1. Professional counterfeiters report tax evasion by e-commerce

Since the beginning of this year, there have been more and more reports of suspected professional counterfeiters or professional negative reviewers on e-commerce tax issues. We have recently received a large number of tax-related consultations from students, of which more than 30% were professional counterfeiters or negative reviewers threatened to report to the tax, and used this to ask for benefits. The market for asking for benefits ranges from 6,000 to 30,000 yuan.

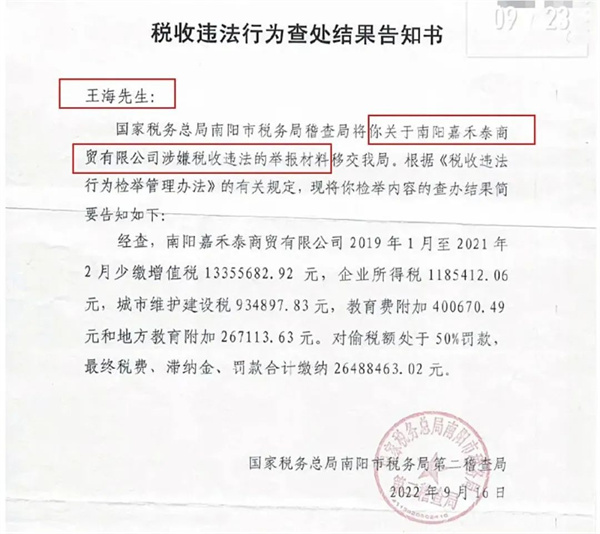

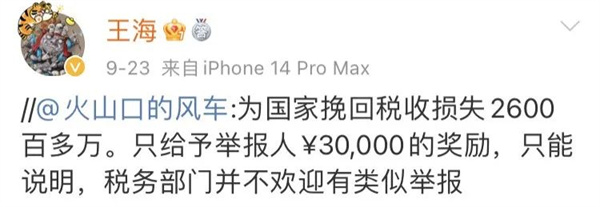

Such incidents are becoming more and more serious. Some are reasonable and legal reports, which is understandable. For example, the famous anti-counter Wang Hai reported that the top 1 "Qi Auntie" in Tmall mugwort category was tax evasion. The result was that "the tax bureau determined that the final tax, late payment fee, and fines were paid a total of more than 26.48 million yuan. Only a reward of 30,000 yuan was given to the whistleblower."

However, there are more professional counterfeiters or bad reviewers who make money out of nothing and extort money in the name of reporting, which has a great impact on the normal business activities of e-commerce companies.

Given that similar reporting phenomena are common, we will discuss this type of issue professionally below.

2. Can you report tax evasion in e-commerce without evidence?

According to the provisions of the Management Measures for Reporting Tax Illegal Acts, reporting matters that cannot be identified or cannot provide clues to tax Illegal Acts will not be accepted.

So what evidence does the whistleblower need to provide? The whistleblower needs to provide the name, company name, company address, and evidence of the tax violation of the person being reported.

In the above Wang Hai case, the "Notice on the Examination of Tax Illegal Behaviors" issued by the Second Inspection Bureau of Nanyang Municipal Taxation Bureau clearly mentioned that the tax evasion materials of "Qi Auntie" were provided to the tax department by the anti-counter Wang Hai, an anti-counter, which shows that Wang Hai is very professional in his work, has done his homework, has mastered certain evidence, and the reporting materials meet the acceptance requirements of the tax department (picture below).

Therefore, we can see that reporting a company to evade tax requires providing substantial evidence of illegality. The submitted evidence needs to clearly prove that the tax evasion exists. The tax authorities will verify it after accepting the report.

3. What handles may the whistleblower seize to report?

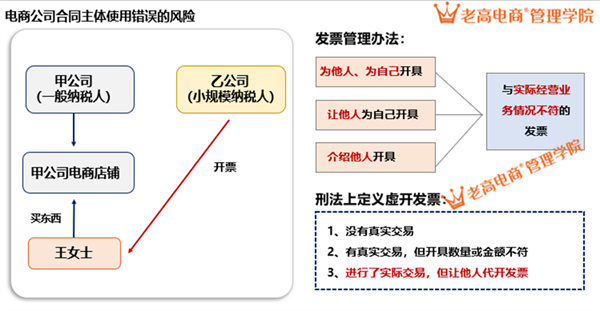

Situation 1: Company A sold goods in a store, but asked Company B to issue an invoice, and was later reported.

For example, a student received a call from a tax office before: someone complained that the invoices they issued were inconsistent with the actual business entity and were suspected of issuing false invoices, and asked for an explanation. It also attracted tax inspections, and both companies involved were later punished.

Situation 2: Negotiate the price with the customer and indicate that the invoice will not be issued; or the invoice will be issued with tax points; or the customer service will not issue the invoice or delay the invoice for various reasons, and the result will be reported.

If there is a dispute over the issuance of invoices, then we must be treated with caution. For example, a student previously received a tax inspection notice from the Shanghai Taxation Bureau, saying that the customer purchased products from his store on Alibaba 1688 platform. Due to invoice tax disputes, the invoice was not issued, and he was complained and reported by the customer. Subsequently, the tax notice checks the sales turnover data from 2020 to 2021... Therefore, invoice management and internal fiscal and tax control also need to attract the attention of e-commerce companies and should not make low-level mistakes.

Situation 3: Through tools such as business consultants, the index is converted into data and the store transaction flow is captured to report.

Now that professional counterfeiters are becoming more and more professional, they have learned to capture and analyze e-commerce data. This is the case for Wang Hai.

When the tax department receives detailed transaction data provided by the whistleblower, it only needs to compare the actual tax amount of the reported company, and immediately determine the difference. If the evidence is conclusive, the case can be filed for inspection.

Of course, it is not anyone who just holds a bunch of data to be credible. The tax department has a very serious work process. The whistleblower this time is Wang Hai, a famous professional anti-counter, so relatively speaking, the tax department will pay more attention.

Situation 4: If the other party can provide real and effective internal clues and evidence, this is not an external professional counterfeiter, but an internal insider.

For example, the Hangzhou tax authorities received a report letter, which stated that a Hangzhou cross-border e-commerce company established two sets of internal and external accounts, and had the problem of concealing income and underpaying taxes. It was accompanied by screenshots of the company's internal emails and reports. The tax authorities checked after receiving the report and immediately conducted an inspection of the company. Finally, a fine was imposed on the company's tax evasion.

E-commerce companies will leave a large amount of data information in their daily operations. Compared with traditional companies, e-commerce data is more transparent and more difficult to conceal. Therefore, tax compliance is also the future trend of our e-commerce.

4. How to deal with e-commerce in the face of reporting or extortion?

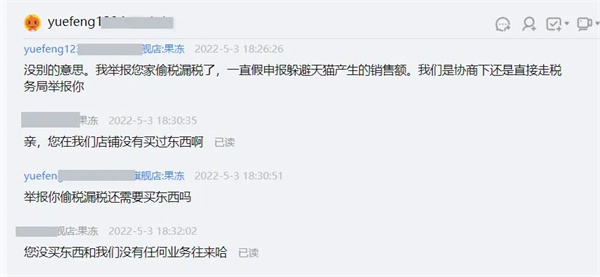

First, we must judge whether the other party has substantial evidence of reporting. Don't worry about extortion that makes a name out of nothing and bluff. (Picture below)

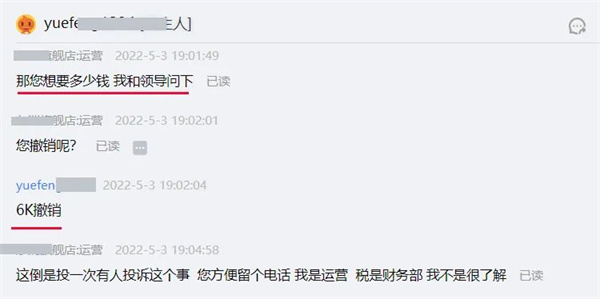

Second, if the other party claims to have some clues, ask the other party to ask for the conditions to give up the report, the specific amount, and save the chat records as evidence of being extorted. At the same time, we must respond in a timely manner, conduct self-inspection and self-correction on possible financial and taxation problems, and be clear about them.

Third, if the other party really reports and is accepted by the tax authorities, how should we deal with it?

① Once the report is accepted by the tax authority, it cannot be revoked. The tax authorities will come to the company for inspection based on the reporting information.

② If a merchant receives a tax inspection call, he or she needs to ask about the tax inspection content involved, the visit time, and what information he or she needs to provide in order to make corresponding countermeasures.

③According to the requirements, we must prepare the information and wait for the tax teacher to come to the door or go to the tax bureau to submit the information.

④ Do more homework in daily life and don’t cram the moment. In daily finance, tax filings should be improved, loopholes should be reduced, and risk avoidance indicators should be avoided.

Since professional counterfeiters are on the brink of legality and illegality, the relevant departments are cautious about this and neither oppose it nor vigorously promote it. Quoting Wang Hai’s Weibo is to express this meaning (picture below).

To sum up, in a sense, professional counterfeiters and professional bad reviewers are in a gray area, and the tax payment problem in the e-commerce industry is also in a gray area. Grayscale survival, gradually standardize without panic, and planning early is the right way for e-commerce. (End)