On the morning of November 20, 2017, Alibaba Group, Auchan Retail SA and Runtai Group announced that it had reached a strategic cooperation in new retail. According to the strategic agreement, Alibaba Group will invest approximately HK$22.4 billion (approximately US$2.88 billion) to directly and indirectly hold 36.16% of Gao Xin Retail's shares.

Due to the rising cost of online traffic, e-commerce giants including Alibaba and JD.com have gone offline, hoping to create closer connections with consumers through a richer offline experience and a broader marketing space, thereby achieving new performance growth.

Since Jack Ma proposed the concept of new retail last year, Alibaba's new retail layout has been in full swing, gaining incremental users, improving user experience, and realizing transformative technological innovation have become the three major principles of the new retail layout. It is reported that this cooperation will focus on big data and commercial Internetization, and will complete the reconstruction and upgrading of "people, goods, and places" through comprehensive digitalization, and work hard on three aspects: online and offline integration, modern logistics and personalized consumer experience.

In addition to strategic cooperation with offline giants such as Intime Department Store and Gao Xin Retail, incubating and investing in Hema Fresh and Ele.me, another important layout of Alibaba is to integrate husband-and-wife stores and community stores in third- and fourth-tier cities in China through retail, and directly establish contact with consumers with a huge retail network system.

Reconstructing China's retail system

Imagine two scenarios: Retail Tong recommends that the shop owner replace Pepsi Coke in the shop with Coca-Cola, and after the change, the shop's sales doubled; last night, the consumer ordered Yangcheng Lake hairy crabs online, and after get off work the next day, he went directly to the freezer at the supermarket in front of the community to pick up the crabs that had been delivered earlier, and buy some ginger vinegar. Based on a huge data network and a fast-response supply chain system, Retail hopes to turn consumption into a very simple thing.

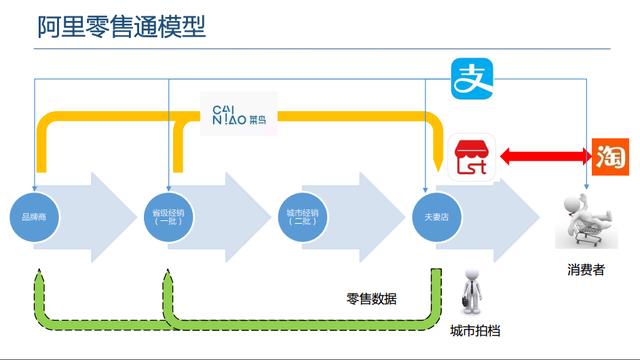

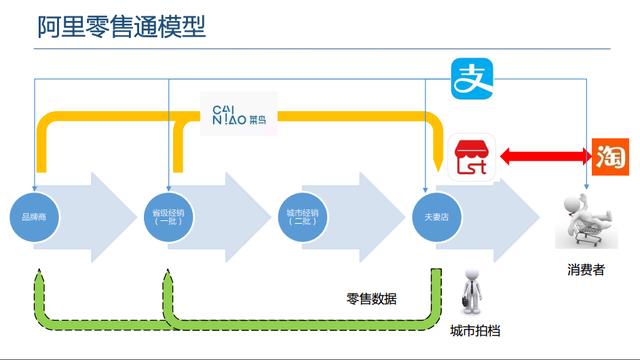

Unlike in the past, Alibaba's new retail entry point is not retail but circulation, but through a commercial system composed of Cainiao, Alipay, Taobao and Tmall, the smooth circulation of brand owners and husband-and-wife stores, reduce circulation consumption, and realize de-intermediation.

Currently, the B2B market is full of people. The third echelon includes regional B2B platforms such as FamilyMart and Kuaike. The second echelon includes Starlink and China Business Huimin. It has cross-provincial operation capabilities and has 10,000+ stores. The first echelon is the game between Alibaba and JD.com. Alibaba has retail channels, and JD.com is a new channel. The advantage of Retail Connect is that Alibaba has a complete ecosystem, strong resource integration capabilities, brand negotiation capabilities and massive retail terminal data.

For brands, retail can help channels sink, enhance channel control, save marketing and labor costs, and at the same time reduce obstacles from middlemen and promote terminal data backflow, thereby achieving rapid customer feedback, promoting new product releases and product improvements.

For distributors, retail connect can improve the efficiency of traditional distribution channels, reduce unnecessary distributors, avoid adulteration and goods collection, and regulate goods and prices. At the same time, relying on a unified retail network, same-city distribution greatly saves logistics costs, increases coverage areas, and leaves more profit margins.

For stores, they can increase revenue by increasing product sales and service types, and use Retail Network's big data services and integrated marketing activities to upgrade services to enhance competitiveness, while saving ordering costs and ordering time, and speeding up arrival speed.

For consumers, buying more cost-effective products and enjoying more personalized services will make consumption simpler and life more convenient.

Where do dealers and brands go?

Behind the retail connection, it is actually a deconstruction of the three major values of dealers. In terms of funds, when Alipay can provide upstream product parties with pledge financing and provide accounting periods for downstream stores, the value of the dealers' capital is no longer essential, and warehousing and logistics are convenient. When Cainiao provides in-store logistics in the same city with much higher integration efficiency (one store can get more gifts), the logistics value of a single brand dealer is no longer unique. When store information and even store inventory data can be transparently given to the brand owner, what does the dealer use to play with the product party?

In the ideal state, the differentiated competitive advantages of channels, terminals, and ground personnel will be smoothed out by retail, and brands will compete in a flatter world. Choosing retail connect may encounter resistance from the distribution system, but it can also bring dividends. Passiveness and passiveness will actually lose the historic opportunity for changes in the circulation industry.

How can brands find a balance between new retail and traditional distribution systems?

Embrace retail and seek death, and do not embrace retail and wait for death. If you are worried about impacting the original channel system, you can use its sub-brands or new SKUs that are adapted to small stores to try to sell the market. New SKUs or sub-brands under big brands + consumption upgrade replacement concepts + high gross profit space products in stores are more popular.

The original strong distribution area can weaken new retail and focus on weak distribution areas. For key dealer protection areas, Retail Pass can choose to "block" according to the requirements of the brand.

Retail Connect will greatly reduce the cost of market distribution, but the focus of competition will shift to store sales. How to interpret and analyze store data and use land to promote marketing to stores will be the top priority.

Under the circumstances of boycotting the existing distribution system, new channels that understand e-commerce operations can be used to operate new retail.

Existing traditional dealers will accelerate the reshuffle, either being eliminated and replaced by new service providers, or being transformed into service providers with certain data operation capabilities and terminal ground promotion capabilities. In the past, store markets, displays, shopping guides, and terminal activation were all means of differentiated competition for brands. When these pan-channel competition methods are transparent and flattened, the brand will return to the construction of brand power and product power itself, seizing consumers' mental resources. Retail will start from the fast-moving consumer goods field. After the system is complete, it will gradually penetrate into maternal and infant, beauty, special channels and other fields. The maternal and infant industry also needs to focus on and learn from Retail.

With the improvement of bargaining power for brands and the compression of profit margins in the middle links, the development of retail and other B2B will eventually elevate the weakest link in China's retail stores to the height of modern retail.

Thank you for your attention and support to Laogao E-commerce Club . Please indicate the source of the reprinting website www.shxuanming.net

Click to register to apply to join the well-known e-commerce network - Laogao E-commerce Club. Any merchants from all over the country, Tmall merchants, Taobao Crown Store, Jinguan Store, and other e-commerce platform merchants can apply to join!

EN

EN CN

CN