The drama of 2021 is no less weak than that of 2020. From the catering brands Yoshinoya and Haidilao to the pharmaceutical brand Jinxun and the education and training institution New Oriental, they are all the same script. They were once very popular and were popular all over the streets and alleys, but now they are gradually weakening.

Times, this is the sigh of the vast majority of people! The incident that caused netizens to sigh again was that the former women's clothing giant La Chapelle was reported to be "bankrupt", which temporarily dominated the hot searches on Weibo, and the youth of the post-80s and 90s fell.

Apply for bankruptcy liquidation by multiple creditors

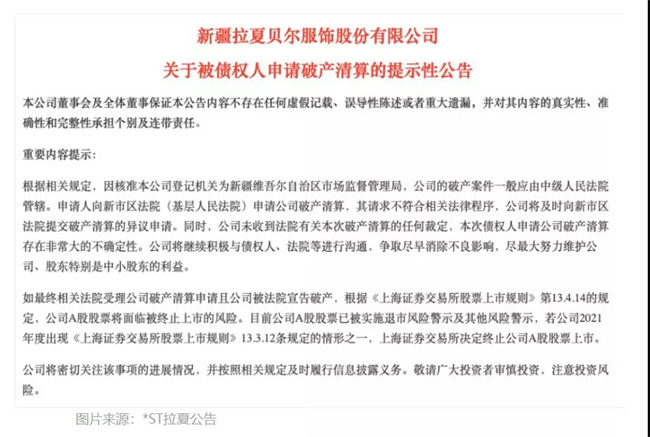

On November 22, Xinjiang La Chapelle Clothing Co., Ltd. (hereinafter referred to as "La Chapelle") issued a reminder announcement on the application for bankruptcy liquidation by creditors, and it was filed for bankruptcy liquidation by multiple creditors.

Creditors Jiaxing Chengxin Garment Co., Ltd., Haining Mangrove Clothing Co., Ltd., and Zhejiang Zhongda Xinjia Trading Co., Ltd. believed that La Chapelle could not repay its due debts, and its assets were insufficient to repay all debts or obviously lacked the ability to repay, so they filed an application for bankruptcy liquidation of La Chapelle to the court.

In response, La Chapelle's response was that the requests of the three applicants did not comply with relevant legal procedures and had submitted an objection to the court for bankruptcy liquidation in a timely manner. At present, La Chapelle has not received any ruling from the court regarding this bankruptcy liquidation.

As of the close of November 23, La Chapelle's market value was only 868 million yuan, which had evaporated by more than 11 billion yuan since its peak. Its 144 bank accounts have also been frozen. The company has involved 58 unexamined/unmediated litigation cases, and the cumulative amount of disputes involved is 530 million yuan.

Debt is high, and losses for many years

La Chapelle was founded in 1998. After 19 years of development, it was listed on the A-share market in 2017, and then went downhill all the way to today. Since 2018, La Chapelle has begun to suffer losses. That year, La Chapelle's revenue increased by 13% year-on-year to 10.176 billion yuan, and its net profit attributable to shareholders dropped from 499 million yuan to negative 160 million yuan.

By 2019, La Chapelle's situation became even worse. His revenue that year fell to 7.666 billion yuan, with a significant increase in losses. His net profit attributable to shareholders decreased by 1258.07% year-on-year, with a loss of 2.166 billion yuan.

So in 2020, La Chapelle's A-share stock was officially "been hated", and its A-share stock abbreviation was changed to *ST La Chapel, because of two years of continuous losses. In the first half of the same year, La Chapelle's net loss was 707 million yuan, an increase of 41.97% from the same period last year.

As of the third quarter of 2021, La Chapelle's total liabilities reached 3.86 billion yuan, while its current assets are only 2.889 billion yuan, with an asset-liability ratio of 133.63%. Insolvency has become a fact.

A media called La Chapelle, and the person in charge said that the company is actively planning various debt solutions such as debt exemption, debt discount, debt extension, and debt repayment with goods. It is also actively divesting non-core businesses and related assets, strengthening timely recovery of receivables, increasing inventory clearance efforts, and making every effort to alleviate liquidity pressure and maintain the stability of basic production and operation and core businesses.

Crazy expansion, stocks are high all year round

From 2001 to the end of 2017, the number of stores in La Chapelle nationwide reached 9,448, with nearly 10,000 stores, and thus it was awarded the title of "offline store king". This is because Xing Jiaxing, the founder of La Chapelle, has a deep belief that he believes that not opening a store is equivalent to a regression.

As the saying goes, success is Xiao He and failure is Xiao He. In the era of the seller's market, the crazy expansion of opening stores has allowed La Chapelle to grow. But with the advent of the buyer's market era, the crisis also followed.

In 2012, La Chapelle proposed the development strategy of "multi-brand + direct sales". In the following years, it successively launched sub-brands such as 7Modifier, La Babité, POTE, JACK WALK, MARC ECK, 8EM, etc., covering men's and women's clothing, children's clothing and other fields. At the same time, offline stores have entered a period of rapid expansion. From 2012 to 2017, the number of stores in La Chapelle has increased at a rate of 1,000 per year.

The rental fees for entering Wanjia stores, all direct labor fees, R&D fees, logistics fees, inventory fees, etc. for a wide variety of clothing, are huge costs behind each one. The most serious of this is inventory, and La Chapelle has not escaped the deadly clutches of the women's clothing industry.

In 2017, La Chapelle's inventory of top and bottom and skirts alone reached 33.113 million pieces, and the end-of-term book value of the inventory goods that year was as high as 2.32 billion yuan.

The crazy store expansion and the involvement of multiple brands have continuously increased costs, making La Chapelle's inventory high for many years, and has also led to profits not increasing with the expansion of stores. Judging from financial data, 2013-2017 was the period of rapid growth in the number of La Chapelle stores, but its net profits were 407 million yuan, 503 million yuan, 615 million yuan, 532 million yuan and 499 million yuan respectively, with basically no growth.

Since 2018, La Chapelle has begun to reduce stores to reduce costs and increase efficiency, and the number of stores has dropped from 9,448 at the end of 2017 to 9,269 at the end of 2018. By the end of 2020, there were only 959 stores left in La Chapelle, and 8,489 stores were closed within three years, which was equivalent to closing nearly 90% of the stores.

By June 30 this year, there were only 427 offline stores left in La Chapelle, less than one-twentieth of its peak.

La Chapelle's Self-Rescue

In addition to reducing stores, La Chapelle has two ways of self-rescue - live broadcast and private label. But it was too late and the results were not good. The pit fee for live broadcasts needs to be considered for La Chapelle, who is heavily in debt. La Chapelle's aesthetic is old and will also face large-scale returns and will also have to bear the freight loss, which is not cost-effective at all.

The private label has caused La Chapelle to face problems such as counterfeit goods, declining quality, weakening brand power, and uncontrolled marketing data for the parent company, which is harmful to La Chapelle.

I wanted to save myself but failed!

Common problems with enterprises in the last era

La Chapelle, a 23-year-old company, has not escaped the so-called trend of the times. It can be summed up in one sentence: if you have skills but no principles, you can only find skills. If you have skills but no principles, you can still find skills.

This is a sentence that Lao Tzu said thousands of years ago, and it still applies in today's environment. Looking at La Chapelle's journey, he was born in line with the times, caught up with the era when the entire country was extremely eager for material things, and took advantage of the momentum to expand and develop. Once the times passed, the present is different from the past. On the surface, it seems that it was because of failure to manage costs well in the early stage and its strategic and tactical mistakes. In fact, as a company, La Chapelle never thought about why he was born and why he existed, and he did not think about the root problem.

Running a business is the same as being a human being. Humans have three questions about philosophy, and enterprises also need three questions about philosophy. Otherwise, it will be water without a source and a tree without roots. Once the wind of the times is no longer blowing, the seller's market will transform into a buyer's market. If the company has no roots, it will not have corresponding strategies and tactics, and it will not be able to handle the tricks, and the result will be abandoned by the times.

There is nothing wrong with the times. The times are just constantly evolving, just like the metabolism of the human body every moment. What is wrong is that companies have not evolved, have not learned the ability to actively evolve, have not found their own navigation system to navigate in the Commercial Sea, and have no own compass.

When a company does not have its own navigation beacon and compass, any movement in the times can change the fate of the company. So what are this self-navigation beacon and compass? It is the mission, vision and values of the enterprise. Every enterprise needs to seriously think about what its backbone is, why your enterprise was born, what value it needs to provide at this stage, and where will it go in the future?

This is what Lao Tzu calls "Tao". Both enterprises and people need it, and enterprises need it even more. In the last era, China was in poverty and had a great demand for material things. The companies born at this time did not need to think about these things, because as long as you have products, someone would buy them because people needed them.

But today is different. The society as a whole has entered a huge material abundance, and spiritual and cultural needs are the first choice. This requires the company to build its own brand and occupy the minds of users. Your market will be transformed here, and corporate profits will also come from here.

Enterprises have their own roots - mission, vision and values. Changing an era is like planting a tree in another place, just living in another place, and not dying!

![#Laogao E-commerce Newsletter#[E-commerce Evening News on September 16]](/update/1663319891l131676538.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Evening News on January 18]](/update/1516265604l090754991.jpg)

EN

EN CN

CN