There are few knowledge and interpretations about the content operation of (e-commerce) platforms, so let’s sort out some of my experiences and share them with you.

There are actually quite a few articles about "content" on the Internet, and they can be summarized into two types:

The first and most common ones are written around the "public account". This type of content is limited. A rough summary is that the content is equal to copywriting, jokes, and hot topics. Content operators are the "editors" behind it. Most of them teach people how to write 100,000 articles, how to establish a character, and how to interact.

The second type is the high-end version, which integrates APP, H5, short video, live broadcast, etc., which is theoretical and comprehensive. It can collect many good cases. It is just that I have seen too many BGC, PGC, and UGC, which sounds very high-end. Holding a bunch of theoretical knowledge can be used to brag, it has no substantial effect on my work.

Unfortunately, there is very little knowledge and interpretation of the content operation of (e-commerce) platforms, so let’s sort out some of my experiences and share them with you.

As for the user operations, new media operations, brand operations, data operations, etc. summarized by other online masters, it may indeed exist. But in my opinion, I am actually doing some of the mentioned contents, and some of them are actually difficult to separate and do separately. Especially user operations. For us, merchants and buyers are our users, so we cannot generalize this. You can read the operation summary of some APPs. I think many of them are well written.

(one)

I am an e-commerce platform, which is one of the most difficult jobs to explain clearly to my parents.

Let me first talk about the operational work that I have more daily contact with as an e-commerce operator:

Merchant operations, also known as business control among Alibaba industry waiters, are the most basic ability. They need to layer the merchants in the industry and make these merchants contribute to the greatest extent through a certain reward and punishment mechanism. What they contribute depends on what the current KPI is, which may be GMV, or the number of buyers. Occasionally, for some large customers, you must also have some BD capabilities, that is, the ability to deceive;

Event operations are usually bound to marketing and traffic, and may have different definitions of different platforms. Judging from Alibaba, most traffic is occupied by marketing activities except for fixed channels. Therefore, playing with marketing activities means mastering the traffic entrance;

Product operation (control product), this is what I said a few years ago. I won’t talk about the activities of controlling products in recent years. The reason is that we have recognized a fact that we cannot control products except for self-operation;

Content operation is about the fact that it is gradually independent since 2016. I prefer to interpret content operation and buyer operation together. After all, for me, if you want to capture buyers, you must have content and the content you make is also for buyers to see. Of course, there is also a purer buyer operation. The main work content is to formulate a buyer growth system through buyers layered, which is more product-oriented.

(two)

Now let’s focus on content operations.

Someone once argued whether the content is the purpose or the means. I think it depends on who will do it. If it is Zhihu and Toutiao, the content must be the purpose. Of course, the implantation of advertising is not ruled out. However, for e-commerce platforms, the content is uncontroversial, it is just a means. Content that does not aim to sell goods is nonsense!

Let’s talk about the four elements of the operation content I understand:

1. Clarify user positioning (buyer portrait)

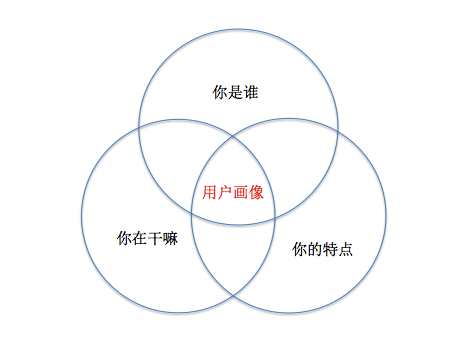

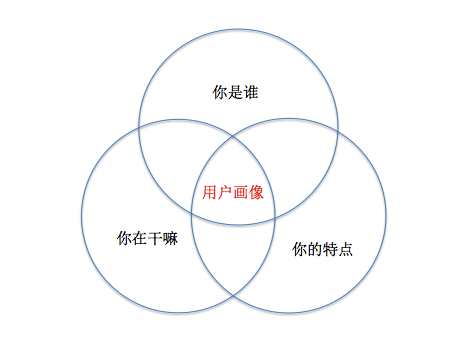

First of all, whether it is e-commerce operation or new media content operation, you must understand who your content is for, that is, user positioning. The user positioning of e-commerce platforms may be relatively more complicated. It is no longer a simple identity, but an intersection after combining the three factors: "who are you", "what are you doing", and "what are you characteristics".

Who are you, including gender, age, region, and income. This part of the data is static data because it is relatively easy to obtain. Over time, most products and platforms call this part of the data a buyer's portrait, and ignore the more important ones;

What are you doing? It is dynamic data, including users' browsing habits, search paths, collection habits, etc. I personally think these problems and data are more suitable for the overall website planning PD for reference. For students who are in content operations, it is good to understand the traffic distribution of their own websites. After all, the paths of most users are similar;

What are your characteristics? This part is the most critical and valuable, but it is often the most difficult to obtain, especially for Class B trading platforms. The data will show some clues, but it is not enough to make judgments and decisions.

For example, if you are selling women's clothing, the needs of Taobao store owners and physical store owners must be different, and the needs of selling high-quality women's clothing and running-through products are also different. Let's not talk about their needs for a while. In terms of identity recognition alone, the role of data can play is far less than that of C-type platforms. At present, we can roughly judge their identity through some accounts, delivery address, LBS, etc., but the accuracy is still far from enough. There are also style preferences, price preferences, purchase cycles, etc. The value that all the data hidden behind a buyer can be mined and brought to us is unimaginable. Of course, in such a complex environment, content operations can be done with a beard and eyebrows, waiting for the buyer to come to the door by himself. At the same time, they can use the most correct method and the most suitable time to let the what they want most appear in front of them after revealing these data.

2. Content organization

When you already know who your buyer (user) is, the next thing you have to do is organize appropriate content for him. Regarding the content, we have to mention the "X" GCs written in the first place. The methodology summarized by the senior still makes sense, so I will not elaborate on it. I want to talk about the content about e-commerce platforms. The content of e-commerce platforms is actually very simple, that is, products, they come from back-end merchants, and your task is how to help these products sell better within a reasonable range.

A boss I admired said something before.

"The content is not secondary refinement, but secondary packaging."

In other words, it is not just about organizing a few activities and building a few pages. Especially for Class B merchants, their self-marketing capabilities are far lower than those of Class C merchants. At least for online platforms, content is needed at this time. At this time, the content is professional endorsement and richness of the platform for buyers; for sellers, it brings a lot of money and brand influence. After forming a virtuous cycle, there will be a steady stream of good merchants, good products and good efforts to help you complete better content organization.

There are many dimensions of content organization, and there will be some differences in different industries. I can think of a few more conventional ones:

By time: new products, hot goods, clearance, festivals, and operations require a certain understanding and grasp of goods and price control;

By origin: Guangzhou Shisanhang clothing and Yiwu small commodities, to a certain extent, origin is endorsed;

According to hot topics: Some peripheral products that are popular in a certain Korean drama, such as lipstick for a period of time, require that operations have a certain sensitivity to the market;

By qualifications: patent, brand, supplier or OEM, provided that you need to have enough understanding of the merchants on your hands;

By category: silk special session, star special session, etc.;

By scenario: It is generally a cross-industry joint activity, such as from the perspective of a baking shop, including baking ingredients, baking tools, baking packaging and electrical appliances.

The above are just some dimensions, and of course there are more possibilities. The segmentation of products and content may reduce the surface traffic data, but in the long run, it will indeed bring high conversion and loyalty, and of course it is also a test of operational professionalism. This is also the reason why more and more niche segments are developing rapidly.

Of course, organizing content in a certain dimension is only the first step, and it is also the stage of content refining. If you want to package better, you must extract the selling points that can best attract the buyer's attention. In addition to understanding the product, it also requires a certain level of copywriting skills. To whom? How to say it? say what?

For example, it is also an event to promote a women's clothing factory. One slogan is to promote the factory area and processing capacity, while the other is "ZARA/H&M domestic OEM factory". Therefore, don’t underestimate the operations around you. Good operations must be written jokes and drawing pictures. All-rounders who understand products and data.

3. Content presentation form

When you have a bunch of content, which can also be called material, the next step to think about is what form to see by your target buyer. Each form will have a different audience and there will be different pros and cons.

(1) Channel Page

All e-commerce platforms will have channel pages, which can exist when the product is initially built, or it may increase or decrease with the development of the business. The display on the channel page is more fixed, allowing buyers to quickly find the content they want, determine the tone of the product, and can also play a better diversion role. The disadvantage is that there are limited ways to play.

(2) Marketing activity page

This is what activity operation is best at. Different product content is displayed through the different dimensions and nodes mentioned in the second point above. Whether the topic is correct, whether the interest points are paid, whether the time is appropriate, whether the page design is comfortable, whether the length will cause buyers to be tired, increase selection difficulties, etc. This series cannot be mastered by listening to a few advices and reading a few articles. It must be accumulated over and over again and again, as well as experience after accurate interpretation of the data. The data results of activities of different purposes will inevitably be different.

Another example is that there must be a big difference in the stay time of the inspection page. One stays for a long time, which means that the product selection is well positioned, while the other is the opposite. At this time, you must have data analysis capabilities, horizontal and vertical comparisons, including channel pages. You can see the health through data, when to revise, and how to change it. The cruel thing is that when you change the industry, you may need to accumulate the above content again, but in fact it is not that scary. Through accumulated experience, analysis methods and dimensions, quick trial and error, you can quickly re-enter the new field.

(3) Search recommendation

This is currently the most advanced and most mellow, but also the most effective way. Think about whether you are starting to pay more and more attention to the sectors such as "good goods", "must buy list", and "guess you like" when opening the Taobao homepage. However, this is also based on a large amount of data accumulation and algorithms. What content operation can do is to prepare a rich content library on this basis. Once the collection of certain keywords is triggered, the content you prepared varies from person to person is displayed.

(4) Graphic and text format

In the past, I often thought that the output of content in the form of graphic texts was a very low cost-effective thing. After all, I had to write such long text just to recommend one or several products. However, more and more Taobao experts and professional mainstream media were trying to get a share of the pie on the e-commerce platform, and even vertical content platforms such as Xiaohongshu and what is worth buying were included. After I wrote a few articles myself, I found that existence was reasonable. Although it seems like a painstaking task, in such a closed place, by cutting off the comparison, reducing the decision-making cost of buyers actually increases conversion, especially professional, literary, or funny textual guidance, which is sometimes more likely to resonate with buyers.

(5) Live broadcast format

Needless to say, you may have been a concept of internet celebrities and the first year of live broadcast in 2016, and the form of live broadcast has been gradually attempted to introduce into Class B e-commerce platforms. I have broadcasted live broadcasts and have also led a group of Class B merchants as seed anchors to develop their work focus step by step. I have some experiences to communicate here. I won't go into details here. I just want to emphasize that Class B live broadcasts should be professional and not look at faces.

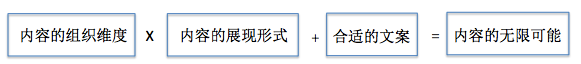

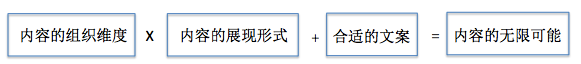

Based on the above points, I have summarized a formula as follows:

Let’s give two chestnuts:

Chestnut 1: (category + origin) x marketing activities + professional profile

Organizational dimensions of content: sub-category (wine), origin (France)

Content presentation form: Marketing activity page (usually short-term activities, mostly accompanied by some promotional interest points, in the case, according to the time dimension of the tour)

Suitable copywriting: Revealing the French wine production area + Introduction to the production area

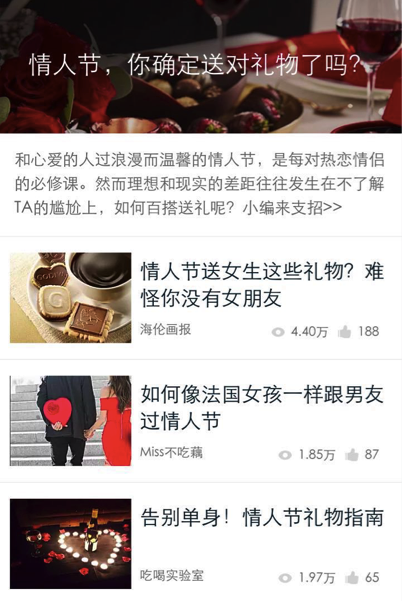

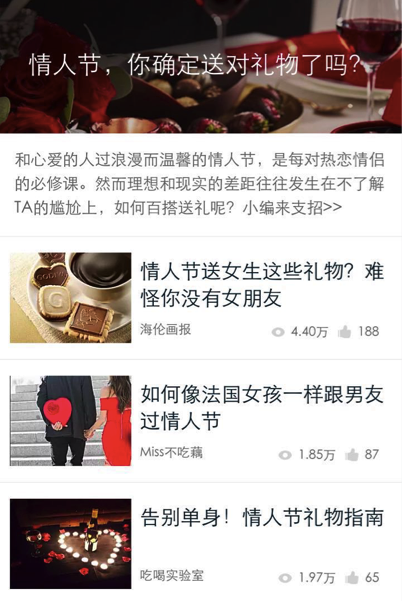

Chestnut 2: (Time, also a hot topic) X graphic form + appropriate copy

Content organization dimension: Time (hot spot): Valentine's day

Content presentation form: pictures and texts

Suitable copywriting: Ask questions, poke pain points, give guidance

Similarly, I believe that as time goes by, there will be many different forms of display waiting for us to create, which is also the most fun place to operate.

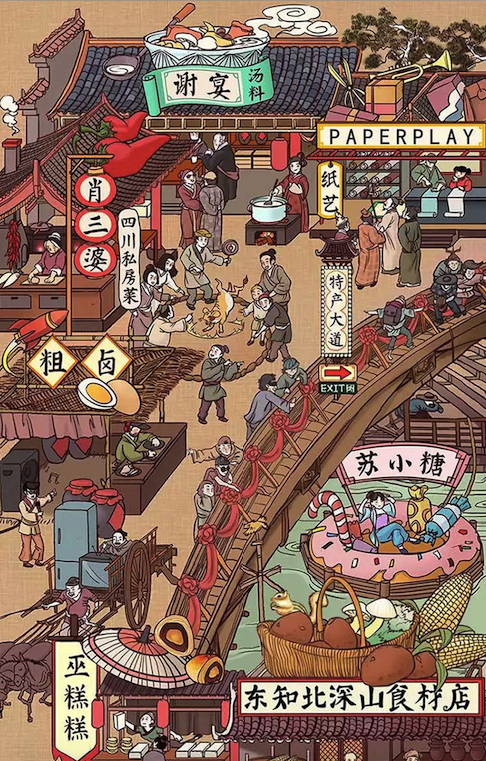

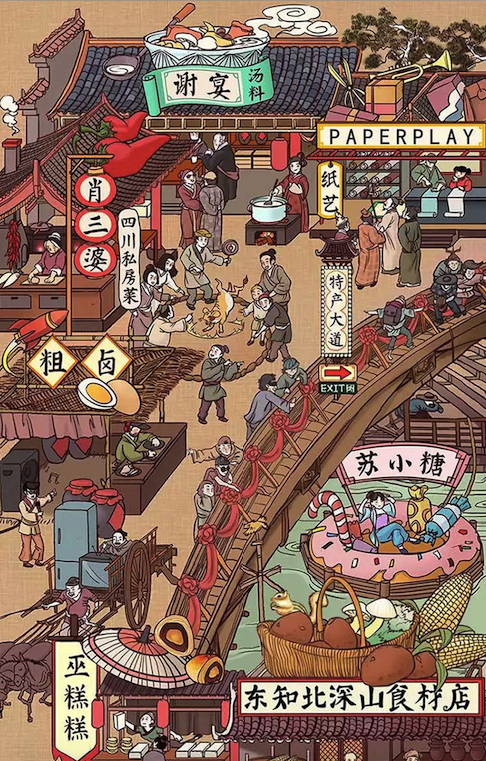

4. Dissemination of content

It has to be admitted that the difficulty of disseminating e-commerce content is much higher than that of some public accounts and interesting H5 pages. Its trading attributes are natural restrictions on the boring gossip, comparison and funny psychology of being a natural person, but it does not mean that it cannot be done. I personally think Taobao has done a good job in this regard. The 3D invitation letters for Double 11 and the Qingming River During the New Year’s Goods Festival are all good cases. However, Class B platforms do need to work harder in disseminating content.

Finally, I want to say that no matter what kind of content you are doing, you must be clear about who your content is for, organize the appropriate content for it, and find the most suitable way for him to see it. If you can pay for it and are willing to actively spread your content, then you will succeed!

![#Laogao E-commerce Newsletter# [May 7 E-commerce Evening News Brief]](/update/1620378363l365908361.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Morning News on January 5]](/update/1609809326l126988356.jpg)

EN

EN CN

CN