, the National Bureau of Statistics released data showing that the number of "flexible employment" in my country has reached about 200 million. The relevant media believe that the employment situation is flexible and diverse, and that workers are motivated and are sought after by young people. It depends on your own opinions, and I believe readers have their own judgment.

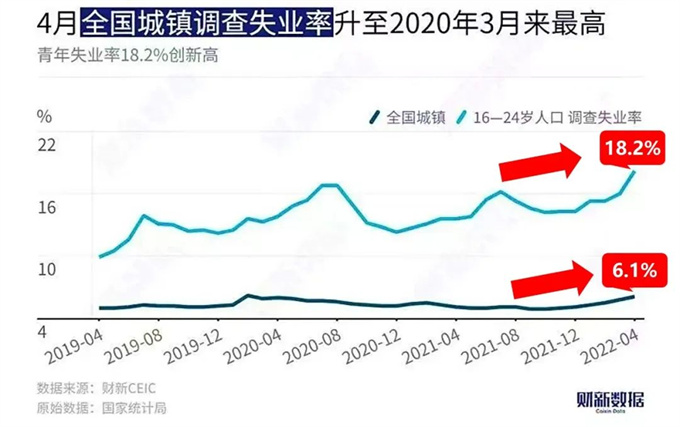

According to the latest data released by the National Bureau of Statistics, the national urban surveyed unemployment rate rose to 6.1% in April 2022, of which the unemployment rate for young people aged 16 to 24 reached 18.2% (related to the employment situation of college graduates in recent years), the highest in history.

Several adverse factors have been caused by the epidemic:

① Offline physical enterprises are closed;

② Foreign trade enterprises lose orders and customers;

③ China's supply chain is transferred abroad, investment and technology are moved out;

④外商投资持续下滑……这些都会显著冲击就业。

The cold winter of employment will inevitably bring about the cold winter of consumption. Starting from the second half of 2021, the consumption winter has become prominent. A large number of new domestic products and new consumer brands that have received multiple rounds of financing have collectively declined and suffered huge losses. Because they found that the products could not be sold, the consumption trend was weak.

Why is traditional e-commerce still growing in 2021? Because traditional e-commerce is a growing demand, new domestic products and new consumer brands are a stimulating demand. The former tends to be rigid demand, while the latter tends to be elastic demand. When the economy is down and purchasing power declines, consumers will first abandon dispensable elastic demand.

If the economy continues to decline, traditional e-commerce will also be affected in the future.

Big manufacturers are very sensitive to economic data, and their judgment on trends is based on rational research on big data. So, they always lead the way in laying off employees. For example, JD.com, Alibaba, Tencent, ByteDance, Xiaohongshu, Midea, Jiang Xiaobai...

Therefore, the era of rapid growth of e-commerce is gone forever. In the past, relying on dividends and trends, many e-commerce companies have reached a scale of over 100 million; now and in the future, dividends are exhausted and economic downturns are irreversible. So, what will e-commerce rely on to make a living in the next three years?

3. Business efficiency wins

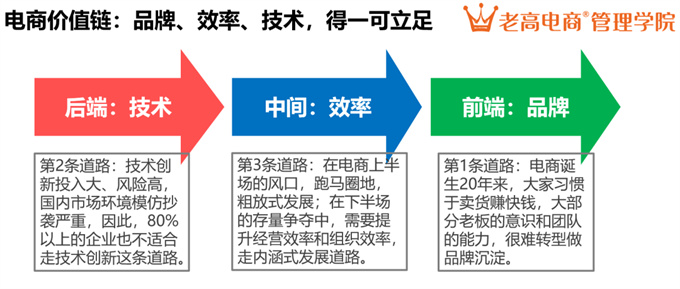

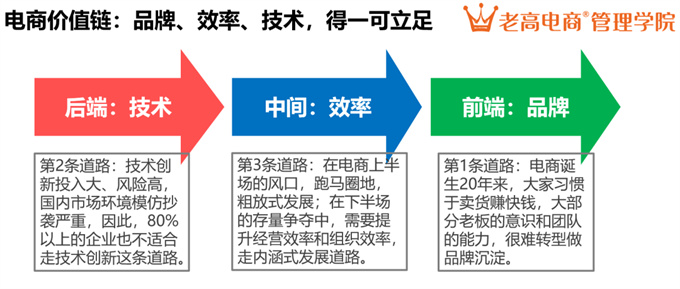

From the perspective of the value chain of e-commerce companies, front-end brands, back-end technologies, and intermediate efficiency are three decisive links. The good news is: you don’t need to become an all-round company, you only need to master one of the links, and you are enough to stay in the future.

The first path: build a brand. In the 20 years since the birth of e-commerce, people have been accustomed to selling goods and making quick money. Most bosses’ thinking and team abilities are difficult to transform into a brand.

The second path: engage in technology. Technological innovation has large investment and high risks, and the domestic market environment is severely imitated and plagiarized. Therefore, more than 80% of enterprises are not suitable for the path of technological innovation.

The 3rd path: Efficiency leads to victory. At the forefront of the first half of e-commerce , we will be able to capture land and develop extensively; in the second half of the stock competition, we need to improve operational efficiency and organizational efficiency and take the path of connotation-oriented development . This is a path that most e-commerce companies can grasp.

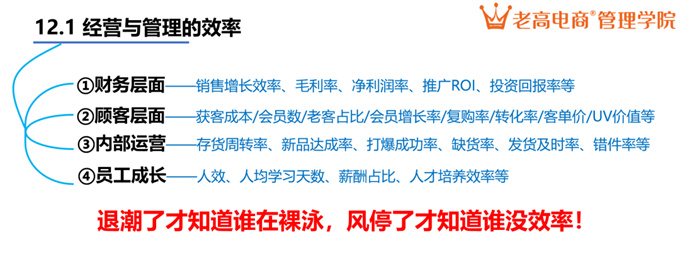

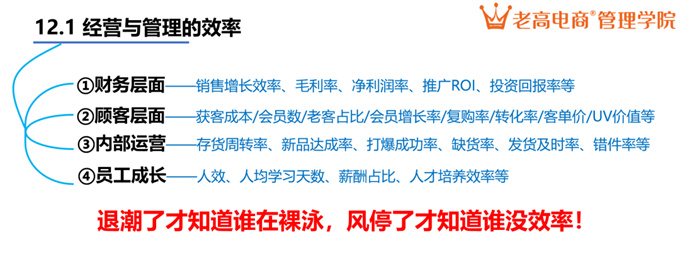

What exactly does business and management efficiency include? We can divide it into 4 levels:

① Financial level - sales growth rate, gross profit margin, net profit margin, promotion ROI, return on investment, etc.;

② Customer level—customer acquisition cost/number of members/proportion of old customers/member growth rate/repurchase rate/conversion rate/user unit price/UV value, etc.;

③Internal operations - inventory turnover rate, new product development achievement rate, new product explosion success rate, out-of-stock rate, delivery timeliness rate, error rate, etc.;

④ Employee growth - human efficiency, per capita learning days, salary proportion, talent training efficiency, etc.

Health of business indicators is more important than scale! As long as the operating efficiency indicators are healthy, the enterprise is safe; on the contrary, if it is scale but not efficiency, it will decline sooner or later.

4. Selection of emerging sub-tracks

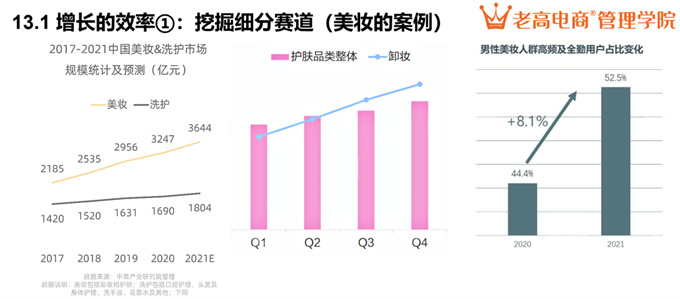

Strategy lies in choice, and choice is greater than effort. Although the growth rate of e-commerce market is getting lower and lower, the growth rate of many emerging sub-categories will still be higher than 10%. Please see the following cases.

Case 1: More than 60% of the subcategories of the cosmetics industry of the Taobao platform declined in 2021, but there are also some rapidly growing subcategories: the growth rate of cosmetics removal products reached 30.79% in 2021, breaking the threshold of 5 billion yuan for the first time, reaching 6.062 billion yuan. Makeup removal is also the category with the largest increase in the entire skin care track in 2021. Sun protection increased by 16.26% to 8.659 billion yuan.

Case 2: In JD cosmetics category in 2021, there are still multiple sub-categories that are growing: facial skin care accounts for as high as 66.79% in JD beauty, with a total sales of 24.122 billion yuan, an increase of 86.37% year-on-year. Perfume and makeup accounted for 24.49%, with sales reaching 8.845 billion, an increase of 85.54% year-on-year. Sales of men's facial skin care reached 2.597 billion yuan, a year-on-year increase of 63.64%.

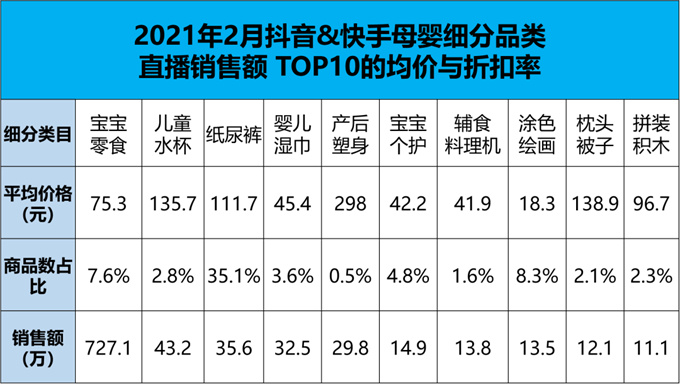

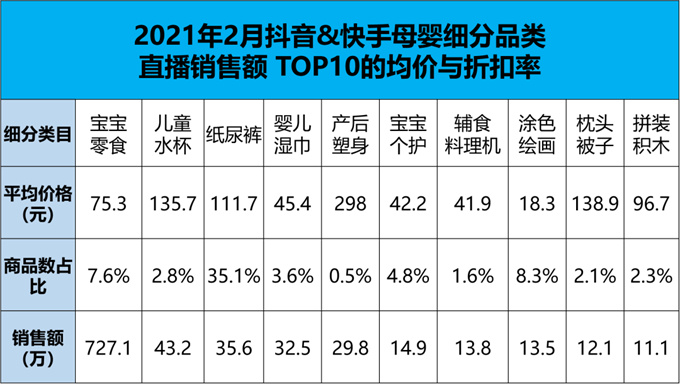

Case 3: (See the table above) Among the top 10 maternal and infant live broadcast sales of Douyin and Kuaishou in February, baby snacks sold 7.27 million, accounting for only 7.6% of the product (the number of products in the subcategory accounts for the overall number of products in the maternal and infant category) and the average discount rate in the live broadcast room is 5.7%; diapers account for 35.1%, but the sales are only 356,000, and the average discount rate in the live broadcast room is 41% of the price.

From the perspective of marketing grass planting, the number of interactions in diapers accounts for 10%, and the proportion of interactions in baby snacks accounts for only 1%, which means that the marketing investment is also different when choosing different products.

It can be seen that merchants’ investment in subcategory selection, product development, supply chain and marketing resources is not completely rational decision-making.

In the new channels, whether it is domestic e-commerce or cross-border e-commerce, the first priority is to select products, with the principle of large market, fast growth and relatively few competitors.

In the consumer goods field, most merchants rely on regular high-frequency large-scale new products, high-volume and small volumes, and test data. According to the explosion, they will then rebate or clear the order.

5. Big store growth strategy

For top 5% of the top merchants, it is reasonable that the growth rate should be about 3 times the overall growth rate of this category. For example, the growth rate of the "sun protection" sub-category of beauty products is 16%, so the top merchants can achieve a growth rate of 48%. Ladder merchants can obtain a natural growth rate of 1-1.5 times. Leg merchants will be under greater pressure.

From Tmall, JD.com and Pinduoduo, we all saw that large stores are much more efficient than small stores. It is reflected in three aspects: First, from the perspective of traffic allocation, 5% of the top stores will divide up 40% to 50% of the traffic in the future. Second, from the perspective of new product strategy, the new products of the top flagship stores are classified according to explosive, prosperous, flat and stagnant, and the success rate of explosive and prosperous models exceeds 50%. Third, starting from the second half of 2020, Tmall has lifted cross-category traffic restrictions. From data analysis, we found that for a new category, if it is done in a large store, the output efficiency is 3 times higher than that in a small store.

6. New product growth strategy

Data from Tmall Xiao Black Box shows that in 2021, Tmall's new product releases exceeded 200 million, and the number of heavy new product consumption exceeded 120 million, and the transaction amount of Tmall's new product accounts for 35% of the Tmall market.

The explosive power of new products is the absolute match point that determines brand growth. The explosive power of the new product period determines the brand's growth throughout the year. If the new product performs weakly, it will seriously affect the brand ranking and annual performance.

At the same time, the weight of JD's new products is getting higher and higher, and the sales of JD's new products in many categories account for more than 40%!

Many years ago, the success rate of e-commerce new products was only about 5%, which was called the "new product curse". Now, with the increase in the weight of new products by Tmall and JD platforms and the development of consumers' shopping habits that are new and boring to the old, the new product curse has been completely broken.

7. Improve organizational efficiency

Laogao E-commerce Management School has trained more than 5,000 e-commerce bosses in the past three years and has operated more than 40 e-commerce projects worth over 100 million yuan. From a large number of cases, we have found a basic rule: the performance of the middle and senior management companies with sound and powerful middle and senior management continues to grow.

Nowadays, e-commerce waist and legs merchants are under increasing pressure. In the final analysis, the competitive environment has changed: dividends have disappeared. Second, the competitors have changed: from operating individual combat to joint combat between functional departments.

Specifically, in the past, there were many dividends, and the management of e-commerce organizations was serious, and the operation was conquered by the world. Even relying on the Amoeba group system, the performance could be increased. Therefore, other functional departments were not valued.

Now, there are too many monks and less porridge, and the top competitors have all made organizational upgrades. They no longer rely on operational departments, but cooperate through functional departments such as operation, promotion, customer service, vision, planning, products, procurement, warehousing, live broadcast and new media. The advantages of multiple troops certainly surpass those of individual troops.

8. Professionalism

组织升级的重要结果,就是带来专业主义,可以显著提升品牌溢价和商品毛利率。专业主义包括三点:一是职能部门专业分工,二是业务流程的关键节点由专家把控,不合格不交付下游,三是专业人才快速培养和复制。

Implementing professionalism will lead to an increase in labor costs by 2-4 percentage points, but the gross profit margin will increase by 5-10 percentage points , which is of decisive significance to the company's continued profitability and long-term development.

9. Control business risks

When I answered questions to students, I found that the gross profit margins of many e-commerce companies have been declining in the past two years, and some companies have experienced seasonal losses or annual losses. Especially Pinxixi and Douyin channels, there is great profit pressure and some merchants do not make money. What is worthy of everyone’s vigilance is that having scale and no profit will drive up business risks!

A student said that he was controlling the growth rate of Pinxixi's business this year. It could have exceeded 100 million yuan, but now it is controlled within 50 million yuan. His reason is: the profit is too low, the larger the scale, the greater the investment, and the financial pressure and inventory pressure have led to higher and higher risks.

summary

How can e-commerce make a living in the next three years? Don’t expect new dividends, new opportunities, and new trends to fall from the sky. There is nothing in the future, only hand-to-hand combat, and it depends on who has a good muscle.

① Muscle development means avoiding deficiency and fat.

② Avoid empty weight: getting bigger is not the goal, becoming stronger is the goal.

③The means to become stronger is: business efficiency to win.

④ The success of operating efficiency is to ensure the health of the above 20 core operating indicators, with a completion rate of more than 80%.

⑤ Ensure the health of business indicators: do a good job in organizational upgrades, small front desk and large back desk, establish professional teams, and cooperate with multiple arms to establish core competitiveness.

![#Laogao E-commerce Newsletter# [E-commerce Morning News on April 8]](/update/1634606324l419797086.jpg)

EN

EN CN

CN