The term "tax evasion" has been as terrifying as a tiger in the mountains in recent years.

Among the e-commerce industries we are familiar with, there are many well-known anchors such as Weiya, Xueli, Lin Shanshan, and Pingrong Lusao who "stepped on the thunder".

After these "successful birds" were sniped, the industry once returned to calm.

But the brief tranquility made some anchors mistakenly think that the "peaceful and prosperous era" is coming again...

01. Recovery and fined RMB 5.458 million

Recently, through accurate analysis, relevant departments found that online anchor Yao Zhenyu was suspected of evading taxes.

It is reported that Yao Zhenyu has been engaged in live broadcasts from 2019 to 2021 to obtain income, and has evaded personal income tax of 2.363 million yuan through false declarations and paid 11,800 yuan less other taxes and fees.

In the end, Yao Zhenyu was recovered by relevant departments, charged late payment fees and fined a total of 5.458 million yuan.

With more than 2 million tax evasion, it can be seen how much money this "Yao Zhenyu" has earned.

However, after searching for major platforms, we couldn't find who the anchor was. It seems that "Yao Zhenyu" did not appear under his real name.

Many netizens also talked about this.

So who is this "Yao Zhenyu"?

02. Who is "Yao Zhenyu"?

Based on information such as the real name and location of Xiamen, omnipotent netizens speculated that this "Yao Zhenyu" may be Douyu anchor "Leng Feng" and a veteran gossip anchor on the platform.

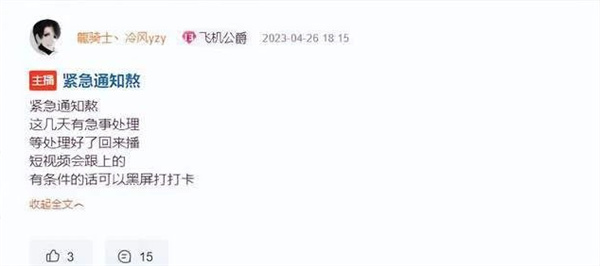

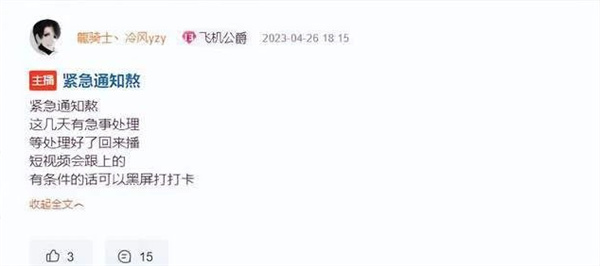

At the same time, according to media reports, "Leng Feng" released a message not long ago, saying that there was an urgent matter delaying several days.

This coincides with the time when the tax evasion incident occurred, and I am afraid it is almost certain.

Although I don’t know whether it is true or not, there are a lot of tax news about this anchor on the Internet.

In March, "Cold Wind" joked to fans during the live broadcast"

I don’t have much taxes, so you can ask the Soul Sword God, the full-level anchor, who is really called too much tax, and it’s estimated that it will cost 1,000 yuan!

Fans asked "Cold Wind", is there any way to avoid taxes?

"Leng Feng" replied: There are methods, but they are all illegal. You will receive a gift of 100,000 yuan. Unless you directly declare and pay 45,000 yuan, other methods will be illegal and you don't have to think about it!

It can be seen that the word "tax evasion" is also a rare and ordinary thing for some unknown anchors.

02. The "unknown" anchor is too hard to make

If there is 100% profit, they will stick to the risk;

If there is 200% profit, they will defy the law;

If there is 300% profit, they will trample on everything in the world.

The live broadcast industry that grew wildly has spawned the anchors' income that countless numbers. But while enjoying it, we also face the reality that the tax deduction ratio remains high.

If an anchor earns 10 million yuan, he will face a tax of about 4 million yuan.

This has also become the reason why many anchors take risks.

At present, in addition to the well-known anchors, there are still many unknown small anchors who are making big money and evading taxes.

In February this year, relevant departments exposed the tax evasion case of online anchors Jia Yaya and Jia Chanchan. After the two anchors obtained income, they failed to apply for tax declarations in accordance with the law. They had underpaid and evaded taxes, and were fined 176,700 yuan and 185,700 yuan respectively.

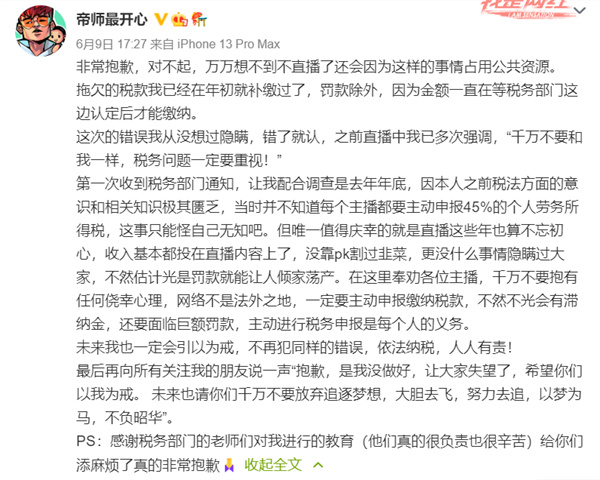

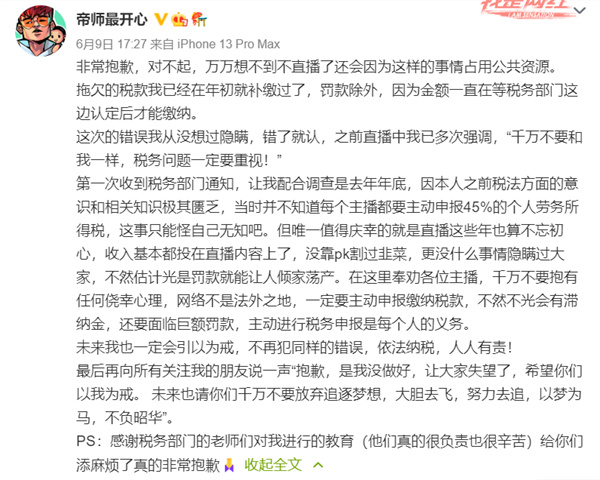

In June last year, the internet celebrity Dishi, who had announced his withdrawal for 20 days, was suddenly reported by the Taxation Bureau that he had paid 1.9786 million yuan in personal income tax, concealed the live broadcast reward income obtained by his individuals to evade personal income tax of 2.2012 million yuan, and paid 347,600 yuan in other taxes. In the end, the relevant departments recovered taxes, charged additional late payment fees and planned to impose a fine of 11.7145 million yuan.

At the same time, an anchor "Xu Guohao" with a monthly income of up to 11.57 million yuan was caught by tax big data and found that he was underpaid 17.5557 million yuan in personal income tax, evaded 19.1419 million yuan in personal income tax and paid 2.1896 million yuan in other taxes and fees, and was eventually fined 108 million yuan.

...

I believe many people are full of question marks about the names of these anchors: every unknown anchor can make money like this.

Indeed, for some people, the anchor industry is really profitable. The novelty and particularity of the industry also make these anchors hide under the blind spots of the rules.

Some professionals said that the core problem of anchor tax compliance is the vague qualitative nature of live broadcast activities, and it is difficult to determine whether it is production and operation income or labor remuneration income, which is why the tax-related risks are caused.

03. It is better to grow through experience than to dance on the red line

From "the number one sister in the business" Weiya, "the principal's ex-girlfriend" Sydney, to tax checks storms in e-commerce in various places. The e-commerce industry has ended its wild growth momentum as flowers fall.

The path to making money by tax evasion has now become a "dead end" for merchants and anchors. After all, under the big data radiation of the fourth phase of Golden Tax, it is clear who is swimming naked.

With these energy and financial resources, it is better to consolidate the basic skills.

The choice of whether to take down the sword of Damocles hanging on his head or let it fall.

EN

EN CN

CN