There is new news about the "scandal" of bankruptcy.

On November 14, MissFresh finally released its 2021 annual report. The report discloses current operating conditions, asset status, business progress, and number of employees.

The reason why it has been raised on the hot search by various media is that in the past three years, the number of employees of Daily Youxian has dropped sharply from 1,925 to only 55.

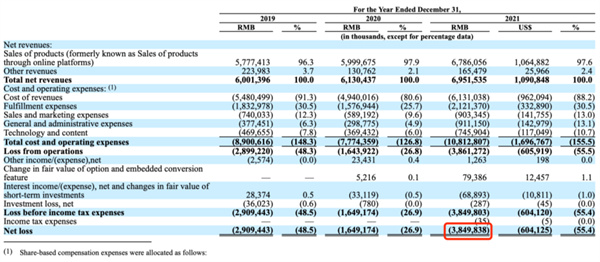

1. Net loss of 3.849 billion yuan

According to the financial report, the total revenue of Daily Youxian in 2021 was 6.965 billion yuan, a year-on-year increase of 13.3%, and the total cost and operating expenses were 10.812 billion yuan, a year-on-year increase of 39.08%.

Because the revenue growth rate is lower than the cost growth rate, MissFresh is still in an operating loss in 2021, with operating loss in 2021 being 3.861 billion yuan and net loss of 3.849 billion yuan.

The balance sheet in the financial report shows that as of December 31, 2021, the cash and cash equivalents of MissFresh were 1.06 billion yuan, the total current assets were 2.457 billion yuan, and the total current liabilities were 3.299 billion yuan.

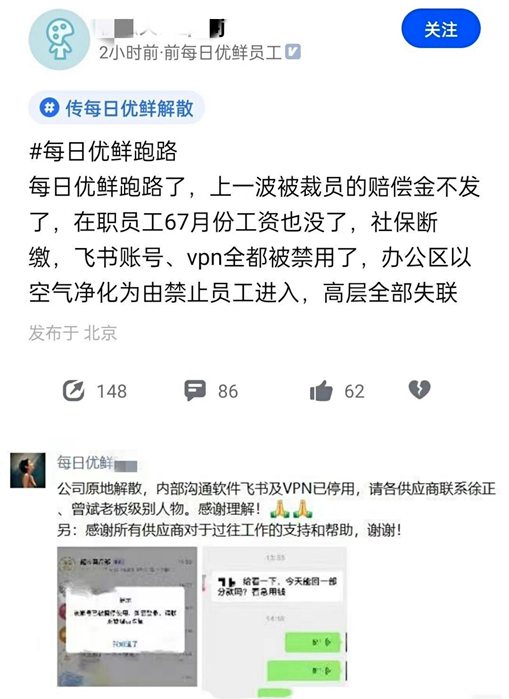

In July this year, MissFresh closed its rapid delivery service nationwide under its forward warehouse model, and only retained next-day delivery services. Subsequently, next-day delivery services could not be placed in many places in Beijing and Shanghai.

In its financial report, Daily Youxian said, "These business strategic adjustments may not be successful in the end."

Jisuda's retail business contributed about 90% of the total net income for the year ended December 31, 2021. After the business was shut down, MissFresh expects a significant decline in revenue in the future.

At present, MissFresh has disbanded its delivery team, but some business-related leases have not been terminated nationwide.

On the second day after the shutdown of Jisuda business, MissFresh started internal "optimization" personnel in the form of an online meeting, involving Jisuda, smart vegetable market, retail cloud and other business lines.

As of December 31, 2019, 2020 and December 31, 2021, MissFresh had a total of 1,771, 1,335 and 1,925 full-time employees.

As of November this year, the company has only 55 full-time employees, accounting for 2.8% of the total employees in 2021, and the "optimization" ratio is as high as 97%!

At present, labor disputes still exist between MissFresh and most of the dismissed employees, mainly focusing on wage arrears and social security provident fund arrears.

As of October 31, 2022, there were about 616 lawsuits filed by suppliers with MissFresh Subsidiaries as the defendant, and about 765 labor-management disputes filed by employees or former employees, with a total amount of approximately 812.7 million yuan.

2.4 years of loss of 10 billion

Over the years, MissFresh's losses have been expanding.

In 2018, 2019 and 2020, the net losses of MissFresh were 2.232 billion yuan, 2.909 billion yuan and 1.649 billion yuan respectively, while the net losses in 2021 reached 3.849 billion yuan, with a cumulative loss of more than 10 billion yuan in four years.

Even today, users have more recognition of MissFresh than complaints, which reminds people of the glorious moments of that year.

Some point of the acquisition of Meituan Youxian that is being demolished

In October 2014, Missfresh was established and is wholly owned by Missfresh HK Limited.

In 2015, MissFresh innovatively proposed the forward warehouse model, laying out several small warehouses in the urban area, each warehouse covering 3-5 kilometers of customer needs, achieving 30-minute fast delivery service for fresh food.

This model has attracted a lot of investments for MissFresh. In three years, MissFresh has completed 5 rounds of financing of approximately 3 billion yuan, and Tencent, Lenovo, Tiger Fund and others have invested in MissFresh.

At that time, MissFresh proposed the "100 Cities, 100 Warehouses and 100 Million Households" plan, which covers 100 cities, expands 10,000 forward warehouses, and provides 1-hour delivery service for 100 million households in the full category of selected fresh food.

So in June 2021, MissFresh was listed on the US stock market, but it broke the issue price on the day of listing, and then the stock price fell all the way.

3. Failure in the forward position

The forward warehouse has made MissFresh famous in one battle, but it also laid hidden dangers for MissFresh's future.

Because forward warehouses improve performance efficiency, but heavy asset forward warehouses also continuously increase operating costs. With the superposition of various costs such as rent, logistics, operation, and distribution in a single warehouse, the performance costs of the forward warehouse model have remained high.

As we all know, the fulfillment cost of forward warehouses is twice that of platform home delivery model, 3 of traditional central warehouses, and 6 times that of community group purchases. Some industry insiders said that the forward warehouse model with excessive fulfillment costs and low gross profit margin is an important reason for the continuous expansion of the loss of MissFresh.

Faced with losses, MissFresh still adopted a typical Internet strategy and began to expand rapidly, taking the lead in seizing market share by burning money for scale.

In 2019, the daily Youxian business covered about 20 cities, with the number of forward warehouses once reaching 5,000. At the same time, the number of forward warehouses 2.0 version was improved, increasing the number of SKUs from more than 1,000 to 3,000, and the storage area from below 150 square meters to 300-500 square meters.

At this time, MissFresh is already moving forward with heavy loads, and has launched price wars many times, issuing large coupons, launching 50% off products, and half-price day on Wednesday, providing huge subsidies to users and dishes.

It is said that MissFresh's annual loss that year was close to 3 billion yuan.

Blind expansion and continuous subsidies have pushed Daily Youxian to a situation of continuous losses. After trying many new businesses that have ended in failure, the labor costs, logistics costs, packaging costs, coupons and promotion costs, and forward warehouse rental costs have remained high. Daily Youxian has finally lost all its ammunition and food.

4. Does fresh food e-commerce still have a future?

This year, the entire fresh food e-commerce company is shrinking its market and significantly reducing its marketing, manpower and other expenses.

Taking Dingdong Maicai as an example, it withdrew from the markets in Xuancheng, Chuzhou, Tangshan, Hebei, Zhongshan, Zhuhai and Tianjin, which made Dingdong Maicai's financial report improve.

Coincidentally, Hema Community’s self-pickup business Hema Neighborhood is also retreating.

This year, Hema Neighborhood closed the two markets in Hangzhou and Nanjing, and withdrew from the four cities of Beijing, Xi'an, Chengdu and Wuhan. Currently, only the Shanghai market remains.

Regarding the situation of MissFresh today, some industry insiders also said that it needs to find its basic profit support point in order to have a chance to turn around, otherwise there will be no hope of turning around.

As one user said, "These grocery shopping platforms really saved my life when they can't go out."

In fact, whether it is the forward warehouse or the community group buying model, as long as fresh food e-commerce companies can deepen the profitable areas, they can still take root in their own customer groups and markets.