Using express cabinets has more or less reduced the shopping experience. At least "face-to-face inspection" has become empty talk. Why can consumers pay for it?

For e-commerce, logistics services are of great importance, especially the "last 100 meters" is particularly trivial and complex. To solve this pain point, e-commerce has made various attempts. Cainiao cooperates with convenience stores to create the "Cainiao Station" and JD.com builds and operates "self-pickup points and self-pickup cabinets".

Against this background, a third-party "smart express cabinet" emerged. Relatively speaking, the threshold for manufacturing and operation of express cabinets is not high: there is no "high technology" to speak of, and you can install it after contacting residential and office properties.

At present, two A-share listed companies have been deeply involved in the "express cabinet" business: Chengdu Santai Holdings (002312.SZ), which launched "Express Easy" in October 2012; Dingtai New Materials (002352.SZ), which announced in January 2017 that it would participate in the capital increase of "Fengchao Technology" through its wholly-owned subsidiary "SF Investment".

The express cabinet model has heavy assets and a long road to money, while players are unwilling to "eat only one section of sugar cane" has made e-commerce suspicious, and their position in the industrial chain is suspenseful.

As the saying goes, "Pity people must have hateful things." In business, it can be said that "the pain points must have cheating people."

Express delivery easy to "savior"

Santai Holdings is a financial electronic products and service provider, mainly engaged in the research and development, production, sales and services of financial electronic equipment and systems, such as electronic order return systems, ATM monitoring systems, and bank digital network security monitoring systems. It was listed on the Shenzhen SME Board in November 2009, with code 002312.

As of the end of 2011, 2,624 of Santai Holdings' 3,508 employees were engaged in BPO projects (Business Process Outsourcing).

From two points, it can be seen that Santai Holdings undertakes "labor-intensive" outsourcing business: those with secondary technical secondary school, high school or below have a proportion of employees as high as 60.2%; the gross profit margin of BPO business in 2011 was only 4.6%.

In 2012, Santai Holdings' employees increased to 6,666, of which 5,301 BPO project personnel increased to 79.5%. Revenue in the fiscal year increased by 128% compared with 2009, but net profit increased by only 19.4%, and net profit margin fell from 16% to 8.6%.

The revenue in fiscal year 2012 was 657 million yuan, but the accounts receivable were as high as 402 million yuan. What’s worse is that the cash flow of operating activities turned from positive to negative:

In 2009, the net inflow was 17.34 million; in 2011 and 2012, the net outflow was 36 million and 20.4 million respectively.

The 2011 annual report also disclosed that the company implemented "full-staff marketing".

The profit margin has dropped sharply, the cash flow has been negative, and the implementation of "full-staff marketing" has been implemented... All of these are "defeats".

In October 2012, the independent director of Santai Holdings proposed to change the purpose of the funds raised and invest in the "24-hour self-service convenience service network".

In January 2013, Santai Holdings invested 60 million yuan to establish its subsidiary "Chengdu Walaila Network Information Technology Co., Ltd." to launch the "Express Easy" business.

As of the end of 2013, Santai Holdings signed 2,356 layout agreements, completed the layout of 1,524 sets of equipment, and delivered more than 5 million packages. Those who use ATMs to make express cabinets are more than enough.

The "Quick Delivery Easy" model has greatly improved the delivery efficiency of the "last 100 meters" of the express delivery industry, and the express delivery cabinets have been exaggerated as "efficient offline entrances", and Santai Holdings has been enthusiastically sought after by investors. The stock price started from the closing price of 1.97 yuan in April 2013, and hit a new high of 45.73 yuan in June 2015 (previous re-rights), up 22.2 times in 26 months.

Santai Holdings, which has already become increasingly weak, has soared its market value to more than 50 billion!

ALL IN "Quick Delivery"

Santai Holdings realizes that the express delivery cabinet business is where it hopes to maximize the financing function of listed companies and raise as much funds as possible for "Express Easy". In the popular term, it is ALL IN.

In June 2014, 712 million was raised through allocation and all invested in "Quaiyi";

In January 2015, I struck while the iron was hot and raised 2.9 billion through private placement;

In June 2015, a strategic cooperation agreement was signed with Haier Financial Leasing, where the latter provided "express cabinet" rental services;

At the same time as signing a contract with Haier Leasing, Santai Holdings announced that it would provide a guarantee amount of 230 million yuan for "Express Easy";

In November 2015, another 2.87 billion was raised through a private placement of 146 million shares.

According to the plan, the total investment of the "Quidiyi" project is 2.14 billion yuan, and it will be implemented in three phases. It is expected that the third phase of 33,000 outlets will be completed in July 2016. The annual revenue and net profit will reach 1.327 billion and 317 million yuan respectively.

With the support of strong funds, "Quidiyi" expands faster than planned.

As of the end of 2015, 88,600 outlets were signed in 79 cities across the country, of which 48,700 have been deployed, and more than 1 million packages were processed per day.

At the end of the first quarter of 2016, the number of distribution outlets further increased to 53,100.

There is light, no "money future"

Billions of funds have been spent and tens of thousands of outlets have been deployed. The "Quidiyi" business has been booming, with revenues increasing from 1.26 million in 2013 to 309 million in 2015.

In 2015, "Super Yi" contributed 163% to revenue growth (the reason why it exceeded 100% was because other businesses declined and the growth rate was negative).

In the first half of 2016, "Super Yi" generated 187 million yuan in revenue, slowing down, but the year-on-year growth rate was still 88.67%.

ExpressEast's business is booming, but its performance is on a red light: its revenue hit a record high in 2015, but it suffered its first loss since its listing (losed 37.9 million); in the first half of 2016, the loss increased to 119 million.

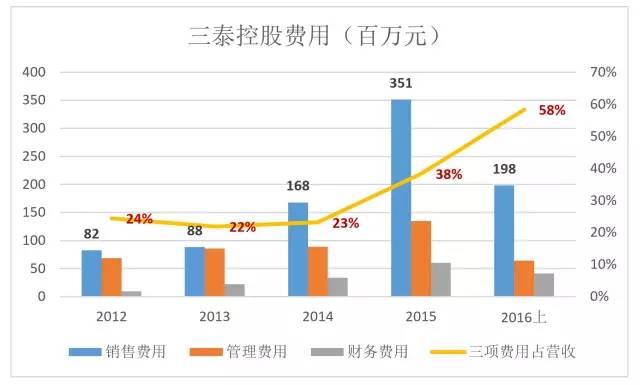

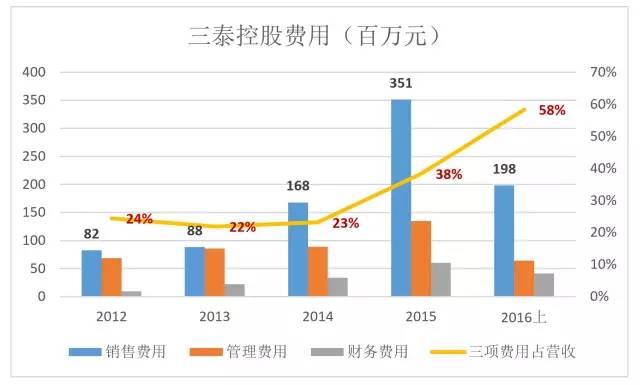

The crux of Santai Holdings' losses is precisely its star business - Redelivery. Since the launch of this business, the proportion of sales, management and financial expenses to revenue has increased significantly. In 2012, the three expenses combined equaled 24% of revenue, and in 2016 this figure reached 58%.

Santaik also admitted that the main reason for the huge increase in costs is "Quaiduyi".

In 2015, the gross profit of "Super Yi" business was 105 million yuan, and the total expenditure of the three expenses was 256 million yuan. The expenses for multiple expenses are twice the gross profit. The situation worsened in 2016, and the market predicted that the loss in the fiscal year will reach 1 billion.

"Revenue 1.327 billion and net profit 317 million yuan" became a sham, and it was difficult to extricate itself from losses for years. Santai Holdings was defeated back to its original form, and its market value returned to the 10 billion line, which was only one point at a high of 50 points.

A major turning point in 2015

Santai Holdings found that the situation was not good in the first half of 2015 and took a series of countermeasures.

First, we are "grouping" with our competitors.

In June 2015, Santai Holdings signed a strategic cooperation agreement with Yangzhou Huiyin Home Appliances, with the main contents: "SuiDiyi" is Huiyin's delivery of goods; Santai Holdings adopts crowdsourcing methods in outlet management and customer service; the two parties synchronize and share in daily operations, promotional activities and data.

(You might as well regard "Huiyin Home Appliances" as "Little Suning": it has more than 360 self-operated/franchise stores, more than 100 repair outlets and more than 2,700 agency distribution outlets in Jiangsu and Anhui. In 2011, it entered e-commerce and plans to establish 10,000 O2O convenience service community stores in the Yangtze River Delta region).

The second is to "extend your hand" to the express delivery company.

Starting from May 2015, Express Yi tried to charge express delivery companies 0.4-0.6 yuan per piece. Data from the China E-Commerce Research Center shows that in 2014, the express delivery industry's profit per ticket was less than 1 yuan, and express delivery is easy to take away half of it, "it's tolerant, but who is intolerable." Some express delivery companies firmly resisted, while the other part began to "peace talks" with express delivery.

On July 29, 2015, Santai Holdings signed an investment intent letter with Fengchao Technology, SF Investment and Suzhou Prolos. However, there was no agreement on valuation, share ratio, repurchase rights, exclusive conditions and business cooperation (office layout, operation model, brand image, production operation and maintenance coordination), and the cooperation intention was abolished.

Interestingly, in June 2015, SF Express, Shentong, ZTO, Yunda and Prologis issued the "Joint Release Announcement". The announcement stated that "co-invested to create Shenzhen Fengchao Technology Co., Ltd., which is committed to researching and developing and operating a 24-hour self-service open platform for all express companies and e-commerce logistics, Fengchao Smart Express Cabinet, to improve platform-based express delivery and delivery interactive business."

Obviously, SF Express had made plans to start charging fees when Express Yi started, and negotiated with Santai Holdings while preparing to build Fengchao. It can even be speculated that negotiations are "cuts" for both parties: First, let's explain the past cooperation and make a comeback; second, there needs to be a transitional period in business.

Three major events that happened in 2015 made it a turning point for "Quick Delivery": the scale reached expectations but there was a huge loss; the result was unknown with "Huiyin" to keep warm; the attempt to charge upstream failed to recover the huge loss, but instead gave birth to a powerful opponent - Fengchao.

At the end of 2016, the "poor and destitute" express delivery actually took action against users: the free storage time was shortened from 48 hours to 4 hours, and 1 yuan was charged for more than 4 hours. If the package is put into the express locker at 2 pm and get it home at 6 pm, you will definitely have to pay the money.

"Express Yi" move has caused a large amount of dissatisfaction. Some residential communities have issued ultimatums, requiring a resolution of time, otherwise the power will be cut off and the cabinet will be sealed. Express is easily forced to make concessions, and the new rules that have been tried for 11 days have been cancelled.

The "Hezong" alliance is disintegrating

Fengchao is the product of "hezong".

"Hezong" is a magical example of the warring countries, meaning to unite the weak forces and powerful oligarchs to play together. For "Shuntongda", "Strong Qin" may be a "unrealistic" express delivery, and in the future it may also be Alibaba, JD.com or Suning.

In June 2015, SF Express, Shentong, ZTO, Yunda and Prolos jointly issued an announcement stating that "co-investment in creating Shenzhen Fengchao Technology Co., Ltd. is committed to researching and developing and operating a 24-hour self-service open platform for all express companies and e-commerce logistics - Fengchao Smart Express Cabinet to improve platform-based express delivery and delivery interactive business."

Fengchao's initial equity structure is: SF Express invested 175 million yuan, with a shareholding ratio of 35%; Shentong, ZTO and Yunda each account for 20%; Prologis holds 5%. Wang Wei is appointed as the legal representative and chairman.

Several express delivery companies among Fengchao shareholders have 87,000 outlets and more than 850,000 couriers nationwide. They plan to complete the deployment of 33 key cities and over 10,000 outlets in the remaining months in 2015.

If Fengchao can reach the level of "make hundreds of millions of dollars a year" within three to five years, it is no problem to go public and valuate hundreds of billions.

The sky is not as good as the human being. Fengchao's shareholders were poured with two basins of cold water:

1) "Express Yi" is leading the scale, but is in huge losses;

2) In the first three quarters of 2016, Fengchao's revenue was only 4.8 million and his losses reached 157 million.

Of the 2.5 billion yuan increase in capital in 2017, SF Express invested 980 million yuan (the "SF Express Investment" which has been injected into listed companies has invested 550 million yuan, and Mingde Holdings has 430 million yuan); Shentong followed up with 100 million yuan, but the shareholding ratio was diluted from 19% to 10%; Yunda has a capital increase of 200 million yuan, and I don’t know whether it will be exercised; ZTO confirmed that it will not participate.

The "Hezong" alliance has diverged. Where is Fengchao going?

"Fengchao" may become "Zhixin"

Fengchao's status is somewhat similar to "LeTV Zhixin": a listed company needs the business partner and related concepts, but if the consolidation is made, it will "kill the financial statements", so the shareholding ratio is controlled below 50%. The picture shows "You can attack and you can defend when you retreat."

Whether it is Fengchao or Zhixin, if there is a profit on the day, the listed company can acquire consideration shares and achieve absolute control. The original shareholders of Fengchao such as Shentong, ZTO, Yunda will obtain new shares issued by Dingtai New Materials and obtain considerable returns.

Although the "money prospect" is a bit bleak, SF Express has to take responsibility for its withdrawal without any withdrawal. Shentong, ZTO and Yunda have transformed into financial investors. The main consideration of whether to participate in the private placement is "funding stock".

The pain points of couriers should not let consumers pay for the order

It takes at most 10 minutes to ride an electric bike in the downtown area for 3 or 5 kilometers. After arriving, I looked at the tall buildings like a jungle. Where is the consignee? You have to call to ask if you are at home or how to get upstairs... The phone cannot be reached and the consignee is not at home, so it is a waste of trouble... When encountering a buyer who has "many things", you may have some troubles when signing for it. How cool and comfortable it is to put a lot of things into the cabinet, wave your hand and not take away a package!

Express Yi and Fengchao have improved the situation of couriers. Some "boys" put the package directly into the express cabinet without asking, which is essentially a shirk responsibility. "Those who travel a hundred miles are half ninety", the proportion of the last 100 meters of handover with users in the shopping experience is probably more than 50%.

In people's minds, "Fengchao" is SF Express, but the well-known user of Fengchao Express Locker is not SF Express. The data for 2016 are: ZTO 22%, YTO 18%, Shentong 14%, Yunda 14%, Best 10%, SF Express 6%...

Since the express delivery cabinet is losing money, SF Express should be "usable" and the wealth will not flow to outsiders. But the actual situation is that the use of YTO, which is not shareholders, is three times that of SF Express.

The reason is mostly because SF Express is worried that it will affect the user experience and have an adverse impact on the brand.

An executive of a express cabinet said, "Only by achieving a certain scale effect and cultivating consumers' full awareness, there will be profitability."

In fact, the embarrassment of express cabinets has nothing to do with scale, and the scale of express delivery and Fengchao is no longer small.

The more critical question is: the use of express cabinets will more or less reduce the shopping experience, and at least "face-to-face inspection" has become empty talk. Why can consumers pay for it?

"Pain points" are often "pits"

The pain point is unmet needs. "There are people doing business that is beheaded, and no one does business that is losing money." If it is profitable to meet certain needs of users, how can there be any pain points?

The need to become a pain point is either lacking the ability to pay or insufficient willingness to pay.

Even though we know that the cost is high and the cash is difficult, we provide services without any loss. We plan to encircle users first and then VCs. This is a dangerous move to die. There are not many lucky people. The more most people are unable to get in the pit, the less anyone can lend a helping hand.

When it comes to express delivery cabinets, consumers are accustomed to enjoying home delivery, and signing in person is more secure, and they lack the willingness to pay. The courier has the willingness to pay for the pain point of the "last 100 meters", but he has no ability to pay (it only takes a few cents to give a package).

Santai Holdings unfortunately fell into the trap, but as the leader of the express delivery industry, SF Express has a deeper meaning to increase its investment in Fengchao - "Heyke's heart is not dead." Due to space limitations, we will not discuss it here.

Thank you for your attention and support to Laogao Crown Club . Please indicate the source for reprinting by Xuanming Network www.shxuanming.net

![#Laogao E-commerce Newsletter#[E-commerce Evening News on September 6]](/update/1662457565l016289614.jpg)

EN

EN CN

CN