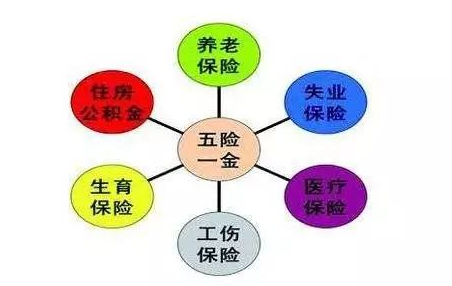

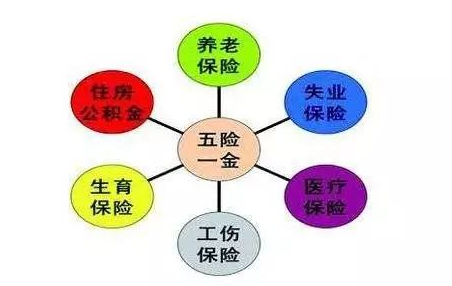

The "five insurances and one fund" include medical insurance, pension insurance, maternity insurance, work-related injury insurance, unemployment insurance and housing provident fund. Recently, some new regulations have been issued regarding the "five insurances and one fund", including cross-provincial medical settlement, pension land, housing provident fund contribution ratio, etc., all of which are related to your wallet. If you don't understand, you will suffer a loss.

New regulations on medical insurance

Cross-provincial medical settlement is launched:

Where to be hospitalized and where to be reimbursed

(1) Gradually solve the direct settlement of hospitalization medical expenses for those who have been resettled across provinces and places, and expand to the direct settlement of hospitalization medical expenses for those who have met the referral regulations by the end of 2017.

(2) Gradually include long-term residents in other places and permanent staff in other places in the coverage of direct settlement of medical expenses for medical treatment in other places.

New pension insurance regulations

4 different situations of pension insurance collection

(1) If the pension insurance relationship is in the place of household registration, it shall be collected locally;

(2) If you are not in your registered residence, you will receive it in areas where you have paid a total of 10 years;

(3) If you are not in your registered residence and have paid less than 10 years, you will be transferred to the previous payment for a period of time;

(4) If you are not in your registered residence and have a cumulative payment period in many places less than 10 years, the registered residence shall be collected according to regulations.

New maternity insurance regulations

It will merge with medical insurance, and the "five insurances and one fund" may become "four insurances and one fund"

(1) In July 2016, the Ministry of Human Resources and Social Security announced the "13th Five-Year Plan" for the Development of Human Resources and Social Security", proposing to merge and implement maternity insurance and basic medical insurance, requiring "improving maternity insurance policies and implementing unified registration, payment, management, handling, and information system for maternity insurance and basic medical insurance participants". The "five insurances and one fund" may become "four insurances and one fund".

(2)自2017年1月1日,河北邯郸、山西晋中、辽宁沈阳、江苏泰州、安徽合肥、山东威海、河南郑州、湖南岳阳、广东珠海、重庆、四川内江、云南昆明等12个试点城市,将生育保险基金并入职工基本医疗保险基金征缴和管理。

The new regulations on work-related injury insurance will exceed 80% by 2020.

(1) By 2020, an occupational disease prevention and control pattern will be established and improved with employers’ responsibility, administrative agency supervision, industry self-discipline, employee participation and social supervision.

(2) The coverage rate of workers who should participate in work-related injury insurance in accordance with the law reaches more than 80%, and gradually achieve effective connection between work-related injury insurance and basic medical insurance, serious illness insurance, medical assistance, social charity, commercial insurance, etc., and effectively reduce the burden on patients with occupational diseases.

New rules for unemployment insurance

At present, seven provinces including Beijing, Shanghai, Tianjin, Hebei, Shandong, Shanxi and Qinghai have announced the hike of unemployment insurance standards. Among them, Beijing has increased by 90 yuan per month.

New housing provident fund regulations

No matter how high the salary

The provident fund contribution ratio cannot exceed 12%

The Ministry of Housing and Urban-Rural Development stipulates:

(1) From May 1, 2016, any housing provident fund contribution ratio exceeds 12%, shall be regulated and adjusted, and shall not exceed 12%;

(2) The policy of appropriately reducing the housing provident fund contribution ratio in phases will be implemented from May 1, 2016 and will be temporarily implemented for two years;

(3) In addition to reducing the contribution rate, enterprises with production and operation difficulties can also apply for a temporary suspension of the contribution of housing provident fund.

How to pay the "five insurances" so that it will not be in vain

1. Insurance is collected locally after retirement at the place of household registration

For example, if you have a household registration in Beijing, work in Beijing, and your pension insurance has been paid in Beijing. Then when you retire, you can apply for a pension in Beijing.

2. Receive it in areas with a total payment of 10 years

For example, if you have a household registration in Hebei, work in Beijing, and your pension insurance has been paid in Beijing. As long as the cumulative payment period exceeds 10 years, you can apply for a pension in Beijing.

3. The age is not enough, transfer to the previous payment for the full period of time to collect it

For example, if you are registered in Hebei and work in Beijing when you are retired, but you have paid less than 10 years of pension insurance in Beijing. Then, if you have been in Tianjin for 10 years in your previous job, you can apply for a pension in Tianjin.

4. Many places have insufficient years, and funds are collected from the place of household registration.

For example, if you have a registered residence in Hebei, worked in Beijing for 8 years, and worked in Tianjin for another 7 years. When you retire, the accumulated pension insurance paid by each place for less than 10 years, so you can only go back to your registered residence in Hebei to apply for a pension.

5. Pay more than 10 years in multiple places and receive them on the last place for 10 years.

For example, if your household registration is in Ningbo, you will pay the fees in Shenzhen and Beijing for 10 years, and your final receipt is Beijing.

6. If you can’t pay enough money, can you withdraw your money after retirement?

If the retirement age does not meet the monthly pension, the insured can apply for a one-time reimbursement amount of the pension insurance personal account (including principal and interest), and the social security department will terminate its pension insurance relationship.

7. What are the conditions for determining the land for a total of 10 years?

You must first meet the conditions for receiving pensions (to reach retirement age, and have paid pension insurance for a total of 15 years), and have a total of 10 years of receiving the region. For example, you have just worked in Beijing for 3 years, then went to Shanghai, and then come back. As long as you have paid in Beijing for a total of 10 years, you can apply for pensions in Beijing.

8. Why did you get the same?

Because the calculation of pension is not only related to your personal pension account balance, but also to the average social security salary in your place of receiving it.

For example, in 2015, the average social salary in Beijing was 7,086 yuan and in Tianjin it was 4,944 yuan. Under the same conditions, you will receive much more pensions in Beijing than in Tianjin!

9. What should I do if I quit after I haven't paid enough for 15 years

The cumulative payment period does not mean continuous. As long as the cumulative payment exceeds 15 years, you are eligible to receive a pension.

If you resign or quit and start your own business, if you want to receive a pension after retirement, remember to continue paying your pension in your personal form. For personal payment, you can consult the Social Security Bureau or call 12333 for consultation.

Thank you for your attention and support to Laogao Crown Club . Please indicate the source of the reprinting website www.shxuanming.net

![#Laogao E-commerce Newsletter# [May 6 E-commerce Morning News]](/update/1634606324l419797086.jpg)

![#Laogao E-commerce Newsletter# [May 24 E-commerce Evening News Brief]](/update/1621846420l509471890.jpg)

EN

EN CN

CN