1. The finances of 31 provinces and cities are negative, and 4 provinces and cities must complete the task of handing over

(Author Hou Zhenzhen, Finance and Taxation Consultant of Laogao E-commerce Management School) According to data released by the official website of the National Bureau of Statistics, in the first half of this year, the fiscal surplus of 31 provinces and cities across the country was negative, with a total fiscal deficit of -551.75 billion yuan.

At the same time, the central government is under great financial pressure.

Therefore, on August 16, relevant leaders presided over a symposium of the main leaders of the government of major economic provinces in Shenzhen to analyze the economic situation and require that the six major economic provinces account for 45% of the country's total economic volume, "Implement a package of policies to stabilize the economy... Stabilizing the economy is also a source of financial stability."

At the same time, the name of the four coastal provinces (Guangdong, Zhejiang, Jiangsu, and Shandong) is required to complete the financial remittance task.

2. The tax collection and management efforts have been strengthened, and e-commerce tax checks have been frequently seen in various places

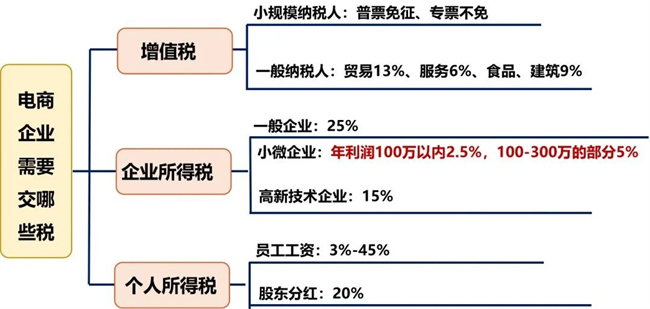

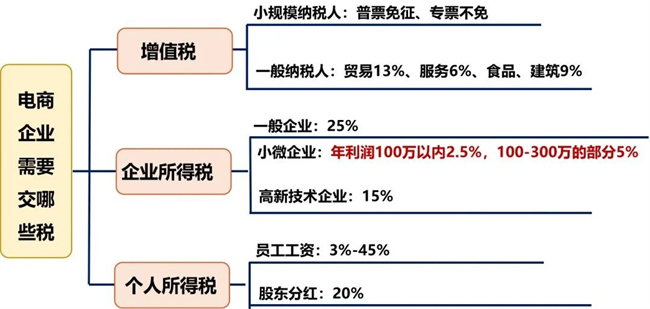

As we all know, taxation is a country's important tool, and most of the fiscal revenue is taxation. In 2021, the tax department organized tax revenue of 15.46 trillion yuan, accounting for 76.3% of the national general public budget revenue and 15.1% of GDP.

Therefore, when fiscal revenue cannot meet government expenditures or fails to meet expected goals, taxation in accordance with the law and increasing fiscal revenue is a very important way.

There are three main ways to increase tax revenue:

(1) Rely on economic growth, expand the tax base and cultivate water sources;

(2) Increase the tax rate level;

(3) Increase taxation and management efforts in accordance with the law and promote the standardization of tax revenue in various industries and industries.

The first and the second type do not meet the current situation, so the third type becomes the main means.

Due to historical reasons, there is a phenomenon of irregular tax payment in the e-commerce industry, and many incomes are in a gray state of "no declaration and no invoice". Therefore, in the past two months, local tax departments have begun to verify tax issues in the e-commerce industry. The financial and tax consultant teacher of Laogao E-commerce Management School has received inquiries from students from Jiangsu, Zhejiang, Shandong, Guangdong and other places on tax-related issues. Basically, they receive telephone notifications from tax home inspections, and then the tax manager goes to the company for on-site inspections, retrieves the company's backend data, and checks supplier procurement contracts and other materials.

This e-commerce tax inspection storm is "quick, accurate and ruthless", and the investigation and punishment are unprecedented. Unlike the last time Beijing e-commerce tax check, we will issue risk warnings first, allowing enterprises to conduct self-inspection and correction. This time, we will notify you directly. We will check the same day and check the e-commerce backend transaction flow. We need to check the data from the past three years, print it out on the spot, and take it away for verification. Some student companies were therefore withdrawn by taxation by more than 200 million yuan in data involved in the case.

At present, according to the feedback from students, only a third-tier city in East China is more humane. The situation explained by notifying the company's finance and legal persons by phone: Why is the platform's income different from the declared income? Perhaps because the student's taxable amount was small (only 10 million), the tax manager directly reported the company's revenue amount and did not go to the company to conduct on-site inspection. The tax manager also said that there are many e-commerce companies with taxable amounts of over 100 million yuan.

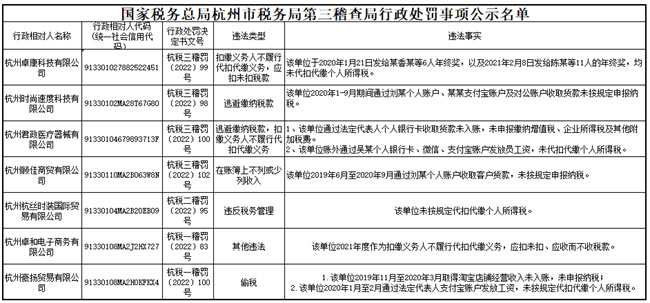

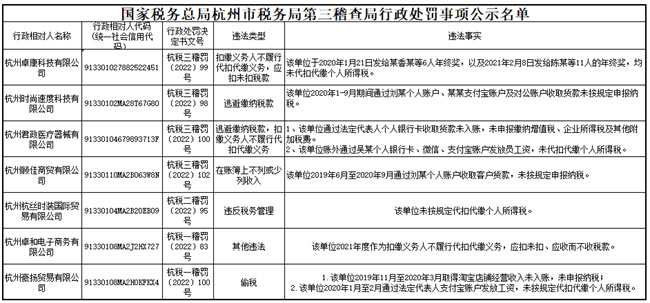

3. Typical cases of tax inspections for e-commerce

On July 7 this year, the Hangzhou Municipal Taxation Bureau disclosed a penalty case:

By checking the tax payment situation of Hangzhou Lexiang E-Commerce Co., Ltd. from 2019 to 2020, it was found that the company sold electronic products on Taobao in 2019 and obtained tax-containing sales revenue of 21450755.74 yuan (excluding tax-containing sales revenue of 18981652.74 yuan), of which 11599 yuan had been declared for tax-containing sales revenue, and another 21439156.74 yuan had not declared taxes as required.

The tax bureau mainly passes:

Hangzhou Lexiang E-commerce Co., Ltd. 's Alipay revenue (transaction flow) corresponding to Taobao account

Financial statements stamped by the Administration (accounts for the Taxation Bureau)

The final compensation and fines totaled 4676,144.81 yuan.

4. What are the key tax inspections?

At present, the author has received a large number of tax-related inquiries from e-commerce students. Based on these case analysis and statistics, let’s sort out where the tax authorities come from and which ones do they check?

First, the key industries of tax audit in 2022 are as follows:

E-commerce industry

Live broadcast and entertainment industry

Intermediary agency

Buying and selling commodities

Production and processing of agricultural and sideline products

Medical beauty industry

High-tech enterprises

Industry and fields such as equity transfer for high-income people

What is the focus of the second tax inspection?

False invoices (and accept false invoices) and false tax deductions

Concealing income

False listing cost

Malicious tax planning using "tax depression" and related transactions

Use new business models to evade the source of tax audit objects

5. Three key points for e-commerce

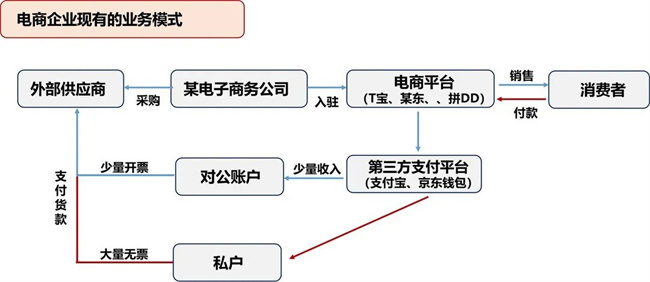

1. Concealing income without reporting

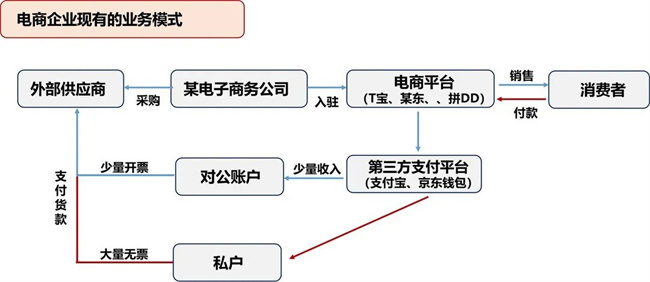

Most e-commerce companies rely on volume to achieve small profits and quick turnover. When selling goods, customers do not need invoices, so when purchasing goods, they do not ask suppliers for invoices. Most of the income will be withdrawn to personal accounts through Alipay by the company. The company's account only reflects a little income, and even reports losses, and survives in the market only at low prices. It can be said that all you earn is tax. This model poses a lot of tax risks.

The E-Commerce Law stipulates: "E-commerce platforms are obliged to retain transaction data for at least 3 years and to the tax authorities simultaneously in accordance with the law. " In other words, no matter which e-commerce platform you open a store on, as long as the tax department needs it, you can get very clear data. The top anchors are discovered through big data; the subtext is that it doesn't matter whether you pay taxes or not, I know everything. Whether you check you depends on the situation.

With the continuous improvement of the fourth phase of the Golden Taxation, the construction of the intelligent tax audit system has been completed, and the construction of the e-commerce tax data platform has come to an end, the arrival of the big data era and the transparency of data, for our e-commerce, the road to compliance is an inevitable trend in the future.

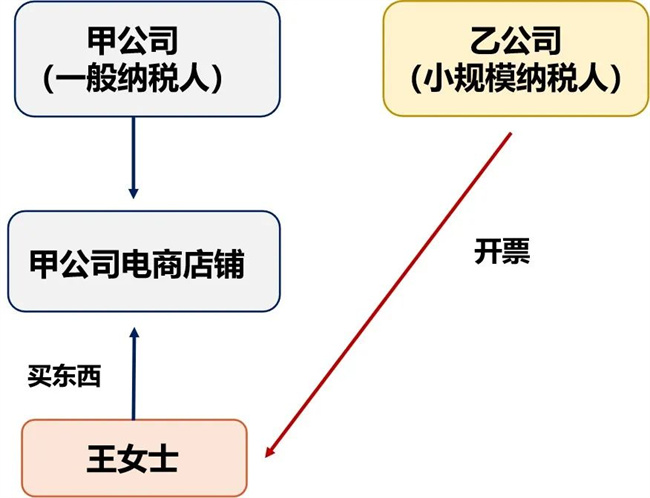

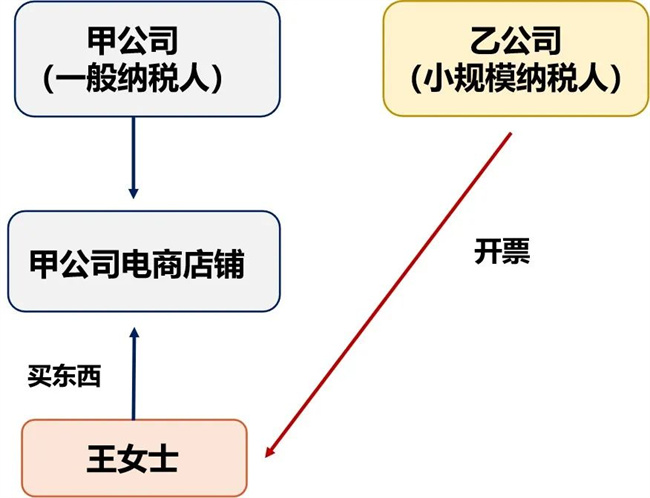

2. Shop A uses Company B to issue invoices for selling goods

First of all, this model involves tax evasion. Generally, taxpayers issue invoices for goods and invoices; while small-scale taxpayers issue invoices normally with 3 tax points, and all VAT is exempted during the epidemic. Therefore, many e-commerce companies choose to use other companies to issue invoices to consumers to reduce tax and fee costs.

Secondly, there is a suspicion of issuing false invoices. If you buy something from a normal person, who must issue the invoice, otherwise it will be a false invoice! Store A sells goods and Company B issues invoices. This is obviously inconsistent with the third-rate, and is prone to being judged as false invoice issuance. At the least, the fine is fined and the serious responsibility is required.

3. Pay wages from private accounts or Alipay/WeChat, and no personal taxes are withheld

The company has the obligation to withhold and pay personal tax on employees. If the private account or Alipay/WeChat pays wages, it will invisibly pass on the personal risks of employees to the company;

Secondly, once an employee has a conflict and dispute with the company, he will report to the tax bureau that the company evades taxes. The salary paid in his personal account is direct evidence of the illegality. Why is the salary not paid through the public account? Why do employees declare so much personal income tax? How did this money come about? Is it the off-book income of the store? The employees’ salaries are so high that you only earn a little bit, which is obviously hard to say!

In fact, there is no difference between e-commerce companies and conventional companies, and the taxation method is the same.

Finally, the compliance of e-commerce companies must be as early as possible. As long as the company continues to operate, the original sin of history will continue. Judging from the punishment cases exposed in the past two years, the guaranteed minimum will be investigated for at least 3 years.

E-commerce companies should prepare for the future, make plans early, and gradually move towards standardization.

!["#Laogao E-commerce Newsletter#[E-commerce Evening News on September 25]"](/update/1519722543l029041880.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Evening News on August 19]](/update/1628762699l369066323.jpg)

EN

EN CN

CN