One data that cannot be confirmed but circulated in the industry is that the total GMV of the WeChat ecosystem in 2017 has exceeded one trillion. Mini programs play a key role in this. "It is said that Zhang Xiaolong found Chen Qi (founder of Mogujie) and showed him the mini program data and said that as long as Mogujie does a good job in this part of WeChat, it is enough to become a big company."

The big company found the second half of e-commerce, so where can small and medium-sized sellers go?

"You must know that the reason why Alibaba's ecosystem has risen is that it relies on Taobao, which has a large number of individual sellers; opening the mini program to individuals means that WeChat can build an e-commerce platform that carries a large number of individual sellers like Taobao."

This is the huge increase in e-commerce in the future. Today, when the logic of making money in e-commerce has changed drastically, and we who have entered the post-traffic era, if we are still using traffic thinking to do e-commerce and are disdainful of e-commerce trends, we will definitely be ruthlessly eliminated in the times.

In January this year: SEE Xiaodianpu announced that it had received a Series C financing invested by Tencent;

March: LOOK Mini Program E-commerce completed a round A financing of US$22 million; SEE Xiaodian Shop received another round of C+ financing after two months, and thus the C round C financing has accumulated US$50 million;

April: The "national team" invested 1 billion yuan in WeMall, claiming to break the financing record of the WeChat e-commerce ecosystem; Youzan also recently completed a 22-month backdoor listing, merged with Innovation Payment, with a valuation of about HK$4.1 billion, becoming the "first stock in the WeChat ecosystem."

May: The points-based good goods mutual gift mini program "Xingwushuo" has received a round B financing led by Hillhouse Capital, which is the third round in five months this year.

If the mini program e-commerce was still invisible last year, then this year, especially in the past few months, mini program e-commerce has been booming overnight!

All capital seems to be rushing to this battlefield.

Youzan Baiya said in a speech this year: "If you want All in mini programs, the 48-hour repurchase rate of e-commerce can reach 80%!"

Wan Xucheng, CEO of SEE Xiaodian Shop, said in the face of the constant iteration of mini programs: "The continuous iteration of mini programs provides more gameplay for e-commerce."

After analyzing the mini program, Sun Shuo told us: "More and more mini programs perform well in the core data of high retention and long-term activity. Among them, the trading users of the trades of Xiangwu have maintained a weekly retention rate of nearly 50%.

After continuous iteration, mini programs have begun to exert the power of e-commerce. What problems did the mini programs solve that traditional e-commerce cannot solve after many iterations, and what increments did it bring? So that a large number of e-commerce entrepreneurs and investors are flocking to the market?

This is worth our in-depth understanding and discussion.

Why is the rise of mini program e-commerce

We found that JD and Tmall store owners generally have to pay a variety of fees to settle in, and the cost of mini programs is far lower than that of these traditional B2C malls.

Take the clothing category as an example:

The JD platform usage fee is 1,000 yuan per month and the deposit is 30,000 yuan. Transaction rates, 6% to 8% (FBP/SOP) are drawn for each transaction, and the rates for different categories under the category are different.

The margin for Tmall platform is 50,000 yuan, and the service technology fee is 60,000 yuan per year, and a commission of 5% is drawn for each transaction.

It can be seen that Tmall is similar to JD.com, and the cost of opening a store is relatively high.

When opening a mall on a mini program, there are usually only two fees involved: store construction/maintenance costs + rate paid by WeChat.

If you use a mini program generated by a third-party template, the development cost plus one-year service fee is generally between 5,000 and 10,000 yuan. If it is a JD merchant, you can also use Kepler's one-click mini-program light mall for free this year. Some third-party templates are even free. You can find these by yourself, so I won’t introduce them one by one.

In addition, the rate paid by WeChat is 0.6% per transaction.

By this calculation, the cost of mini program e-commerce is really not high, and it will be 5 to 6 points less than the cost of traditional e-commerce.

For a merchant who wants to increase revenue and reduce expenditure, these five points are already full of motivation to guide his old customers to the mini program mall. The extra profit is definitely a considerable number.

Moreover, when users enter the WeChat mini program, the fission power bursting on social platforms with the old and the new will bring unprecedented growth to merchants!

Incredible e-commerce growth

Since the mini program was launched, traffic portals have been opened, and there are currently more than 60. The most common ones are: within the WeChat discovery page, the drop-down bar at the top of WeChat, offline scanning codes, public account advertisements, public account article embedding, nearby mini programs, etc.

Moreover, Android mobile phone users can also place the mini program generation icon on the mobile phone desktop.

Compared to APPs, the mini program has the characteristics of "within reach, leave after use, come again next time, no need to uninstall", which greatly improves the exposure of the mini program in front of users and the convenience of using, and improves the user experience.

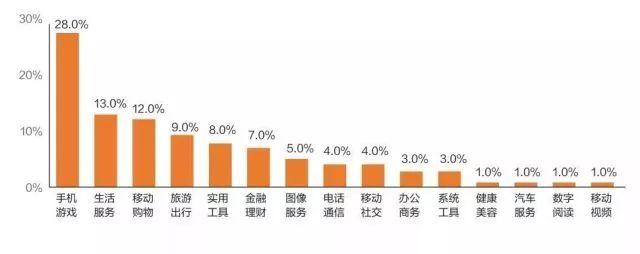

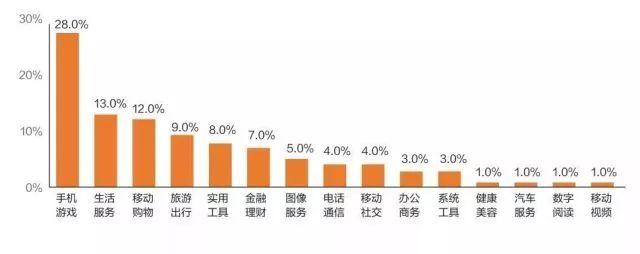

According to statistics from the 2017 "Empress of the Internet" report, the average time spent on mobile applications in Chinese users per day is about 3.1 billion hours, and the time spent on WeChat is about 900 million hours. WeChat accounts for nearly 30% of Chinese mobile phone users’ usage time.

Mobile applications such as QQ, Baidu's iQiyi, Alibaba's UC browser and Weibo are all ranked behind WeChat.

This means that when the user's time has been divided by several major applications, we can no longer seize users' attention and can only follow the trend and rely on their ecology to strengthen ourselves.

The "Mogujie Women's Clothing Selection" mini program made by Mogujie is a classic case. Last year, Mogujie relied on this mini program, and in a month and a half, the number of new customers exceeded 3 million; relying on a group buying entrance, it attracted more than 70% of new users. And the purchase conversion rate is twice that in the App.

At the 2017 annual meeting of the dispatch, Inman CEO Fang Jianhua reminded e-commerce people: "I don't care whether you are online or offline, wherever the users are, we will be!"

It is actually proved that the "Inman Selection" mini program made by Inman has sold 1.1437 million yuan and exposed 6.1336 million times within three days from June 16 to 18 this year.

On June 18 this year, JD.com jointly launched a round of advertising traffic for mini programs. Feng Yan, senior director of the Operation Center of JD.com's WeChat Mobile Q Business Department, said: "The effect is higher than the sharing rate of H5 communications. During the 618 period, the sharing rate of mini programs was 40%, and sometimes even reached 80%.

Alibaba CEO Zhang Yong recently expressed his opinion on the low-price issue of Pinduoduo in an interview with a certain media: "I can say that a large number of users are now coming to Taobao. As long as you are not satisfied three times in a row, Pinduoduo users will definitely come to Taobao. You just treat it as helping me develop the rural market and educate users."

Let’s analyze Zhang Yong’s words actually confirm indirectly that through WeChat, the channel can be successfully completed.

Nowadays, first- and second-tier cities have been saturated, and a large number of new users to be reclaimed are entrenched in third- to fifth-tier cities. As a merchant said, "Our original intention of doing WeChat and mobile Q channels is to sink the channel."

This is where the growth of e-commerce in 2018 and the future!

The logic of making money in e-commerce has changed drastically

At the end of December 2016, Zhang Xiaolong talked about mini programs for the first time; on January 9, 2017, the WeChat mini program was officially launched; on December 28, 2017, the WeChat drop-down evoked the mini program, and it jumped to the circle of friends.

In less than 400 days, WeChat applets have announced 68 major updates and hundreds of features. Now, the number of people using mini programs every day is about 250 million, and more and more companies regard "all in mini programs" as their biggest strategy in 2018.

As of the first quarter of this year, the mini program only covered about 400 million users, and there is still a large market space.

Bai Ya, founder and CEO of Youzan, predicts that by the end of 2018, the number of users of WeChat mini-programs will reach 618 million.

What is the concept of 618 million? As of June 2017, the number of Internet users in my country reached 751 million. Once the WeChat mini program realizes this number of users, it means that WeChat has created another Internet.

It’s no wonder that when Zhu Xiaohu, the founder of Jinshajiang Venture Capital, proposed the concept of “WeChat Internet” when he was supporting the mini program, and also urged entrepreneurs to “rush to start a business with mini program!”

Because this trend is really different. The pig flying in the air is not only an e-commerce mini program. In the Spring Festival of 2018, countless mini programs with more than tens of millions were born. The game ranked first in "jump" and followed by "The King of the Mind". Not only the game mini program, Heikagang announced its own financing, but Yinian, a shared album mini program, also received three rounds of financing within half a year. Mini programs really bear fruit in all walks of life.

In the past, those so-called trends, shared bicycles, unmanned convenience stores, and unmanned shelves, now after the bubble burst, except for a few leading players, the remaining followers are all in a mess.

Having said that, the reason why mini program e-commerce can solve the problem of traffic is actually not to solve the problem from the perspective of traffic.

Traditional e-commerce platforms obtain huge traffic through various means such as advertising, and then introduce them to platforms with a large number of categories and products, to meet the needs of users.

This platform focuses on search, first with products, and then lets users choose. It is a B2C model, which is simply a person looking for goods. The traffic in this mode has been divided up by Tmall and JD.com.

Social e-commerce is different. The essence of social networking is connection, and the multiple parties connected are themselves traffic networks. When a user has a demand, this demand can easily gather a large number of users with the same needs in an efficiently connected social network.

These users are formed together, which means "group buying", and then bargaining with the manufacturer. Theoretically, manufacturers can get a large order without promotion, reducing costs, so they are willing to give benefits to these consumers, while consumers participating in "group buying" get a relatively large benefit.

This is the C2B mode.

The social tool that allows users to connect more efficiently is WeChat, which currently has 1 billion users.

The one who plays the most in this model in WeChat is Pinduoduo. Although Pinduoduo has various problems, Pinduoduo's rise itself can explain the problem.

Huang Zheng once told Tencent that Tencent’s failure in e-commerce is because the e-commerce they understand is that traffic × conversion rate = GMV (total transaction volume).

But the traffic logic is no longer valid today. Pinduoduo has discovered a new logic: people-centered e-commerce, "Understanding people through group buying, and through people's recommendations, it will transition to machine recommendations in the later stage."

Therefore, there is no search bar on the homepage of Pinduoduo's app and mini programs, and no shopping cart is set up. In fact, changing the information flow of Toutiao to product flow is Pinduoduo, which is to "people-centered" to match people and products.

Today (June 28), we learned from China Entrepreneur Magazine that Pinduoduo will submit its listing documents in the United States next week. A platform that can go public cannot be underestimated. We can hate or even reject Pinduoduo, but we must not ignore its platform logic.

Pinduoduo can get up quickly, in addition to low prices, it is precisely using the logic of "people first" to think about what this person needs first. To put it bluntly, low prices are used by Pinduoduo to quickly occupy the market, and the logic of "people first" determines where the ceiling of Pinduoduo is.

Dear e-commerce people, please note that according to this logic, Pinduoduo's future growth path is definitely not category expansion and brand upgrade, but using intelligent systems to match people, products and scenarios. In Huang Zheng's words, it is to "let the right people buy the right things in the right scenario."

From the same perspective, we found that since 2018, these e-commerce platforms have adopted the same development logic.

Taobao held a merchant conference in May this year, and CEO Jiang Fan focused on Taobao's original aspiration and "people-oriented". Taobao operations were immediately redefined.

Jiang Fan told us that Taobao is changing from operating "traffic" to operating "people", from marketing to driving transactions to "members", refined operations drive repurchase and stickiness, and from a single product to diversified operation of IP, content, and products.

He believes that these new operating models will continue to bring explosive growth of hundreds of billions of yuan to merchants.

The two platforms with completely different positions both express the concepts of "people-oriented" and "people-oriented". This is actually the same name and the same name, and both see the real opportunities in the future.

In short, if you really want to have a future, you must notice that the logic of e-commerce has undergone drastic changes. It is no longer possible to do e-commerce with traffic thinking.

Conclusion

On the eve of the storm, there will always be some storm, accompanied by fear and hesitation for the unknown.

I was thinking that when we understand the mystery of WeChat e-commerce and taste the sweetness, we will understand more clearly that in the future, no matter what e-commerce model it is, the competition between each other will definitely not be a traffic competition in the same category, but a competition between the same social chain.

WeChat e-commerce is far from as simple as we see on the surface.

In order to let some people see the future first, to let some Paiyou who follow us and support us seize the lead in retail, WeChat e-commerce is the lead in retail. We sent a team to break down six main modes from the existing WeChat e-commerce gameplay:

First, the B2B2C platform distribution model represented by Yunji, Global Catcher, Beidian, etc.;

Second, the platform "group buying" C2B model represented by Pinduoduo, Taobao Special Price Edition, JD Group Purchase, etc.;

Third, the "platform + expert sharing" model represented by Xiaohongshu, Mogujie, etc.;

Fourth, service provider tool model represented by Youzan, Diandianke, WeMall, etc.;

Fifth, the content shopping guide platform model represented by what is worth buying;

Sixth, there is also the traditional micro-business agency model that has been recently included in the scope of e-commerce operators.

EN

EN CN

CN