It seems not an exaggeration to use this label to describe Suning.com!

This tag also comes from Suning.com's revenue in the past three years. It is said that Suning.com's cumulative losses reached 57 billion yuan, with an average daily loss of more than 50 million yuan.

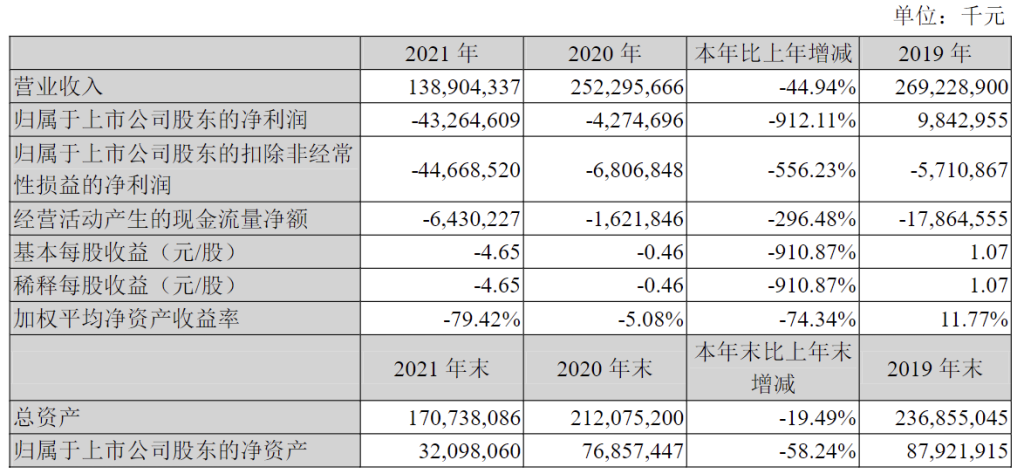

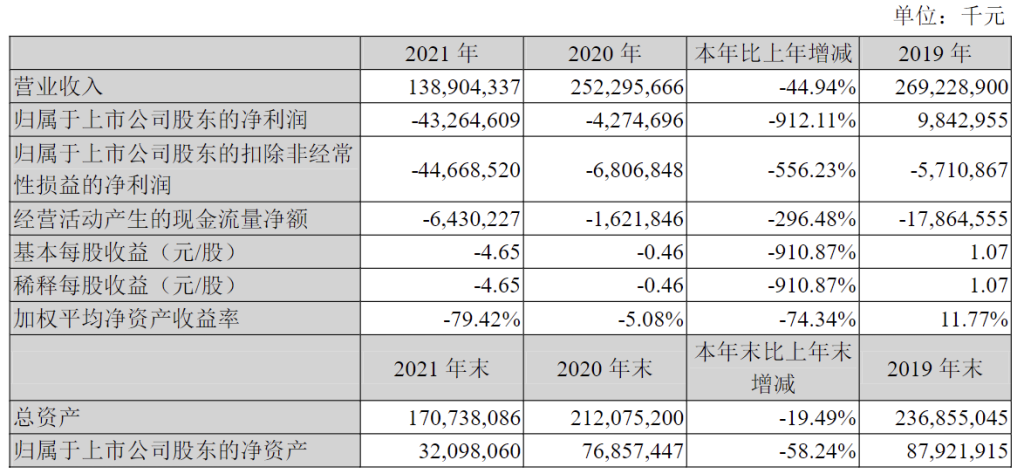

Years of losses, reaching 43.3 billion in 2021

At the end of April, the e-commerce platform - Suning.com released its 2021 financial report, with revenue of 138.9 billion yuan in 2021, a year-on-year decrease of 45%, a loss of nearly 43.3 billion yuan, and a loss of 912%.

According to media reports, if factors such as impairment provisions, investment losses, and deferred income tax return are not considered, Suning will achieve a net profit loss attributable to shareholders of listed companies of 8.563 billion yuan in 2021.

The financial report also disclosed that Suning's commodity sales revenue, which accounted for 92% of its main business in 2021, was 128 billion yuan, a year-on-year decrease of 46%, which eventually led to a large-scale decline in Suning's revenue in 2021, and the gross profit margin of its main business decreased year-on-year, from 9.01% in 2021 to 2.58%.

This decline includes revenue and gross profit margins of all product categories, including daily necessities, communication products, small appliances, refrigerators, washing machines, etc.

It is said that in 2021, Suning encountered unprecedented liquidity pressure. From the end of 2020 to mid-2021, it is the most difficult period for funds. At this time, Suning began to split its business financing and raise large ratings of funds. Even Suning Electric's founder Zhang Jindong was frequently pledging equity and transferring shares, which shows how deep Suning's dilemma is.

Earlier, when Suning.com released its third-quarter 2021 financial report, it said that it had encountered the most difficult period in 30 years of development. In the first three quarters of last year, Suning.com's net profit fell by 1483.29% year-on-year, and its stock price fell by more than 40%. Since August 2020, the decline has reached 60%, and sales have also declined sharply.

This is the lowest level of Suning.com's single-quarter revenue since 2012, and its single-quarter loss is the second highest since its listing in 17 years after a net loss of 4.822 billion yuan in the fourth quarter of 2020.

Now that the 2021 financial report is released, Suning.com has been making losses for seven consecutive years.

Layout is wrong, business is paralyzed

It has to be said that Suning.com's development is due to the dividends of the times. After 2008, Suning.com expanded rapidly in first- and second-tier cities. The number of new stores opened exponentially from 2010 to 2011. It ushered in a highlight of its performance in 2012, and then started a downhill road.

The market structure has changed at this time. Alibaba and JD.com have risen and consolidated their own position. However, Suning only established Suning.com in 2013 and began to officially do e-commerce. The e-commerce landscape is basically established, and Suning.com's competition is not impressive.

When e-commerce exploration did not achieve great results, Suning made many wrong investments and acquisitions, losing nearly 2 billion yuan. Since 2014, Suning.com has partially relied on the sale of its assets and equity to Suning Group and other related parties to obtain "non-recurring" returns to maintain the company's book profit, and the profitability of its main business has declined sharply.

After experiencing a series of failed investments and expansions, Suning is already desperate. In July 2021, Suning got an opportunity to resolve the crisis. Jiangsu State-owned Assets and capital including Alibaba formed a consortium to invest in Suning.com to increase credit for Suning.com.

Zhang Jindong, chairman of Suning E-commerce, stepped down. After state-owned assets entered the market, Suning has now returned to its main business, focusing on e-commerce , offline store business and logistics services related to the core business of home appliances 3C, and online business focuses on the main site Suning.com and Tmall flagship stores.

In terms of logistics services, Suning also stopped the daily express small-piece business in 2021, focusing on the large and medium-sized home appliances and home decoration business, building integrated warehouse and distribution, delivery and assembly services, and expanding orders from upstream brand manufacturers and Cainiao. Suning is indeed constantly saving itself, but these self-rescue cannot resolve the difficulties that have been facing it for many years.

A dilemma does not form in one day, and it also takes time to resolve it.

The dilemma of the enterprise is the result of the times

There are countless companies that have been going downhill in the rise of dividends of the times due to misunderstandings in layout or changes in the times and market demand.

Lao Gao once said that everything has a life cycle, and the same is true for enterprises. In the face of the times, the development of enterprises really cannot be transferred by personal will. Fortunately, Suning has never given up on self-rescue, and those detours are also the price of self-rescue.

When the home appliance market saturated and entered the stock market, Suning opened up "scenario shopping", exploring new usage scenarios and smart home appliances, and at the same time, it is making business layouts in the sinking market, hoping that the former retail giant can take a new path!

![#Laogao E-commerce Newsletter# [E-commerce Evening News on March 30]](/update/1634637709l862528272.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Evening News on August 4]](/update/1628069773l649887235.jpg)

EN

EN CN

CN