This year, the epidemic in Shanghai has been blocked for more than two months, and social group buying has become popular, helping all Shanghai citizens trapped at home. At that time, everyone once speculated that social group buying was about to rekindle!

Half a year has passed, and Baidu Nuomi, the former top group buying platform, has fallen down! Where will the future of group buying go? It is once again placed on the desktop...

1. Transformation failed, Baidu Nuomi closed

On September 20, Baidu Nuomi issued an announcement on the offline APP. Due to the company's business adjustment, the APP will stop services and operations. The APP was removed from the app store on August 31 and will officially stop related services in December 2022.

Baidu Nuomi, which has experienced a battle of thousands of groups, had a daily turnover of more than 450 million yuan in 2015, and its market share ranked first among the top three life service websites.

Since then, it has been going downhill until it is closed.

Nuomi.com, the predecessor of Baidu Nuomi, is the fastest growing business in Renren's internal incubation projects.

In 2014, Nuomi.com surpassed Lashou.com and Wowotun, and its market share rose to third in the industry, second only to Meituan and Dianping. That year, Baidu announced that it had acquired Nuomi.com with full capital and renamed Baidu Nuomi.com.

At that time, with the strong support of Baidu, Baidu Nuomi achieved rapid growth in merchant entry and user scale, and Nuomi.com's newcomer discounts and group purchase discounts were also very strong.

In the following years, players such as Meituan and Dianping appeared in the group buying industry, and Baidu Nuomi's market share was constantly losing. In October 2015, after Meituan swallowed Dianping, it became an industry giant, and Baidu Nuomi, which missed local expansion, grew smaller and smaller.

In recent years, the group buying industry, which has experienced a war of thousands of groups, has gradually become weak. Baidu Nuomi has not found new growth points and cannot provide continuous cost subsidies. With internal and external troubles, Baidu Nuomi needs to "stop losses in time". In 2017, Baidu adjusted its core strategy. Baidu Nuomi has been strong until now, but it still chose to take the initiative to end.

The former group buying platform giants are about to end, so is there no hope and future in the group buying business? Not necessarily, the previous waves come ashore and the next waves come.

2. JD.com plans to build social group buying and test mini programs in a low-key manner

At the end of September, news spread that JD.com had quietly tested a social group buying mini program .

The mini program is called " Dongdongtuan ", which is targeted by Kuaituantuan, which focuses on social group buying - pre-sale model, WeChat community fission, relying on the credit endorsement of the group leader to gather consumers with the same shopping needs, and there are many types of group buying.

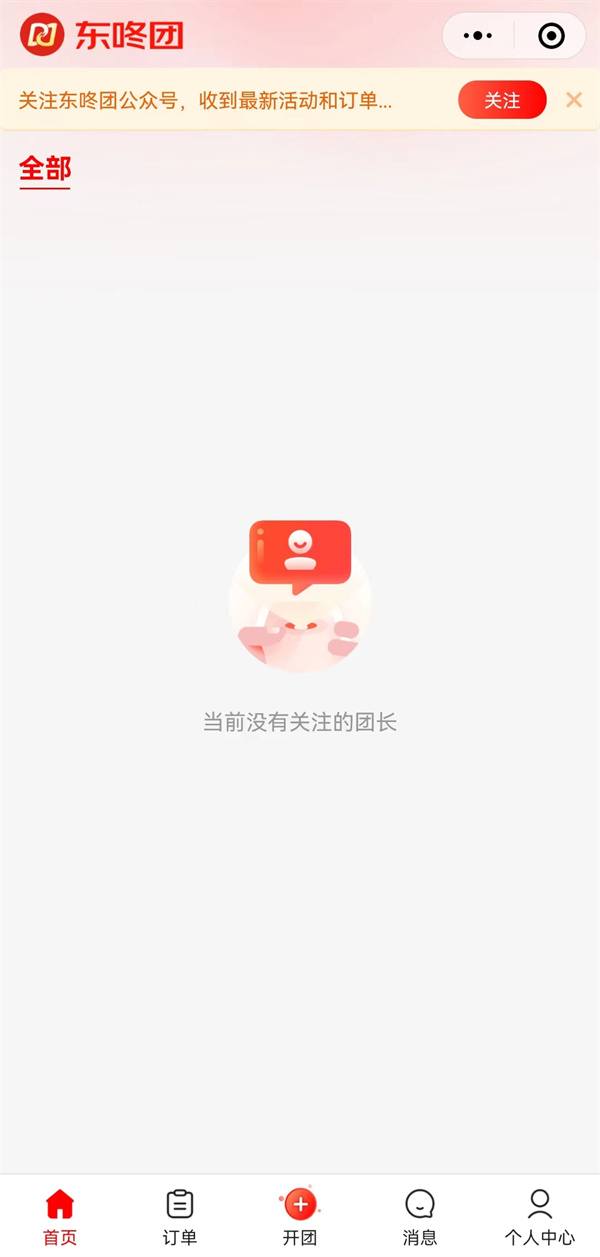

At present, Dongdongtuan’s mini program is in the internal testing stage and cannot be searched in WeChat mini program. It mainly relies on the mini program code in the official account article and the promotion and dissemination of various group leaders.

There are not many group leaders on the Dongdong Group platform, and they are still inviting the group leaders in a targeted manner.

Unlike Kuaituantuan's "0 threshold to initiate group buying", only group leaders who have obtained targeted invitations or invitation codes can initiate group buying. There are also some service providers who can activate group leader permissions by providing invitation codes, but they need to pass the review.

Consumers enter through Dongdongtuan’s mini program code, and there will be no group purchase content on the homepage. Only those who subscribe to the relevant group leader can see the relevant group purchases on the homepage. From the current Dongdongtuan products, it can be seen that it is targeting the sinking market.

It is said that Dongdongtuan’s backend has been connected to JD.com, and the consumer address bar can directly display JD.com’s address. Dongdongtuan’s customer service, after-sales and logistics are also connected to JD.com platform, and JD.com platform is fully responsible.

Some group leaders reported that the group leaders do not have the right to actively list products, and can only select products from the backend product selection pool. These products are reported and uploaded by merchants who are on the JD platform in the backend, and the commission ratio is also set by merchants. However, merchants can set targeted links for group leaders, and the commission ratio of this link can only be enjoyed by targeted group leaders.

In the short term, merchants outside the platform cannot settle in, and it is still mainly merchants within JD.com . Starting from November, JD.com will gradually open up the permissions for merchants outside the platform to settle in.

Since the benchmark is Kuaituantuan, Dongdongtuan also adopts the same model, which is the second-level distribution form . The group leader can recruit help sellers to expand his influence radius, and can also set the commission ratio of help sellers.

It is said that on Xiaohongshu, Douyin and WeChat, some content has appeared to recruit Dongdongtuan team leaders and help sellers. There is basically no experience required and there is no limit on the number of people. It can be seen that JD is prepared.

3. Dongdong Tuan vs Kuaituan

When benchmarking Kuaituantuantuan, we naturally need to compare it with Kuaituantuantuan. Some industry insiders analyzed the differences between the two as follows:

The entry threshold for group leaders is high, but the product selection ability requirements are lower . Compared with Kuaituantuan's "everyone can start a group", the leader of Dongdongtuan adopts a targeted invitation and invitation code system, and only a small number of people can become leader. Compared with Kuaituantuan, which requires group leaders to find sources of goods, Dongdongtuan has a commodity pool directly provided by the official, which reduces the energy and time spent by group leaders and merchants in choosing each other;

The role of the leader is different . In addition to initiating group purchases, the group leader of Kuaituantuan also needs to play the role of customer service, after-sales service, etc., while the customer service and after-sales service of Dongdongtuan are mainly provided by JD platform and merchants. In comparison, the group leader is more like a "tool person" who initiates group purchases.

Different relevance to the platform . Pinduoduo has not shown its relationship with Kuituantuantuan in its official channels. Kuituantuantuan is more like a product independent of Pinduoduo, and Pinduoduo does not assume the role of transaction guarantee. Dongdongtuan has strong correlation with JD.com. Not only does the product selection come from JD.com, but the backend is also connected with JD.com. After-sales, contract performance and logistics are all under the responsibility of JD.com merchants and platforms. The group leader said that JD.com will also bear transaction guarantees.

It can be said that Dongdongtuan is a community tool based on JD.com. It is developed based on JD.com, has stronger official endorsement and services, can provide more guaranteed community group purchases, and can also be integrated into JD.com's ecosystem, but it will also be restricted by JD.com. This is also a different place from Kuaituantuan.

4. Looking at private domains from the perspective of social group buying

This is not the first time JD.com has done group buying. There is a saying that Dongdongtuan is a social group buying mini program serving JD.com. The ultimate goal is to add one sales channel and accumulate more sticky high-frequency traffic.

This means that Dongdongtuan may be JD.com's layout to revitalize its own private domain.

Because social group buying can not only find more vertical consumers, but also more active consumers, and this is what platforms entering the stock era need most, because only more active high-frequency users can bring new growth.

When it comes to private domains, the current main position is WeChat, and WeChat mini-programs are just a tool that carries private domain transactions.

It seems that the arrival of the stock era, it is urgent to lay out private areas!

EN

EN CN

CN