1. Giants are losing users

Double Eleven is becoming more and more attractive to consumers, because the daily price of Pinduoduo’s 10 billion subsidy and Douyin’s live broadcast room is lower than Double Eleven.

Since the beginning of this year, based on Alibaba's financial reports in the first two quarters, it can be found that the growth rate of active users of Tmall and Taobao has shrunk for the first time. In addition to the impact of the economic winter, the continued impact of Pinduoduo and Douyin is the main reason.

Alibaba's financial report shows that in the first quarter of this year, the number of active users of platforms such as Tmall + Taobao + Taobao and Taobao in China's commercial branch increased by 20 million in a single quarter, of which Taote increased by 39 million compared with the previous quarter. Anyone with discerning eyes can calculate that the growth of active users of Tmall and Taobao outside Taote should be -19 million!

In contrast, Pinduoduo's data in the first quarter of this year: the average monthly active users reached 751 million, an increase of 2.5% from the previous quarter, or 18 million.

Alibaba's second quarter data showed that Alibaba's "annual active consumers" of the commercial branch of China increased by 21 million, of which Taote's increased by as much as 20 million users in the quarter. It can be calculated that Taobao and Tmall only increased by 1 million during the quarter!

At the same time, from the perspective of traffic sources, Alibaba's channels and costs for purchasing traffic are becoming unfavorable. For example, traffic platforms such as Douyin and Kuaishou have gradually tightened the export of e-commerce traffic, built their own e-commerce systems, and internally digested traffic.

2. The killer weapon of Pinduoduo and Douyin

The killer weapon of Pinxixi and Douyin has no advanced technical content, and it is to accurately snipe Tmall's popular products with low prices . Let's look at two small cases:

Case 1: On the eve of 618 this year, a mother posted two pictures in the owner group. It turned out that she had purchased a brand of Princess Aisha crystal children's shoes. The actual payment price for the Tmall flagship store carnival event was 110 yuan and it has been shipped. My friend sent her a link to Pinxixi with the same brand and style, and the price was 29.9 yuan, and she had already bought more than 100,000 pieces! The price of Tmall is 3.68 times that of Pin Xixi! As a result, the mother returned the Tmall order and went to Pinxixi to place an order again.

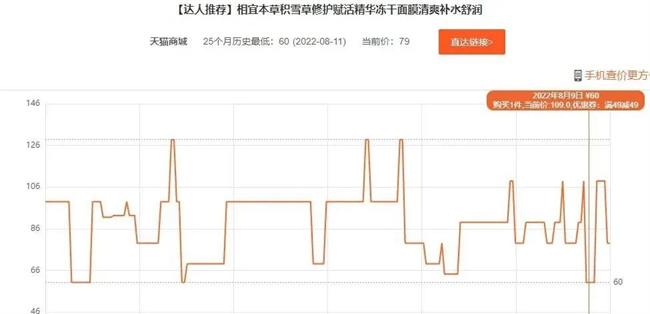

Case 2: A well-known maternal herbal skin care brand has a facial mask that cooperates with internet celebrity anchors, and it costs 60 yuan. And in the Tmall flagship store, the price is 89 yuan. Let’s look at the historical price curve of this product. 60 yuan is the lowest price on Tmall platform. In other words, the daily sales price of the brand on the Douyin platform can directly reach the lowest price of the Tmall big sale! So, some people say that live broadcast killed Double 11.

The above are just two small cases, but they are a microcosm of Pinduoduo and Douyin sniping Tmall users, and they are also the fundamental reason for the continuous loss of Tmall users!

In particular, Pinduoduo uses 10 billion subsidy activities to conduct precise and low-price sniping on the same brands and popular products of Tmall and JD.com in an organized and purposeful manner. This directly poached the lifelines of Tmall and JD.com.

However, JD.com has the advantage of self-operated logistics and an efficient membership service system, so JD.com's users are not so easy to be poached. As a result, Tmall was the first to be affected and suffered the most damage.

3. Alibaba is old, can you still fight?

Alibaba was once very capable and invincible. However, now watching Tmall continue to lose users, the senior management has not taken necessary measures to do so. Merchants sell super low prices on Pinduoduo and Douyin, allowing Tmall users to bear the high prices. This is very unfair to Tmall users, so user loss is inevitable.

We can analyze that Alibaba still has many cards to play. First, do you dare to provide 20 billion subsidies to support merchants for Pinduoduo’s 10 billion subsidies? Second, can we ask the price of the same brand, same product, and same period on the Tmall platform not be higher than any other channel, otherwise the right will be reduced immediately. This is technically not difficult.

Alibaba made a profit of 150 billion last year, while ByteDance lost 604.1 billion last year, and Pinduoduo made a profit of 6.6 billion last year. Therefore, as long as Alibaba puts down its stance and does a fight, Pinduoduo’s annual profit of only 6.6 billion yuan will not consume Alibaba’s annual profit of 150 billion yuan!

From the perspective of game theory, the best way to avoid war is to devote all your efforts to the battle. When the enemy sees that they cannot defeat it, they will retreat. As long as Alibaba comes up with the "20 billion subsidy" plan, Pinduoduo's 10 billion subsidy plan will come to an abrupt end!

In this way, Pinduoduo and Douyin can only return to their original differentiated positioning and compete with Tmall in a layered manner, and the market order will become better, and merchants will not have to be swept into a fierce price war.

Of course, history cannot be assumed. Because it is unlikely that Alibaba will return to the grassroots era in its early years! Alibaba has graduated and has landed, and shareholders have entered the harvest season. Just like Chu Yunfei's troops, they were fighting with white gloves, and they were disdainful to go to the mudlands with Pinduoduo and Douyin.

4. Looking forward to the future

1. Pinduoduo will continue to compete for high-quality customers and high-quality brands of Tmall and JD.com. It is no longer an e-commerce platform positioned in the "sinking market" but a comprehensive e-commerce platform for all people and all brands. In the end, after the success of the revolution, people become kind and gentlemanly, and will also embark on the road of Tmall, wash away the labels of "low price" and "low quality", shuffle small sellers, support big merchants, and support brand building. Because the Tmall model can maximize platform profits. Shareholders will not tolerate a long-term unprofitable business model.

2. Douyin e-commerce will continue to continue to have high-quality customers and high-quality merchants of Tmall and JD.com. In the end, it will no longer be an interest e-commerce platform, but a comprehensive e-commerce platform that combines interest e-commerce and shelf e-commerce. After the revolution is successful, it will become gentle and will embark on the road of Tmall, clean up small businesses, support big businesses, and support brand building. Because this is the only way to stop the bleeding, turn losses into profits, and give explanations to shareholders.

3. The status of JD.com platform is unshakable and it is still the second-year-old. JD Plus members cannot be taken away by other platforms, because the good experience of JD’s self-operated logistics and services is beyond the reach of other platforms.

4. As for Alibaba, it may still be the boss, but its future market share may be one of the three parts of the world.

5. For e-commerce companies, the era of grassroots has ended. We need to make two preparations:

①Business line - Quickly complete the original capital accumulation, promote the upgrading of business models, build large stores, make new products, make brands, and make supply chains, the future is the way out.

② Organizational line - change the workshop model, upgrade strategies and strategies, from operating individual assaults to joint combat between functional departments, organizational upgrades, performance appraisals, building talent echelons, and sustainable development.