What are the e-commerce models?

E-commerce is more than C2C, B2C, and B2B. The following are 10 common relatively mature e-commerce models , and introduces the corresponding business processes, profit models and the business logic behind it. Share with you.

When people talk about e-commerce models, they may immediately think of C2C, B2C, B2B, etc., but now it is 2022, and various new e-commerce models are emerging one after another, and the division is still slightly narrow. Therefore, this article will take into account the traditional e-commerce models and focus on introducing new or relatively niche e-commerce models.

1. Traditional e-commerce

There is currently no separate definition in the industry. Before Pinduoduo, the well-known e-commerce giants basically belonged to the category of traditional e-commerce. This type of e-commerce platform was generally established early, large in scale, and highly well-known, such as Taobao/Tmall, JD.com, Suning, Vipshop , etc. New e-commerce platforms under this model include NetEase Koala, NetEase Yanxuan, Secoo, Xiaomi Youpin, etc.

Traditional e-commerce forms a supply-side network synergy effect through the integration of retail, marketing, logistics, finance and other business formats, thereby improving the benefits of the entire organization and further sharing service costs.

Taking JD.com as an example, JD.com has been upgraded to a retail sub-group, and has "three horses" with JD.com Logistics and JD.com Digital Technology Groups, forming a closed loop of retail + logistics + finance, which is also the development direction of most traditional comprehensive e-commerce in the future.

This part of the content is suitable for in-depth research by e-commerce industry practitioners.

2. Social e-commerce

In the past 2019, the word "social e-commerce" has become popular all over the country and has also attracted widespread attention in the industry. According to incomplete statistics from Yibang Power Network, in the first half of 2019 alone, 17 social e-commerce financing incidents have occurred, with a total amount of more than 2 billion yuan.

Unlike traditional e-commerce, social e-commerce focuses on consumer interpersonal relationships, and generates aggregate benefits based on the sharing of people between people, which in turn reduces the platform's customer acquisition costs and service costs.

Currently, there are four mainstream social e-commerce models:

1. Social content e-commerce

Under this model, the platform relies on high-quality content to guide value-based consumption decisions. According to whether the platform's products are self-operated, it can be divided into two categories. The specific business model and profit composition are as follows:

2. Social sharing e-commerce

Under this model, the platform relies on social relationship chain to promote user fission and commodity dissemination. According to whether the platform's products are self-operated, it can also be divided into two categories. The specific business model and profit composition are as follows:

3. Social retail e-commerce

Under this model, e-commerce platforms rely on retail capabilities to promote inventory optimization and incremental mining. According to the traditional e-commerce division method, they are divided into the following three categories. The specific business model and profit composition are as follows:

4. Social e-commerce service provider

Under this model, the platform empowers all links of social e-commerce based on professional services based on big data and new technologies. According to the types of services provided, it can be divided into the following three categories:

3. Fresh food e-commerce

Fresh food e-commerce refers to the use of e-commerce to directly sell fresh products on the Internet, such as fresh fruits, vegetables, fresh meat, etc. Competition in this track is still fierce. Hema, MissFresh, Dingdong Maicai, Meituan Maicai and other platforms show their magical powers. Of course, there are also some failures, such as MissFresh. If you want to know more, please read: " Burn 11 billion in 8 years! With forced layoffs of more than 700 employees, this e-commerce platform was "disbanded"?》.

The main profit model of fresh food e-commerce is the forward warehouse model, and the forward warehouse model refers to small warehouse units closer to consumers, which are generally set up near communities where consumers are concentrated. Its operating model is: the seller of fresh food products uses cold chain logistics (refrigerated trucks) to deliver the products to the forward warehouse for storage for sale in advance. After the customer places an order, the forward warehouse operator organizes the package production and the "last mile" door-to-door delivery. Whether it is order response speed or delivery cost, the forward warehouse model has great advantages over direct delivery.

4. Maternal and infant e-commerce

As the name suggests, maternal and infant e-commerce refers to a vertical e-commerce platform with maternal and infant products and peripheral services as the main business category .

Affected by the opening of the "second child" policy, the entire maternal and infant market has "get" related dividends, such as nanny, maternal and infant shops, children's playgrounds, etc., which are growing rapidly, and some even become in short supply. The maternal and infant e-commerce industry has also enjoyed the dividends of "second child". According to the "2021 China Maternal and Infant Products Market Review and 2022 Development Trend Forecast Analysis" released by BigData-Research (Bida Consulting), the size of my country's maternal and infant market has increased from 2.59 trillion yuan in 2017 to 3.58 trillion yuan in 2020, with an average annual compound growth rate of 11.4%. In 2021, the market size of my country's maternal and infant industry will continue to maintain a rapid growth trend.

Data source: compiled by MobData, China Business Industry Research Institute

In recent years, the scale of my country's infant milk powder market has continued to grow. Data shows that from 2017 to 2020, the size of my country's infant milk powder market increased from 1873 trillion yuan to 2903 trillion yuan, with an average annual compound growth rate of 15.7%. With the relaxation of my country's three-child policy, it is expected that my country's demand for infant formula will continue to grow.

5. Pet e-commerce

According to the data from the "2021 China Pet Industry White Paper", the scale of my country's urban pet (dog and cat) consumer market reached 249 billion yuan in 2021, an increase of 20.58% over 2020, and the growth rate has returned to the pre-epidemic level. The compound growth rate from 2012 to 2021 was 24.88%. Except for the impact of the epidemic in 2020, most of the annual growth rate of market size has remained above 10% since 2012. With the continuous improvement of pet family penetration rate and industry maturity, the market size of my country's pet industry has shown a steady increase. It is estimated that the market size of my country's pet industry will reach 269.3 billion yuan in 2022.

Data source: 2021 China Pet Industry White Paper and compiled by China Business Industry Research Institute

Therefore, pet e-commerce has a market size of 100 billion yuan, and vertical pet e-commerce platforms represented by e-pet mall and Boqi Pet are booming.

Judging from the current product form, E Pet Mall is fully laying out UGC and PGC content shopping guide modules. The author believes that it will be more in line with the shopping habits of the new generation of pet parents, thereby achieving better development.

6. Vertical sale

Objectively speaking, the early 800 yuan and 百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百百

It must be the world's first e-commerce platform for direct connection manufacturing (C2M). It adopts the C2M model to realize the straight line connection between users and factories, removes all intermediate circulation links, connects top designers and top manufacturers, and provides users with top quality, civilian prices, and unique products. According to its value proposition, it can be seen that the necessary mall only provides users with "low price", "high-quality" and "exclusive" products. The main profit model is a 7% sales deduction point, which maximizes product cost-effectiveness.

7. Shopping guide e-commerce

Statement in advance: I do not recommend that you try this part of the content, and I am not an upstream promoter.

Such platforms generally use CPS to sell goods, import third-party platform products upward through API interface, and develop member customers downward in the distribution model (some involve member grading). The profit model is mainly: ① Commission price difference; ② Membership fees; ③ Gross profit of some self-operated products .

Currently, the relatively mature platforms in the industry are Peanut Diary, and the current development momentum include Taoxiaopu and Fenxiang.

Among them, Peanut Diary is a comprehensive shopping guide platform. Taoxiaopu focuses on Alibaba-style products (strongly combined with Taobao), and Fenxiang focuses on JD.com products (strongly combined with JD.com + WeChat).

Friendly reminder that the fission effect of this mode is very scary, please do not test it easily.

8. Cross-border e-commerce

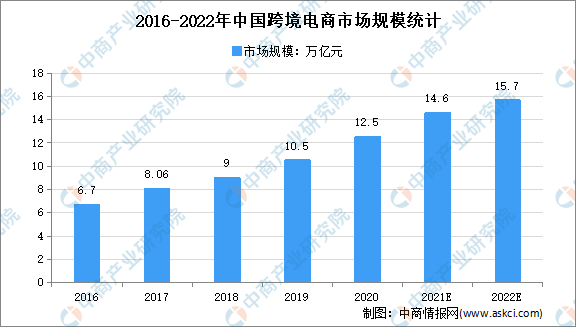

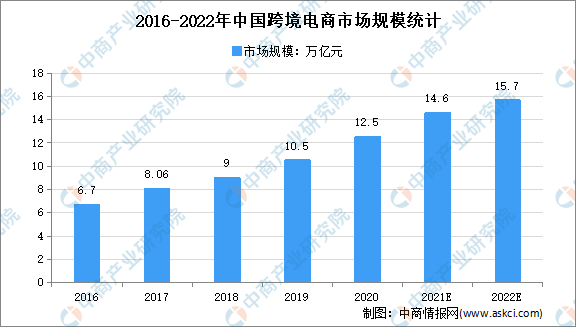

According to data, the scale of China's cross-border e-commerce market in 2020 has reached 12.5 trillion yuan, an increase of 19.04% year-on-year, and the market size is expected to reach 14.6 trillion yuan in 2021. Among the overall scale of cross-border e-commerce import and export, exports accounted for 77.6% in 2020, and the overall scale of cross-border export e-commerce was about 9.7 trillion yuan, an increase of 20.79% year-on-year. China Business Industry Research Institute predicts that the scale of China's cross-border e-commerce market will reach 15.7 trillion yuan in 2022.

Data source: 2021 China Pet Industry White Paper and compiled by China Business Industry Research Institute

At present, in addition to the leading e-commerce companies, the better export sectors are shopee, Akulaku, Lazada, etc. The operating model of this type of e-commerce can actually refer to the trading ideas of domestic mainstream e-commerce (store groups or refined operations), and at the same time combine with the user habits of the site; the import sector is mainly concentrated in leading e-commerce platforms, such as Tmall International, JD International, NetEase Koala, etc., and the vertical field of Yangwo is doing well.

Taking Yangwo as an example, the "buyer merchant system" is its core advantage. Yangwo Dock focuses on global products, covering 800,000 different products from 83 countries and regions, with up to 60,000 professional buyers, among them, there are many Internet celebrities and professional buyers. These people have provided a better carrier for Yangwo Dock to achieve global personalized consumption recommendations, and are also an important backing for defending the quality of products at the source and improving overseas shopping experience.

9. Mini Program E-commerce

After the father of WeChat, Zhang Xiaolong, officially announced that the mini program will be officially launched on January 9, 2017, e-commerce models based on the mini program ecosystem emerge one after another. Needless to say, the top PDD, JD and other traffic comes with their own traffic, we focus on small power stores that "focus on WeChat product efficiency marketing".

The platform claims to be "the largest mini-program e-commerce service platform in the WeChat ecosystem", and has connected upwards of 100,000+ SKUs of 1,000+ brands, and has downwards of 3,000+ self-media, with 1 billion+ daily PV.

In addition, it is worth noting that the newly launched "Tencent Smart Retail" mini program this year. As a decentralized traffic distribution platform + private domain traffic diversion platform, and also has LBS-based product capabilities, Tencent Smart Retail has a lot of imagination in the future.

10. Finished goods distribution model

This model is completely different from the seventh shopping guide model. The distribution of tail goods refers to providing the distribution capabilities of branded products only for B-end or small B customers, similar to Alibaba. Currently, I have done better, including Aikuan, which focuses on "the first choice for brand distributors".

The operation model is to recruit brand merchants upward, with brand merchants providing goods (discounted final goods) and logistics services, and paying downward to recruit distributors (only level 1). The platform is responsible for guiding distributors operations, and distributors are responsible for sales. The platform and distributors allocate the price difference of goods in a certain proportion.

(Note: Due to the diversity of e-commerce businesses, the classification standards in this article are not 100% rigorous, so the same e-commerce platform may be classified under different categories.)

EN

EN CN

CN