Seeing him get up with Zhulou

Seeing him entertain guests

He saw his building collapse

Do you still remember "Qudian"?

A live broadcast gave away 1,000 iPhone 13s, and sauerkraut fish sold 250 million GMV for 1 cent, which was praised by netizens as the most "rich" live broadcast room.

A week later, netizens pulled out their "camera loan originator" dark history, and celebrities from all walks of life drew a clear line, becoming the fastest live broadcast room to fall from the altar.

Anyone who can say a roller coaster experience will say something: awesome!

Recently, Qudian has made another sound, and it is simply summarized in three words - it’s a loss.

- 01 - Net loss of 650 million in a quarter

Qudian released its 2022 financial report on February 21.

According to the financial report, Qudian's revenue in 2022 was 578 million yuan, a decrease of 65.1% from the same period last year; the net loss attributable to the company's shareholders was 362 million yuan , and the net profit in the same period last year was 589 million yuan.

"Revenue plummeted, net profit lost huge losses ." These eight words are enough to describe Qudian's achievements in the past year.

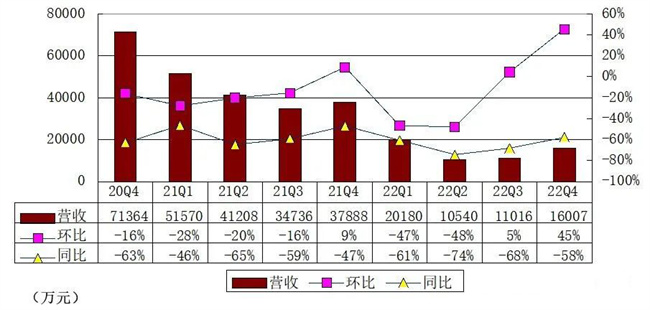

Source: Lei Di

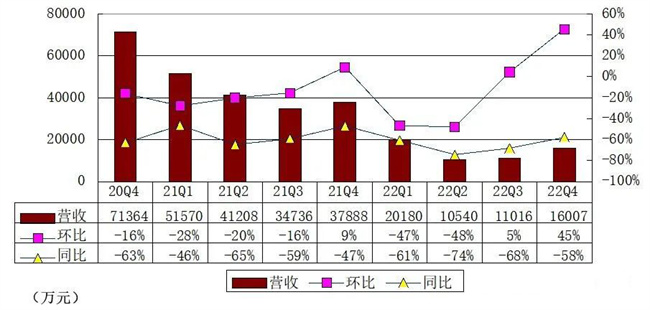

In the four quarters last year, Qudian's revenue was in a state of a year-on-year decline of more than 45%.

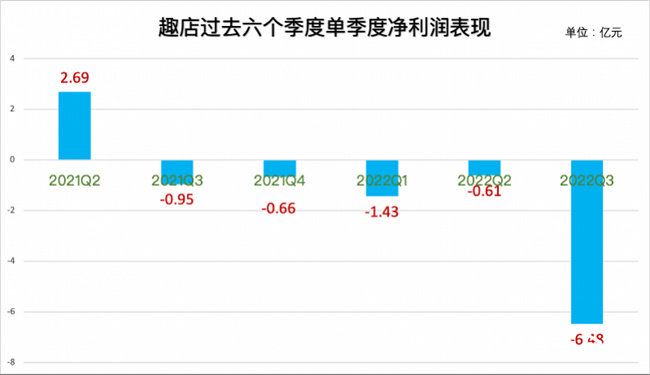

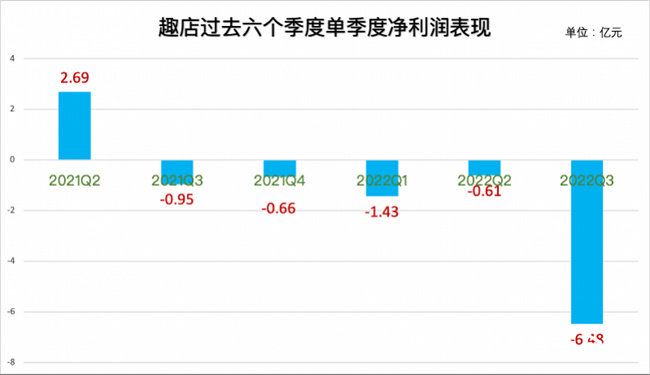

What's even more exaggerated is that Qudian's net profit performance in the third quarter of last year actually reached -650 million , the biggest loss in recent years.

Among them, the operating profit alone reached -300 million.

Source: Nandu Weekly

Despite this, Qudian still has strong monetization.

In the fourth quarter, Qudian's net profit attributable to the company's shareholders was 490 million yuan , and the revenue of this sector was mainly due to the sales revenue generated by pre-made dishes.

And its controversial online lending business seems to be put on a silence.

“We continue to carry out business transformation in the fourth quarter, with our lending book business gradually decreasing to the final stage. Entering 2023, we remain agile, harness market dynamics and leverage new business opportunities, including overseas, and as always committed to creating long-term value for our shareholders.”

Luo Min mentioned words such as "transformation" and "agility" in his words, which undoubtedly swears the determination of Qudian to "change the face".

It is obvious that although pre-made dishes are indeed a good "hot spot", Qudian has a lot of "black history". In addition, the controversy over the pre-made dishes franchise model has forced Qudian to jump out of this "hot spot" and find another way.

- 02 - The market value of US$11.5 billion plunged, with only 200 million remaining

The self-deprecating history was exposed, and netizens called out "the originator of campus loans" one by one. The Qudian was like an ant on a hot pan, with no way out.

Not only that, Qudian's pre-made dishes are also turbulent due to suspected false publicity of the shelf life and suspected leek cutting of franchise business.

Amidst controversy and continuous losses, Qudian began to gradually reduce the pre-made vegetable business in September last year, such as dismissing the team, clearing inventory, and terminating cooperation with suppliers.

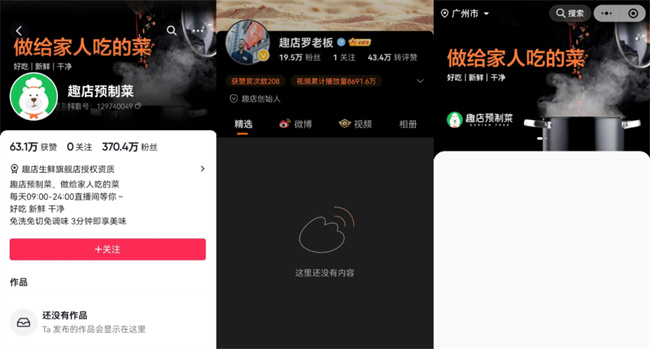

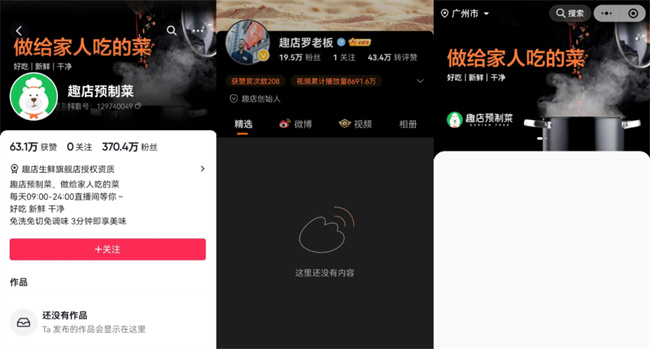

Searching Qudian’s Weibo and Douyin accounts, I found that the relevant content has been cleared, all the store products have been removed from the shelves, and even the WeChat mini-program mall is empty.

TikTok, Weibo, WeChat mini programs

Qudian, which had tasted all the bitter fruits, immediately announced the cessation of new credit issuance.

In October of the same year, the operating entity of Qudian's "Qufenqi" was cancelled, and another installment loan platform "Laifenqi" also ushered in the same ending.

Qudian, which cut off various businesses, also means that its market value will suffer a huge impact.

In the fourth quarter of last year, Qudian received a delisting warning from the New York Stock Exchange for its stock price below US$1 for 30 consecutive trading days. This is also the third time Qudian was warned to delist last year.

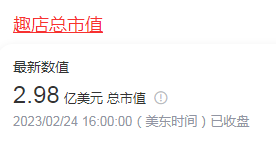

Although Qudian has now reached the minimum listing requirement, its market value has fallen to the bottom, far less brilliant than before.

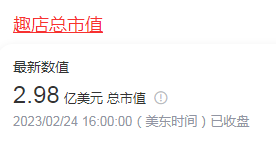

As of press time, Qudian's market value was only US$298 million, less than a fraction of the US$11.5 billion market value in 2017.

All this may be just a cocoon!

- 03 - If you want others to know, don't do it unless you do it yourself

Generally speaking, "leeks" have only the life that has been cut, but Qudian has fallen dramatically in the hands of "leeks".

Luo Min may have guessed the beginning, but he certainly never thought that he would end in this way.

Qudian, a listed company that once spent 100 million yuan to open a live e-commerce outlet, did gain a large amount of traffic.

But because of those "human blood steamed buns" incidents, I returned to the pre-liberation overnight.

This brings an inspiration to the live e-commerce industry-

To do things with high profile, you must endure high pressure scrutiny.

Even if you are a listed company, even if you are terriblely "rich", in front of the live broadcast camera, you are an ordinary seller serving the public.

Just like New Oriental Online, Yaowang Technology, and making friends, they are all creating a positive and glorious image and giving their live broadcast room positive energy.

This is not only for the sake of market reputation and attracting more brand followers, but also a must-have option for your company not to repeat the old path of "Qudian".

As Lao Gao said:

Altruism is the only way to achieve oneself.

The same is true for businesses.

Which path will you take in front of the screen?

![#Laogao E-commerce Newsletter#[E-commerce Evening News Brief on June 14]](/update/1652145126l900304477.jpg)

![#Laogao E-commerce Newsletter# [June 8 E-commerce Morning Newsletter]](/update/1634606324l419797086.jpg)

EN

EN CN

CN