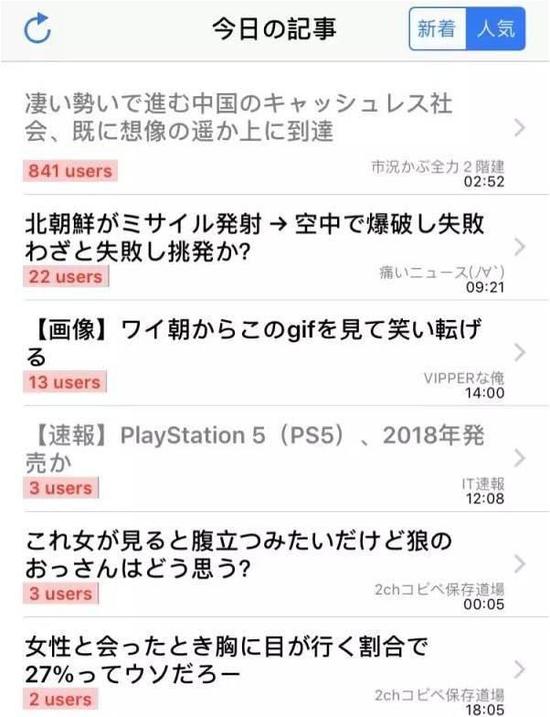

Recently, an article titled "China's non-cash society has developed rapidly beyond imagination" has attracted a lot of attention from Japanese netizens on the famous Japanese forum 2ch.

This article actually summarizes the Japanese's amazing popularity of mobile phone payment in China.

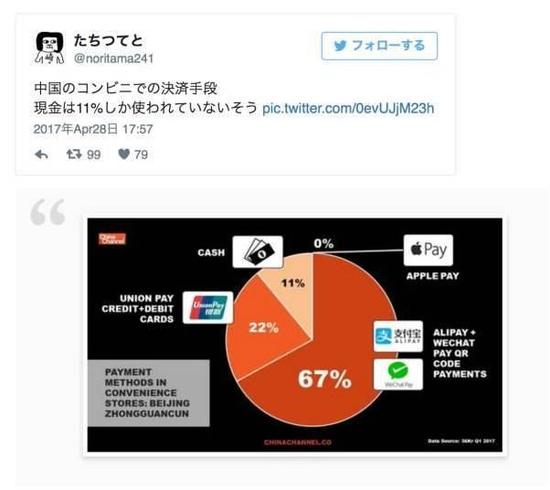

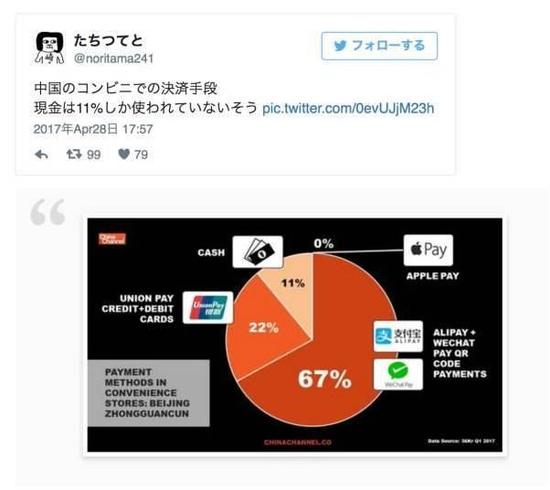

For example, in China's convenience store payment methods, cash payment accounts for only 11%.

For example, KFC in Kunming, Yunnan is promoting mobile ordering, and there is only one order for cash ordering. I can't eat even if I can't use a smart phone.

There are also simple mobile stalls on the roadside, but the payment QR code is standard.

What is even more shocking is that without a smartphone, you can’t even have to beg for food…

This article has 841 comments, while the big news of North Korean missile launches has only 22 comments.

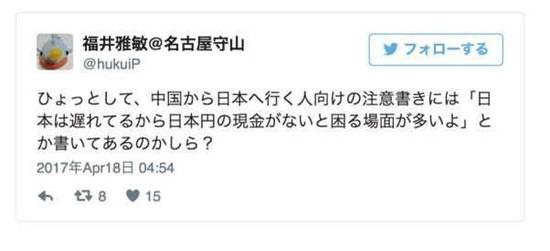

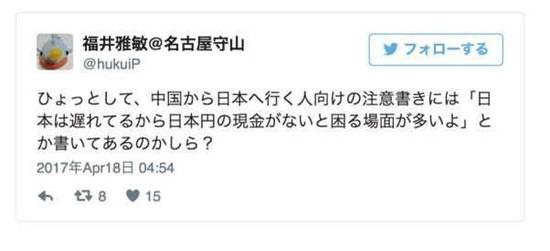

The Japanese in the comments have a bit humble attitude. Someone replied: Will Chinese people be reminded before traveling to Japan, "Japan is very backward, so they should bring cash to avoid trouble"?

Some people are also worried: I feel that Chinese people will say that using cash is dirty and inconvenient, so they look down on the barbaric Japanese.

This explosion article was deleted shortly after, and the reason is unknown. But it can be seen that China's mobile payment market is indeed leading the world. According to Forrester Research, China's mobile payment market reached $5.5 trillion last year.

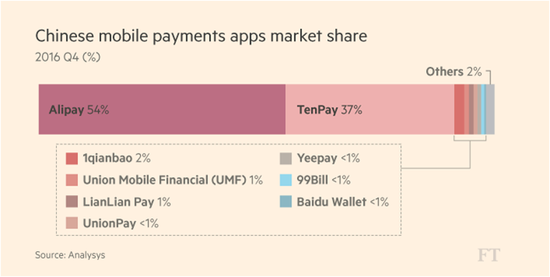

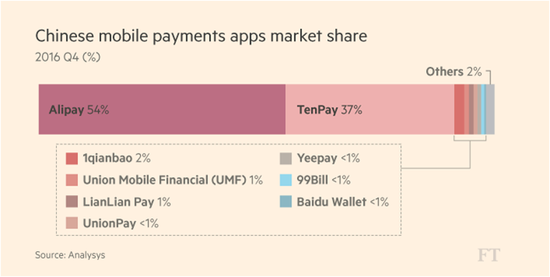

In such a huge market, Alipay and WeChat occupy the leading position. As of the end of 2016, Alipay has already had a market share of 54%, and Tencent, represented by WeChat, has a market share of 37%. Less than 10% of the market share remained divided by several other institutions, while Apple Pay, launched in China early last year, did not squeeze into the top ten. China's mobile payment market has formed an oligopoly pattern.

Let’s take a look at Japan. On the one hand, due to factors such as laws and regulations, there have been no third-party payment companies like Alipay and WeChat that can directly transfer accounts from bank accounts in real time. On the other hand, Japan's "Kar culture" is deeply rooted. Japan's transportation card (suica) has far surpassed the concept of transportation card. It can be used in various fields such as transportation, retail, services, supermarkets, etc., basically covering the entire country. With this card, there seems to be no mobile payment.

Not only Japan, the US mobile payment market is also far behind China, with a scale of US$112 billion, which is only one-fifty of China's.

Why is the United States, which is both the world's leading players in finance and technology, lagging behind China in Fintech, especially in mobile payments? In fact, the United States has long been accustomed to living by swiping cards, and their credit cards are much more popular than China and Japan. Compared with credit card swiping, taking Apple Pay as an example, its experience in offline scenarios has not been greatly improved. This is just the difference between taking out a card from your wallet to swipe (no password required to enter a credit card) and taking out a mobile phone from your pocket to swipe. In addition, Americans’ habits of using credit cards are difficult to change in the short term, and many users are also worried about the security of mobile payments. Even if Apple Pay has gradually become popular in the US market, the US mobile payment market is still far behind China.

And when Apple Pay first started to be online in the United States, even in the big city of New York, only a few stores supported Apple Pay payments. A year later, Apple Pay is still relatively limited in use. Although large chain stores have been fully supported, more merchants, especially offline restaurants, still do not support this kind of mobile payment. Compared with mobile payment methods such as scanning the QR code, mobile payment represented by Apple Pay in the United States requires matching mobile hardware, such as iPhone users and iPhone 6 or above to support it; on the other hand, the transformation cost of POS is high, the price of a new POS machine is about 600 yuan, and the transformation requires about 300 yuan, while the cost of the QR code is almost "zero". This is also the reason why the coverage rate of mobile payments in the United States is far behind.

At the same time, the United States' "national conditions" are difficult for this low-cost mobile payment to penetrate every corner. As we all know, the security of the United States is not good, so you always have to bring $20 to protect yourself when you go out to avoid robbing people. Unlike beggars who beg for a QR code, if a homeless man takes his mobile phone to rob, he says to you, "Hey Baby! Come and scan the QR code!" There shouldn't be many people who will succeed in such a "gentle" robbery. Since cash is always carried with you, the completely "cashless" society advocated by mobile payment is meaningless in the United States. Of course, this is just a joke.

In a research report, market research firm eMarketer said that China's rapid push for near-end payment is largely based on its latecomer advantage. China does not have a solid credit card culture, so it jumps directly from the cash payment stage to the mobile payment stage. Changing consumers' deeply rooted consumption habits has become one of the well-known challenges in developing mobile payments in developed countries such as Japan and the United States.

Thank you for your attention and support to Laogao Crown Club . Please indicate the source of the reprinting website www.shxuanming.net

![#Laogao E-commerce Newsletter# [E-commerce Evening News on April 25]](/update/1519722543l029041880.jpg)

![#Laogao E-commerce Newsletter#[E-commerce Evening News on December 20]](/update/1671527481l721651598.jpg)

EN

EN CN

CN