The retail industry has attracted much attention this year. After the first release of the China Shopping Center Development Index and China Convenience Store Prosperity Index, the Ministry of Commerce once again launched the "China Retail Industry Development Report (2016/2017)" on July 3. As of the end of 2016, there were 18.1191 million retail operating units in my country, a year-on-year increase of 5.2%. The annual retail sales of goods were nearly 29.7 trillion yuan, an increase of 10.4% year-on-year. Since the second half of 2016, the sales of large retail enterprises have improved significantly, and physical retail has shown signs of structural recovery. However, while the structural recovery is taking place, different situations are also presented in various business formats.

High cost pressure on convenience stores under high growth

In the previous China convenience store prosperity index, convenience stores showed good development momentum with a data advantage of 22.2 above the boom-to-bust line. China's convenience store prosperity index is a result obtained from cross-analysis of sales, number of stores, business environment and other aspects based on multiple dimensions such as industry, stores, and cities. The overall prosperity index of convenience stores in the first quarter of 2017 was 72.2, which was 22.2 higher than the boom-to-bust line, reflecting that convenience store practitioners maintained a relatively optimistic attitude towards the development trend of the convenience store industry in the first year of 2017. Looking at 2016, the total number of stores in China's convenience store industry increased by 9% year-on-year, and sales scale increased by 13% year-on-year. The number of stores and sales scale maintained a high growth rate. In the "China Retail Industry Development Report (2016/2017)", convenience store sales grew the fastest in 2016, with a growth rate of 7.7%.

It is worth noting that although convenience stores are regarded as the best development model in the retail industry, the convenience store industry also has its own hidden secrets. The overall costs and main business costs of maintaining operations by the company are concerns about many convenience store industry managers. The convenience store industry is currently maintaining a high growth rate. During the development process, some stores that rely on extensive expansion will inevitably appear. Problems such as poor operating performance and inefficiency will gradually emerge. Convenience store managers must take the initiative to make adjustments to reduce cost expenditures and alleviate pressure.

In addition, a group of non-professionals have also entered the market. In April 2017, JD Group's "Million Convenience Store Plan" was released, and it is expected that more than 1 million JD convenience stores will be opened nationwide in the next five years. Although Taobao and JD’s convenience stores are not standard convenience stores in the eyes of professional convenience store industry insiders, they will undoubtedly form a new competitive force within the scope of community commerce.

Big brother who fell behind in department stores' growth rate

In the "China Retail Industry Development Report (2016/2017)" released by the Ministry of Commerce, department stores are one of the several business formats listed at the bottom of the growth rate.

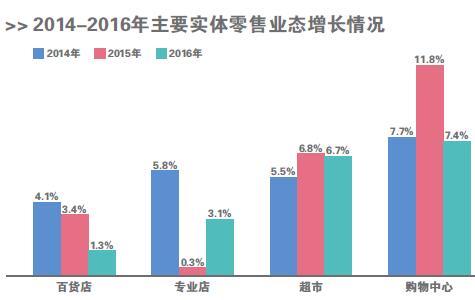

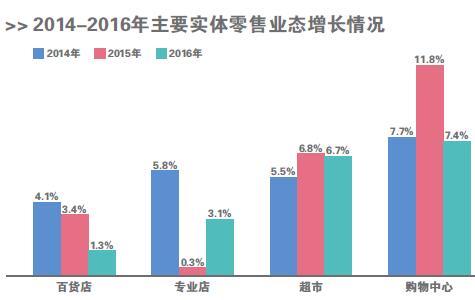

According to the monitoring data of key distribution enterprises of the Ministry of Commerce, sales of convenience stores, shopping centers and supermarkets grew rapidly in 2016, with growth rates of 7.7%, 7.4% and 6.7%, respectively, and sales of professional stores and department stores grew slowly, with growth rates of 3.1% and 1.3% respectively. In addition, the growth rate of department stores fell by 2.1 percentage points compared with the previous year.

Compared with supermarkets actively exploring the model during exploration, the reason why the growth rate of department stores is criticized is mostly the model. The report pointed out that in my country's traditional retail industry, some companies still use entry fees and joint venture deductions as their main sources of profits. Retailers are introducing factories into stores, renting counters, not mastering product terminals, not participating in the sales process, and not directly serving customers. They only provide commercial services such as cashiers and property management on the brand. The self-service business function has declined and the market sensitivity is low, which is one of the crux of the current slow business transformation and business model upgrading in the retail industry. This business model is the main business model of traditional department stores.

In addition, the common problem of department stores, supermarkets and shopping centers is serious homogeneity, among which about 87% of the products in the department store industry are the same. Homogeneity will inevitably lead to excessive price competition, and retail enterprises will operate in small profits or even unprofitable operations. The department store's main agency sales model of clothing, shoes and hats products also lacks competitiveness. The report pointed out that the layer-by-layer agency system is a commonly used sales model in the traditional retail industry. The layer-by-layer price increase has led to inflated product prices and lack of market competitiveness.

Regarding the development of the department store industry, Guo Zengli, director of the Development Committee of China Shopping Center, pointed out that the role of traditional department stores is equivalent to transferring inventory risks to suppliers, price risks to consumers, and property risks to owners. However, in the current environment of accelerated consumption upgrading, this role is not competitive enough. In fact, department stores should transform towards dual-center direction, serving consumers on the one hand and brand owners on the other.

Thank you for your attention and support to Laogao Crown Club . Please indicate the source of the reprinting website www.shxuanming.net

Click to register to apply to join the well-known e-commerce network - Laogao Crown Club. Any merchants from all over the country, Tmall merchants, Taobao Crown Stores, Jinguan Stores, and other e-commerce platform merchants can apply to join!

![#Laogao E-commerce Newsletter# [November 22 E-commerce Evening News]](/update/1519722543l029041880.jpg)

![#Laogao E-commerce Newsletter# [March 1 E-commerce Evening News Brief]](/update/1677662552l360606695.jpg)

EN

EN CN

CN