Everyone used to be busy going public, but now they are busy going public again.

In the past two days, Qutoutiao, which was very popular in that year, issued an announcement to announce its delisting, saying that the company received a letter from Nasdaq on delisting its stock on March 14, indicating that the staff had decided to remove the company's securities from Nasdaq. Unless the company requested an appeal to the above decision, the company's American depositary stock will be suspended when the market opens on March 23, 2023.

Public information shows that there are two main reasons for delisting. One is that Qutoutiao's stock price has been lower than US$1 for a long time and has failed to comply with the rules; the other is that Qutoutiao has not disclosed its 2022 interim financial report.

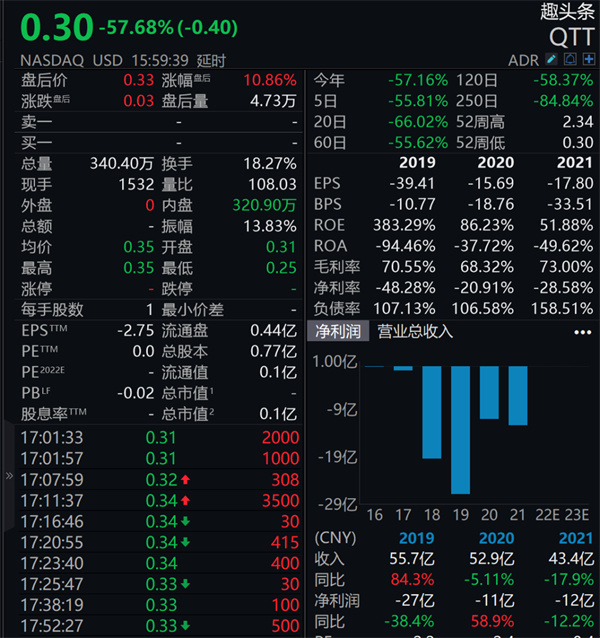

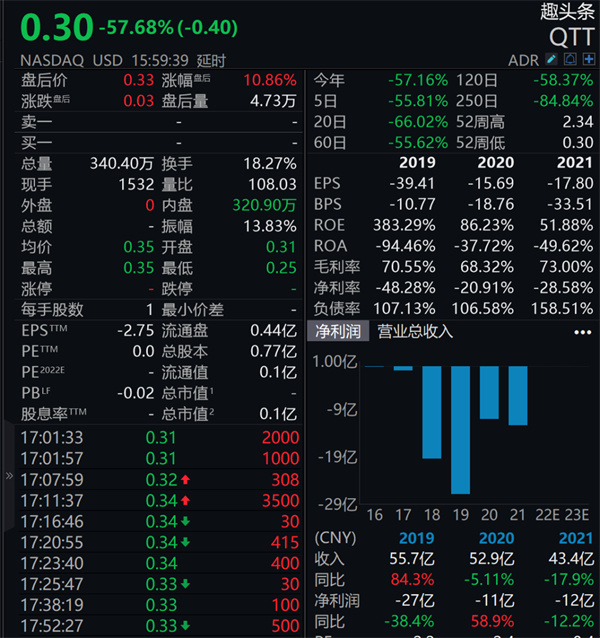

Qutoutiao stock price

Qutoutiao said it would not appeal Nasdaq's decision to delist its stock, and as a result, its stock stopped trading on March 23, which officially announced its delisting.

01. The scenery represents the existence of

Qutoutiao has a name in the industry: "the first stock to aggregate mobile content", and it inevitably repeats the same mistake and becomes the peak of listing.

In 2016, Qutoutiao captured a large number of users in the sinking market with its first "online earning" model. At that time, Qutoutiao, together with Pinduoduo and Kuaishou, became the "three giants in the sinking market".

Tan Siliang, founder of Qutoutiao

The rise of Qutoutiao is very similar to Pinduoduo. It invested in the sinking market that had not been paid attention to at that time. With the online earning model of making money by reading information, it successfully seized the market and rose rapidly.

And what is the so-called online earning model?

It refers to the platform attracting users through subsidies, and users can receive corresponding cash rewards after completing tasks such as check-in and browsing.

It is said that two years after it was launched, Qutoutiao's cumulative installed capacity reached 181 million and monthly active users exceeded 60 million. It was the second largest mobile content aggregation application in the app at that time, second only to Toutiao.

After gaining fame, Qutoutiao also gained favor from the capital market, and Tencent, Alibaba and Xiaomi have all become investors of Qutoutiao.

Two years later, Qutoutiao was listed on the US stock market, setting a new record for the fastest listing of Chinese companies on the Nasdaq. The previous record holder was Pinduoduo.

On the day of listing, Qutoutiao triggered five circuit breakers due to its rapid rise and fall, with an opening price of US$9.10 per share. At the close, the stock price soared by 128.14%, reaching US$15.97, with a market value of US$4.662 billion.

After the announcement of delisting this time, as of March 21, Qutoutiao's stock price was US$0.296 per share, with a total market value of only US$8.6292 million. Compared with its peak, its market value fell by 99.8%.

02. Start from content and end from content

Back then, in order to improve retention, Qutoutiao launched the gold coin system. Users can get instant gold coin rewards by opening Qutoutiao, registering, signing in, reading news, inviting friends (accepting apprentices), sharing news to WeChat and clicking to read it.

Users can also withdraw cash by a certain amount of gold coins. Unexpectedly, this model of sharing articles can make money. The effect was unexpected, which consolidated the status of Qutoutiao and attracted the attention of giants.

The scenery is the scenery. It is like two sides of a coin. The other side of the scenery is also the shortcomings of Qutoutiao. It does not produce content itself, nor does it have the ability to produce content, which has led to the content construction system not being formed and has no stable and high-quality content output. When it faces Toutiao head-on with Toutiao, Qutoutiao has no advantage.

In the fourth quarter of 2020, Qutoutiao began to go downhill. At that time, Qutoutiao achieved operating profit for the first time under non-US general accounting standards, because Qutoutiao took measures to reduce costs. At that time, Qutoutiao's operating cost was 440 million yuan, a year-on-year decrease of 12.3%. Among them, sales and marketing costs were 680 million yuan, a decrease of 50.3% compared with the same period last year.

Before this, the huge user promotion fee caused long-term losses. In addition, Qutoutiao also had to fight wits and courage with many "order-brushing parties" and launched various anti-cheating mechanisms, which made it fall into huge internal friction. The former daily active users and new users took a sharp turn, Qutoutiao slowly entered the current situation.

Some media commented that the reason why Qutoutiao is different from the fate of Pinduoduo and Kuaishou is because it lacks deeper value barriers and product "moat".

For example, Pinduoduo first entered the sinking market through a "slash" and then captured the high-consumption population in first- and second-tier cities through a 10 billion subsidy, and accumulated a group of users who really paid for their low prices; and Kuaishou also found new hope by relying on the "family-based" e-commerce supported by the "old irons".

Of course, there are some voices saying that because Toutiao and TikTouyin are too strong, Qutoutiao's decline has led to the decline.

03. The revelation of Qutoutiao's loss of power

At the just-passed annual meeting of Laogao E-commerce Club, Li Jinguo, founder of Shanghai Zhongling Enterprise Development Co., Ltd. and founder of "Value Strategy", put forward a point of view, he said:

Value exists, and enterprises just discover value. In this case, what the enterprise should do is determined by the cycle! What a company can do is already there. The reason why a company can make money is that it discovers value and matches value. If the company cannot match, it cannot make money.

Li Jinguo, founder of "Value Strategy",

Therefore, the decline of Qutoutiao is related to the times, its own business layout, and it is also related to its lack of core competitiveness and has not found a matching value point.

Putting aside business success, let’s take a look at the inspiration for e-commerce.

Qutoutiao’s products are content. Everyone knows that in the future, companies will look for incremental volumes in the existing market. The only way is to do a good job in marketing. So how to do a good job in marketing? It's whether your content is good enough.

If Qutoutiao fails, it means that fast food content has been eliminated by the times. If e-commerce companies want to do a good job in content marketing and then increase sales, they can at least not make fast food content, otherwise the growth may have nothing to do with you!

In this way, the boss should think about how his company should build a content production system, what kind of talents should be recruited to match, how to produce content after the team is formed, and how your brand and product should be better reflected, etc., all of which are related to growth.

Use the experiences of other people’s businesses to inspire your own thinking and seize them, because there may be new opportunities hidden there!

![#Laogao E-commerce Newsletter# [E-commerce Morning News on August 24]](/update/1598231318l595271374.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Morning News on December 11]](/update/1512954865l483881383.jpg)

EN

EN CN

CN