Via "saves" Wang Leehom!

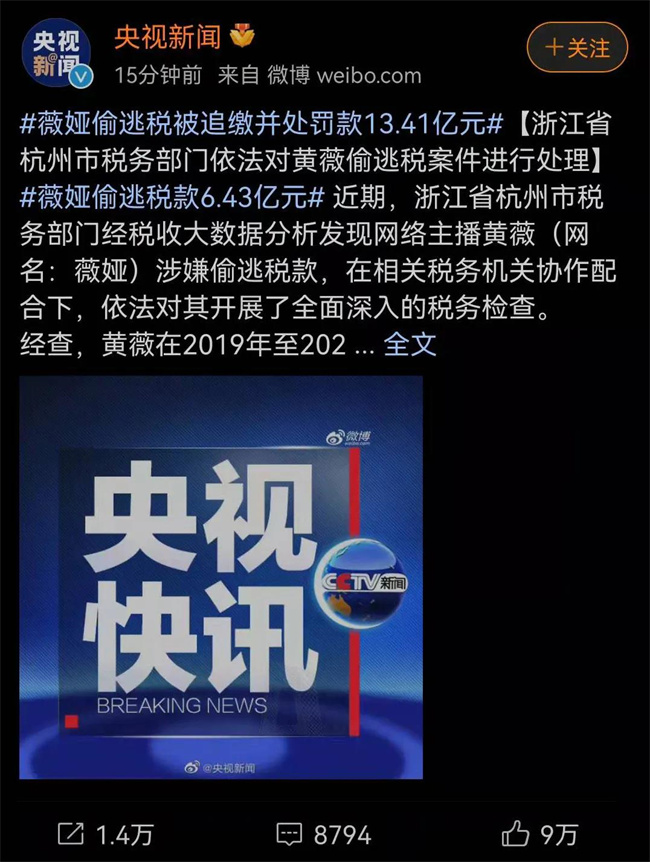

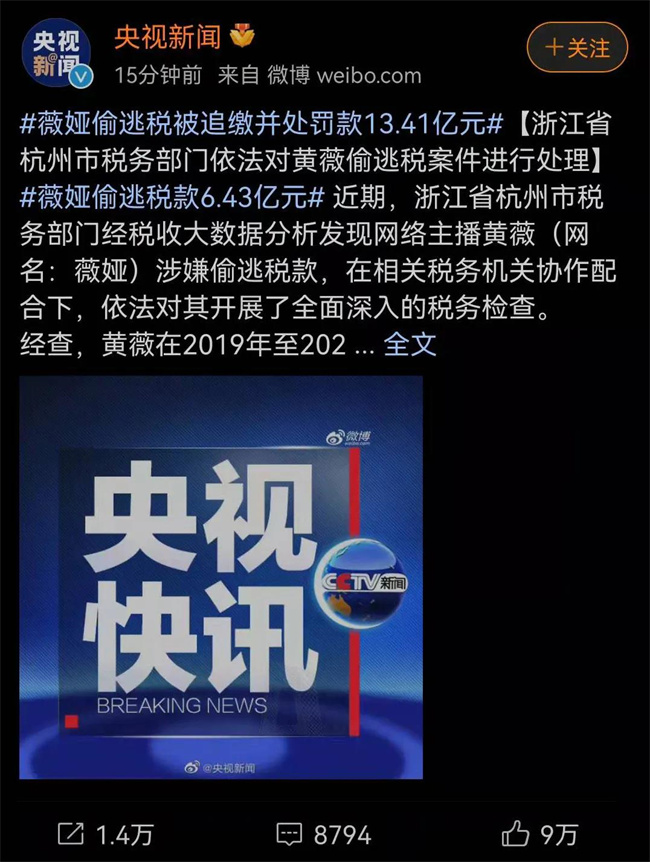

At 4 pm on December 20, according to the evidence from CCTV News and other media, Weiya was recovered and fined 1.341 billion yuan when she evaded taxes!

Via "save" Wang Lihong

The news fermented for nearly 15 minutes, and the news of Viya evading taxes directly reached the fourth place on Weibo's hot searches, with the number of readings of the topic reaching 50 million and the discussion reaching 34,000.

Nearly 200 media including CCTV News, Xiake Island, CCTV.com, Xinhuanet, China Women's News and other media are rushing to report.

20 minutes after the incident, Viya's tax evasion hot search directly pushed Wang Leehom, who had made a mistake in the flower field.

Due to Via's failure, the Taobao live broadcast trailer that was originally scheduled to hold "Via Makeup Festival" at 7 o'clock last night was also cancelled. It is rumored that Via's company requires employees to go home to rest first, and their wages will be paid during this period.

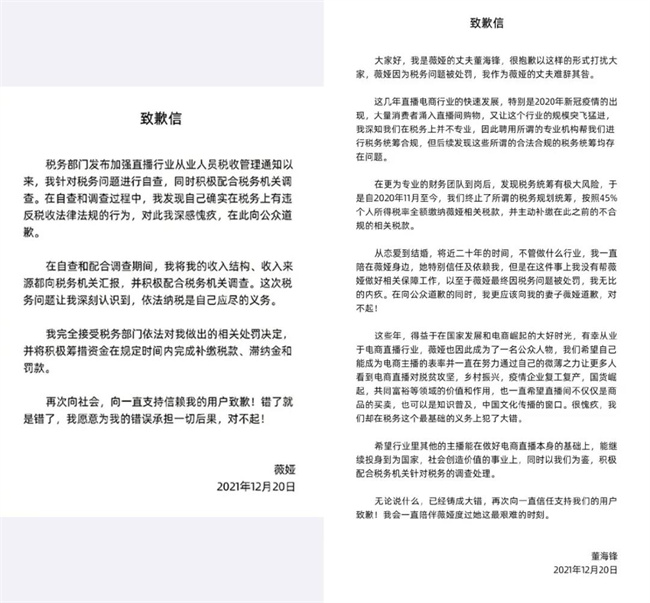

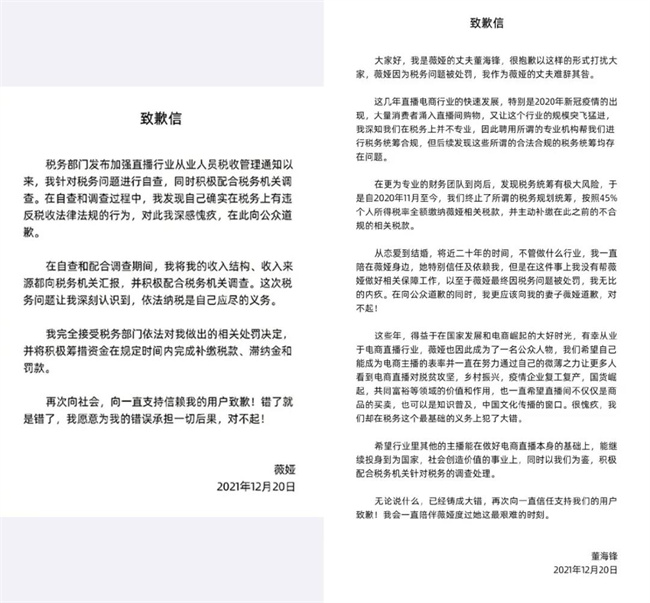

In the afternoon of the same day, Weiya and Dong Haifeng (Via's husband) successively issued apology letters , saying that they would fully accept the relevant penalty decisions and actively pay taxes, late fees and fines on time, and apologize to the public.

After Via collapsed, Li Jiaqi, who was standing side by side, inevitably became the target of public doubt. Therefore, Li Jiaqi responded: "We are honest in our business and live broadcasting every minute."

However, during the live broadcast that night, Li Jiaqi "joking" said, "Explain how to get the coupons, because there will be many new fans today."

Actively pay 500 million yuan in active reporting without any information yet

According to CCTV News, between 2019 and 2020, Huang Wei (Viya) evaded 643 million yuan in taxes through concealing personal income and fictitious business conversion income nature, and other methods of underpaying 60 million yuan in taxes.

During the tax investigation, Huang Wei was able to cooperate and actively pay 500 million yuan in tax payments, and at the same time actively report tax-related illegal acts that the tax authorities have not yet grasped.

Taking into account the above situation comprehensively, the Inspection Bureau of the Hangzhou Taxation Bureau of the State Administration of Taxation, in accordance with relevant laws and regulations, imposed a fine on Huang Wei, totaling 1.341 billion yuan .

Among them, 500 million yuan for hidden income evasion but voluntarily paid tax and 310 million yuan for underpaid tax and voluntarily reported underpaid tax, 319 million yuan, 6 times fined 319 million yuan; 4 times fined 109 million yuan for hidden income evasion but voluntarily paid tax, 116 million yuan for underpaid tax, 116 million yuan. Recently, the Hangzhou Taxation Bureau Inspection Bureau has served Huang Wei with a tax administrative handling penalty decision in accordance with the law.

Log out! The similarities between the thunder anchors

Tianyan Check shows that on December 3, Hangzhou Qianyi Enterprise Management Partnership (Limited Partnership) underwent industrial and commercial changes, and the company's status changed from existence to cancellation, and the reason for the cancellation was the resolution to dissolve . The company was established in November last year with a total investment of more than 4 million yuan. Huang Tao (Viya's younger brother) contributed more than 50% of the investment ratio is the final beneficiary, while Dong Haifeng (Viya's husband) and Viya contributed a total of about 10%, of which Dong Haifeng is the actual controller of the company.

All of this seems to be similar to Sydney, who was the top anchor before.

Before it was revealed that tax evasion was evaded, Sydney had cancelled the Shanghai Douzima Marketing Planning Center and Shanghai Huangsang Marketing Planning Center, which had Sydney's original name Zhu Chenhui as its legal person and investor. These two companies were suspected to be involved in tax evasion, and Sydney's "Hangzhou Qianyi Enterprise Management Co., Ltd.", as the executive director, was also cancelled and dissolved on December 3.

After the incident was exposed, Xueli's accounts such as Weibo, Douyin, Xiaohongshu, official accounts, and Taobao live broadcast were all banned. Similarly, Weiya, who was involved in tax evasion, was also banned from accounts such as Taobao live broadcast, Weibo, Douyin account, Kuaishou, and Xiaohongshu.

However, although they are both top anchors, Sydney's tax evasion funds are only more than 65 million yuan, which is far from Viya's more than 600 million yuan.

Is live broadcast a double-edged sword?

In just five years, Weiya has been on the "New Fortune 500 Rich List" with her net worth of 9 billion in mid-2021 with her e-commerce live broadcast.

Data shows that from January 2020 to September 26, 2021, Weiya's net income reached 2.92 billion , Li Jiaqi reached 2.41 billion, and Sydney reached 697 million, firmly occupying the first live streaming revenue.

Using the live broadcast trend, she has gained an unshakable position, which makes people sigh that the times create heroes. But she, who is already on the list of rich people, does not stick to the most fundamental principles, which is really a pity.

A whale falls into all things. For merchants, Via's ban means that more traffic will be released, which is a "accidental" opportunity, but for Via, everyone doesn't have to take advantage of it. Starting a business is not easy. After all, Via is also an admired entrepreneur, and it's a big mistake to improve it!

It has to be said that as top anchors such as Via and Xueli continue to expand the ceiling for live streaming sales, countless people are ready to go. According to statistics, China's current anchor accounts have more than 130 million, and almost 1 in every 10 people is an anchor.

There are many famous entrepreneurs among them. Luo Yonghao, who paid off 600 million yuan in debt through live broadcasts in three years, did not hesitate to hang the official seal to consume Li Guoqing, who did his own live broadcasts, Yu Minhong, who sent all the desks and chairs for live broadcasts, and entrepreneurs such as Dong Mingzhu, who found a 22-year-old successor to sell goods, also put down his figure and joined the live broadcasting army to "bring salt" to the products.

Some people say that live streaming is a double-edged sword, but what hurts oneself is still desire and ignorance. "If you come out and do it, you will have to pay it back in the end." When a lot of wealth is in your hands, how to treat it normally becomes something that every anchor, every e-commerce person, and even every public has to face!

Irreversible trend

After years of development, e-commerce has long gone through an era of wild growth and entered an era of meticulous cultivation in the mature period. With the release of new e-commerce tax policies in 2020 and the birth of the fourth phase of the Golden Tax Tax tax big data, the e-commerce industry is gradually maturing and standardizing. This is an indisputable fact and an irreversible trend.

With the sudden outbreak of tax evasion by major anchors, learning and understanding the basic knowledge of taxes, establishing a standardized financial team, and timely adjusting layout has become the "basic operation" for every company leader to truly assume social responsibility , and it is also a responsibility for their own companies and employees.

Be a person who abides by laws and regulations and a person with social responsibility. Laogao E-commerce Class has launched online courses related to e-commerce tax to help companies improve their own tax system and prevent problems before they happen!

![#Laogao E-commerce Newsletter# [E-commerce Morning News on April 24]](/update/1634606324l419797086.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Evening News on August 8]](/update/1519722543l029041880.jpg)

EN

EN CN

CN