Tax evasion is like a sharp blade hanging on the head, and it will fall down at some point!

Recently, an announcement from the Taxation Bureau has spread widely across the Internet.

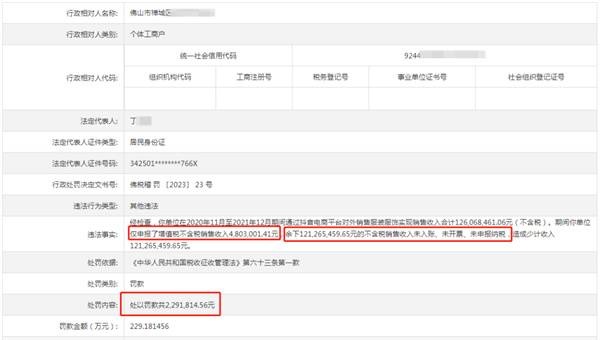

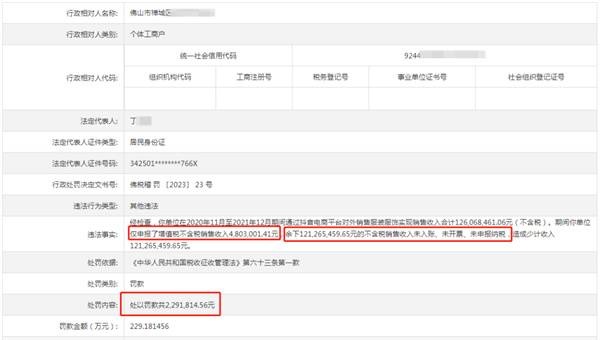

A clothing store (individual business owner) in Foshan sold to the public through the Douyin platform. The hidden income reached as much as 121 million yuan during the year. It was eventually inspected by the Taxation Bureau and fined 2.29 million yuan.

Hidden most of the sales and only take out some small profits to declare taxes. Who will you catch if you don’t catch them?

It is obvious that using individual industrial and commercial households for tax planning is likely to be taken into the trap. After all, under the strong supervision of the fourth phase of the Golden Tax Big Data, it is clear who is swimming naked at a glance...

01. E-commerce merchants who have repeatedly investigated and committed crimes

Every year, there are people who are punished for tax evasion, and every year, there are merchants who fly into the flames.

According to incomplete statistics, several companies have been punished for tax payment issues since last year, with the total amount involved exceeding 100 million yuan and the amount of fines exceeding 10 million yuan.

The beauty brand FENTINY, whose main enterprise is a Guangzhou e-commerce company.

The brand has 245,000 followers on Douyin and has a total sales volume of 1.049 million units in flagship stores. The products include oral beauty, makeup, skin care, etc.

It is understood that the main company of the brand was fined 1.4978 million yuan for obtaining sales revenue and sales commissions of Kuaishou and Douyin platforms through personal bank accounts, personal WeChat, and Alipay. Its failure to make tax declarations constituted tax evasion.

In October 2022, a Guangzhou Trading Co., Ltd. obtained a total of 112 million yuan in tax-inclusive sales through online sales, but failed to pay taxes as required. In the end, the relevant departments imposed a high fine of 8.9238 million yuan on it.

Tax big data will not only supervise merchants with GMV of over 100 million, but will not let those small merchants go.

In 2023, a cosmetics company in Guangzhou was fined RMB 837.33. Its sales on TikTok from January to April 2021 were only 12,900 yuan, but it was also fined by relevant departments for tax evasion.

A very small businessman will eventually be unable to escape the French Open. It can be seen how wide the tax inspections of the tax department are.

It is worth mentioning that the tax check retrospective period is generally 3 years, and special circumstances can be extended to 5 years. This means that the investigation and punishment of tax issues of online merchants by relevant departments was traced back to 2018.

02. The fine is 26.58 million yuan, and Tmall Top merchants will also fail

Some people are lucky, while others are weak in legal awareness.

From the ban on tax evasion by leading anchors such as Via and Sydney to the launch of a "tax supplement" craze in the industry, tax evasion in the e-commerce industry is common.

Since most e-commerce companies face individual consumers, the demand for invoices is much lower than that of enterprises, some enterprises choose not to declare uninvoiced income to evade taxes.

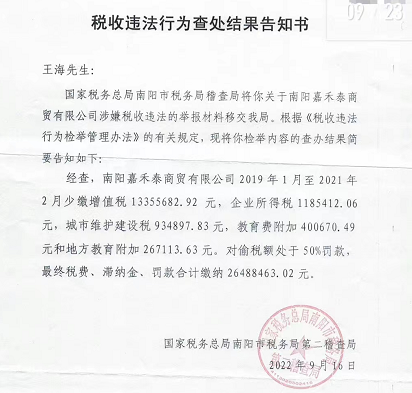

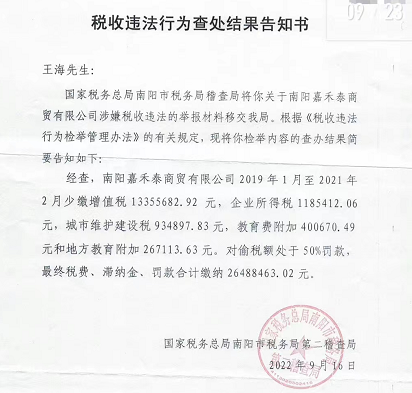

In 2022, Qi Auntie, who is the top 1 in Tmall mugwort category, was determined by relevant departments to pay a total of more than 26.48 million yuan in final taxes, late fees and fines for more than 16 million yuan.

There are many businesses that are lucky because they are self-employed or family-run. Although they have companies, they still collect payments from private accounts. They are unwilling to pay tax declarations because they do not have bank statements from the government to the government.

In fact, under the supervision of the tax big data of the fourth phase of Jintao, it is difficult for e-commerce companies to achieve the purpose of tax evasion. So, the bosses in front of the screen, no matter what routine you use, they are very clear about it.

The lawyer said:

Tax evasion includes two types of penalties: administrative penalties and criminal crimes. If a taxpayer evades taxes, the tax authority shall recover the taxes and late payment fees he did not pay or paid inadequately, and impose a fine of not less than 50% and not more than five times the taxes he did not pay or paid inadequately; if a crime is constituted, criminal liability shall be pursued in accordance with the law.

It seems that in the era of "using numbers to manage taxes", if enterprises want to operate for a long time, they can only go to the law of legality and compliance.

03. E-commerce bosses, small actions should be restrained

Any idea of tax evasion will have a high probability of failure.

Therefore, e-commerce bosses should be cautious about tax matters, and the following behaviors should be corrected:

False invoices:

The general taxpayer’s invoice is issued for sale is 13%, while the normal invoice is issued for small-scale taxpayers. Therefore, many companies will find ways to reduce costs and choose to use other companies to invoice consumers.

Volume of order brushing:

Using order brushing to increase false sales is an unspoken rule in the industry. On the one hand, there is the fourth period of the Golden Tax that will leave you nowhere to hide, and on the other hand, there are attractive interests. Bosses must conduct a good risk assessment, otherwise the gain will not be worth the loss.

No invoices, no account transfer:

Merchants often take advantage of consumers' habit of not issuing invoices and declare as little as possible and list less income. But what will happen? The above cases are all lessons from the past.

In addition, e-commerce bosses must also establish a standardized fiscal and taxation system and conduct tax physical examinations in advance. If you encounter tax audits, don’t resist. You can seek help from professional institutions to communicate with the tax authorities to strive for the greatest tax benefits for the company and reduce potential losses.

Tax is actually not terrible. What is terrible is that you don’t plan anything and you have a name for illegal business operations. If you are fined, you will be disliked by customers.

![#Laogao E-commerce Newsletter# [May 29 E-commerce Evening News Brief]](/update/1519779573l517616211.jpg)

EN

EN CN

CN