No one could have thought that the Internet term "playing soy sauce" invented many years ago can become the reality today.

The just-passed National Day netizens are basically "striking" Haitian soy sauce. The reason for the incident is that Haitian's soy sauce sold overseas has no additives, while the soy sauce sold in the domestic market contains additives.

Consumers' focus has gradually evolved from the dual standards of soy sauce ingredients at home and abroad to food safety issues, and finally to whether additives should appear in soy sauce...

Haitian Soy Sauce has been in trouble since then!

1. Market value evaporated by 50 billion in 4 days

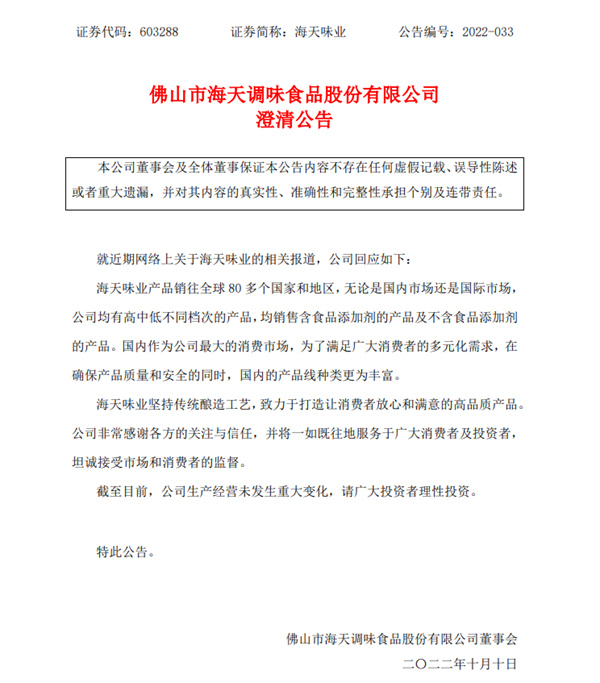

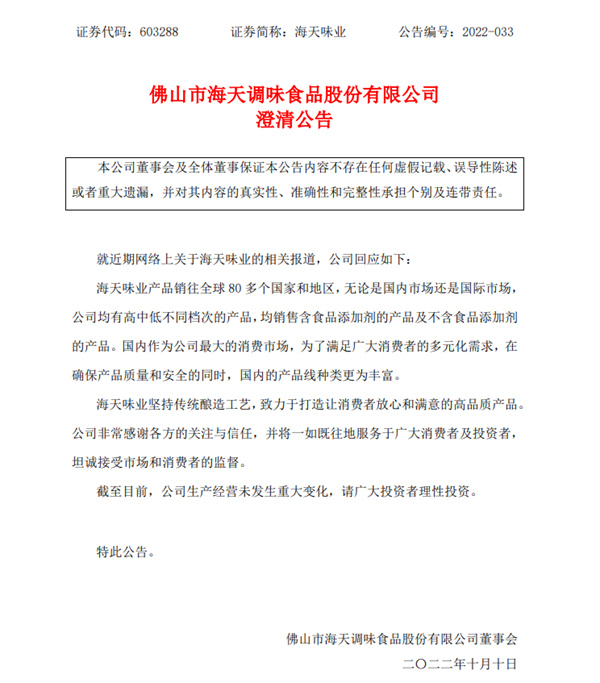

Under the crisis of public opinion, Haitian Flavor Industry issued two announcements on September 30 and October 4, trying to clarify the rumors, but because it did not focus, it added fuel to the fire, and because of its attitude of talking about winning or losing with consumers, it was labeled as "pride".

On October 9, Haitian Flavor Industry issued a third announcement, which finally directly explained the "double standards" issue that everyone was concerned about , and the farce gradually came to an end.

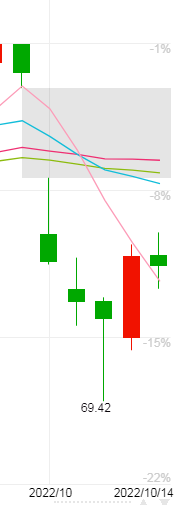

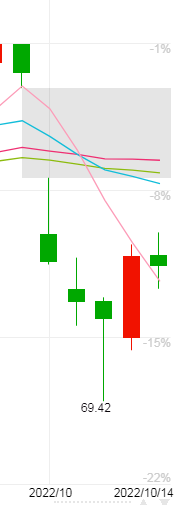

Haitian Flavor Industry’s three clarifications were made in exchange for three negative lines in the A-share market, with a cumulative decline of more than 12% in three days. On the first day of China's opening after the celebration, Haitian Flavor Industry's stock price plummeted, opening sharply by nearly 8% lower, and fell 9.35% as of the closing.

As of the closing on October 12, Haitian Flavor Industry's stock price closed at 72.75 yuan, a decline of 0.95%, with a transaction amount of 801 million yuan, and the company's total market value fell to 337.1 billion yuan.

Stocks that fell sharply after the holiday

Since the end of the National Day holiday, Haitian Flavor Industry's stock price has experienced four consecutive declines. The company's stock price has fallen by more than 13% in four trading days, and the company's market value has shrunk by 52.1 billion yuan.

Public data shows that as of August 26, 2022, the number of shareholders of Haitian Flavor Industry was 176,800, a decline of 3.8% from the end of June.

2. The dominance of Haitian Flavor Industry

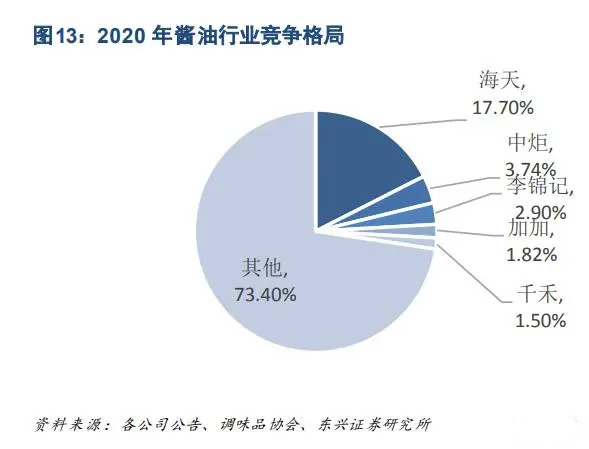

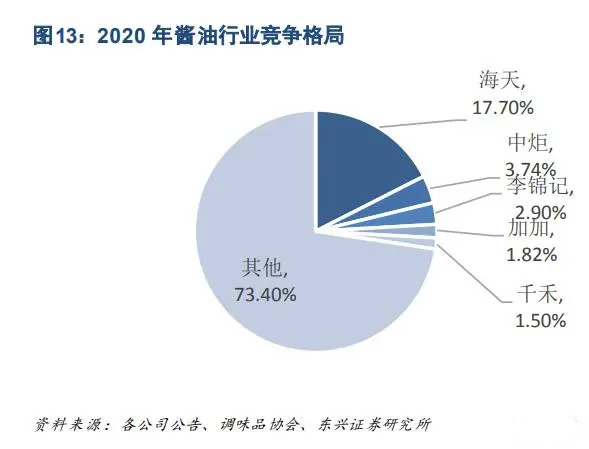

Although the market value has evaporated by more than 50 billion yuan, Haitian Flavor Industry's current market value is still 330 billion yuan, and the market value that has fallen is said to be slightly more than the total market value of Zhongju Hi-Tech (23.9 billion) and Qianhe Flavor Industry (16.3 billion).

The soy sauce brand under Zhongju Hi-Tech is Chubang Delicious Fresh, and the brand of Qianhe Flavor Industry is Qianhe Soy Sauce, these are all products that consumers are familiar with.

Looking at the entire soy sauce industry, Haitian Flavor Industry, Zhongju Hi-Tech, Qianhe Flavor Industry, and Lee Kum Kee, together form the current leading matrix of domestic soy sauce. Haitian Flavor Industry's market share, sales expense ratio and management expense ratio are above the other three companies.

The reason why Haitian Flavor Industry has such a status is due to the company's largest moat, which is the huge and intensive distributor system . Many domestic brands, including Moutai, rely heavily on the dealer system.

Compared with other soy sauce brands, Haitian Flavor Industry's sales network has developed the earliest, and 100% covers cities at the prefecture level and above in China. Among the inland provinces in China, 90% of the provinces have sold more than 100 million yuan.

In Haitian Flavor Industry's 2021 financial report, 94% of its sales revenue came from dealers. As of the end of 2021, Haitian's dealers had reached 7,430, while Zhongju Hi-Tech, Hengshun Vinegar Industry, Qianhe Flavor Industry, and Gaga Food only had 1,748, 1,829, 1,899, and 1,525 respectively.

This double standard incident of additives has affected Haitian Soy Sauce to a certain extent, and some C-end consumers may turn to other brands. But in fact, as long as the B-end dealers do not take action, Haitian Flavor Industry's hegemony will not have too much impact.

Because the main group of soy sauce is the younger generation, while Haitian Flavor Industry's consumer group is mainly middle-aged people. In third- and fourth-tier cities, restaurants, pre-made dishes and other fields, the choice of soy sauce is not in the hands of consumers.

In some local supermarkets below the third and fourth tier cities, the soy sauce brand may not be complete, but there must be Haitian soy sauce, which is the role of the dealer.

3. Hegemony originates from the dividends of the times

Haitian Flavor Industry successfully transformed in 1994 and became a large-scale professional seasoning production and marketing enterprise in the world.

The entire period of development of Haitian Flavor Industry happened to catch up with the rise of China's market economy from 0 to 1. In the 1980s and 1990s after the reform and opening up, China was in a state of shortage of economy and rose in line with the tide of the times. Haitian Soy Sauce began to go north, expand east, cultivate centrally, and move westward very early, and completed the laying of products across the country before its competitors.

At the beginning of the 21st century, soy sauce in vast areas in the north was still single, with heavy colors and strong flavors. Haitian Flavor Industry brought the concepts of dark soy sauce and light soy sauce unique to Guangdong and even promoted them to the whole country. With the first-mover advantage, Haitian Flavor Industry has successfully established a huge and sophisticated offline dealer channel.

In February 2014, Haitian was successfully listed on the main board of the Shanghai Stock Exchange. Since its listing, Haitian Flavor Industry has maintained a double-digit growth rate. From 2014 to 2020, the company's average annual revenue growth rate was 15.3%, and the average annual growth rate of net profit attributable to shareholders reached an astonishing 21.9%.

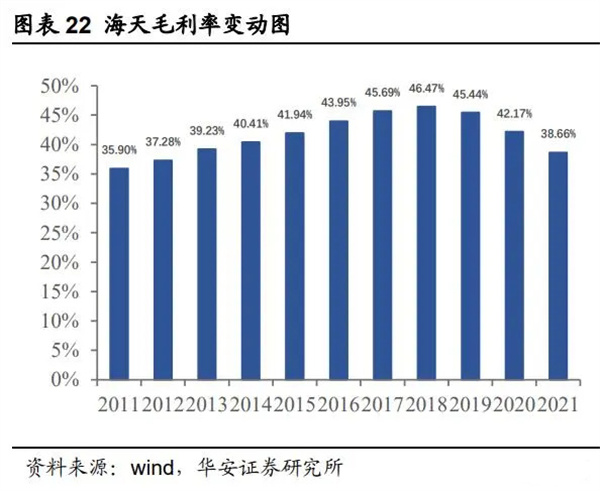

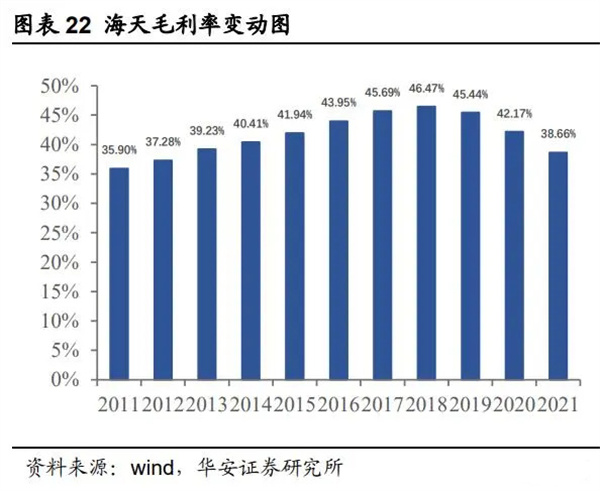

Specifically speaking of product gross profit margin, the gross profit margin of the condiment industry in which Haitian Flavor Industry is located is high . For example, Haitian's main product gross profit margin in 2019 was 47.52%, of which the gross profit margin of soy sauce reached 50.38%, far exceeding the 15% of Petroleum.

It is said that in the past, Haitian Flavor Industry's diluted ROE (return on net assets) remained at around 30% all year round, nearly 10 percentage points higher than the overall ROE of the condiment industry.

Due to the impact of the epidemic in recent years, Haitian Flavor Industry's revenue and net profit growth rates have been lower than the company's growth rates in previous years. Even in the first quarter of this year, Haitian Flavor Industry experienced a decline in performance in a single quarter for the first time. Haitian Flavor Industry achieved revenue of 7.21 billion yuan, a slight increase of 0.72% year-on-year; net profit of 1.829 billion yuan, a year-on-year decrease of 6.36%; net profit of excluding non-operating items was 1.791 billion yuan, a year-on-year decrease of 5.49%.

4. Success or failure is subject to the times

In the past three years of the epidemic, all once glorious consumer companies will be affected, and many traditional companies are very difficult, and some even go bankrupt.

The business world is rising and falling, and enterprises are prospering in the times and return to the times.

The future era is an era of stock markets. For traditional enterprises, the biggest homework is to consolidate the basic market and achieve high repurchase on the basic market.

The dispute over additives in Haitian Flavor Industry once again upgrades consumers' awareness of food additives. When the whole nation pays more attention to healthy diet, it is also an opportunity for the entire food consumption industry to become healthy and high-end products.

At this time, if the company can adapt to the trend of public opinion and adjust its product strategy, it may be the best brand promotion. Once again, re-purchase will not be a problem. After all, high re-purchase will require accumulation and multiple reputations. However, being banned by consumers only requires improper one.

Although Haitian Flavor Industry is still the industry leader and its position will not be shaken in the short term, if it does not reflect on itself and reexamine the market and the times, in this changing new consumption era, the seeds of rewriting the pattern have been planted, and it may be too late to change it in the future.

EN

EN CN

CN