Revenue is 1046.2 billion yuan!

This huge amount of data was disclosed in the 2022 full-year financial performance report released by JD.com recently.

The performance is not only higher than market expectations, but also a historic moment when JD Group's annual revenue exceeded 1 trillion yuan for the first time.

CEO Xu Lei called it an important "milestone" for JD.com.

But just after the performance was disclosed, JD.com's US stock market "spent"...

- 01 - 57.9 billion yuan evaporated overnight

The time when the US stock market fell was the same as the time when JD.com disclosed its performance on March 9.

After the disclosure of its performance, JD.com's U.S. stock market closed down 11.28%, and its market value evaporated by US$8.3 billion overnight, or about RMB 57.9 billion.

Some media said that the reason for the sharp drop in stocks was because JD.com’s data in addition to revenue was poor; others said that JD.com started the relationship of "10 billion subsidies".

In terms of revenue growth , JD.com's revenue growth rate in 2022 was only 9.95%. Compared with the same epidemic situation in the previous two years, JD.com's revenue growth rate reached 29.28% and 27.59% respectively.

In terms of net profit , JD.com achieved a net profit of 10.38 billion yuan in 2022, a significant increase of 391.57% year-on-year. There is a clear gap from the net profit of 49.41 billion yuan in 2020.

In terms of net sales profit margin , JD.com was only 0.93% in 2022, which is much lower than 6.62% in 2020 and 2.06% in 2019.

Judging from the GMV data , JD.com's GMV in 2022 was 3.47 trillion yuan, with a growth rate of 5.6%. In 2021, JD.com's GMV growth rate reached 26.2%.

In addition, some institutions predict that Pinduoduo, one of JD's competitors, has become infinitely close to JD in key data, and has even surpassed JD in terms of average monthly visits.

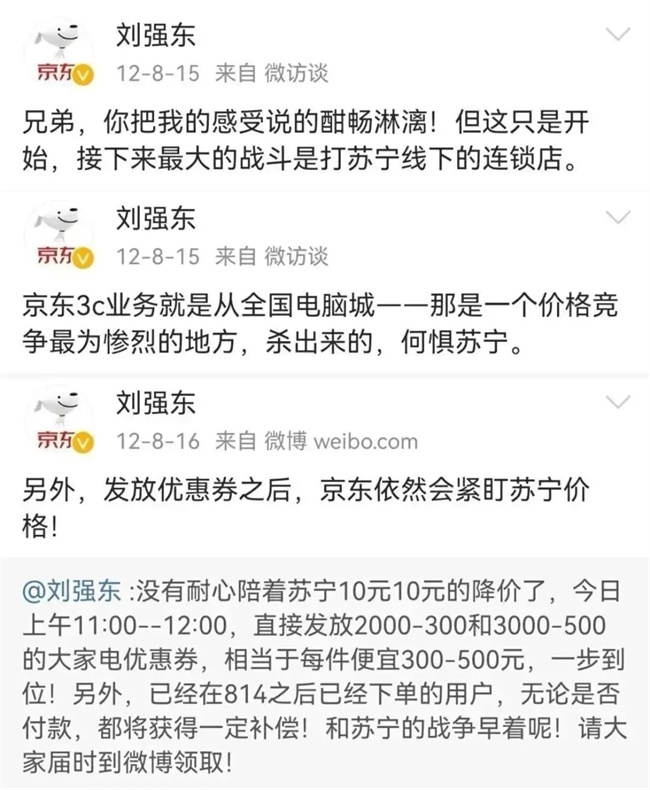

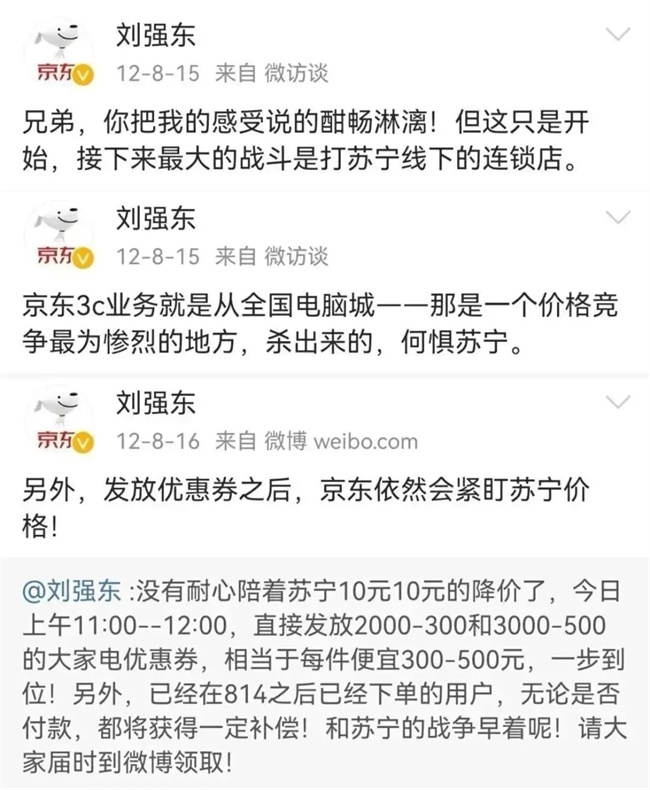

This may be followed by Liu Qiangdong's call last year-

JD.com is losing its mental advantage in low-price

Low prices are the most important weapon of success in the past

No longer pay attention to our low-price advantages, so that if this continues, it will become the second Suning

Therefore, with growth anxiety, JD.com will regain its "low price" strategy at this time and promote "10 billion subsidies".

- 02 - Another powerful tool in low-price strategies

Once upon a time, JD.com defeated Dangdang and Suning with a low-price strategy. Now, Pinduoduo is approaching JD.com with a low-price blade.

And all this has changed since Liu Qiangdong returned to China with great strength.

At the beginning of the year, JD.com deliberately lowered the entry threshold for merchants and released the "Chunxiao Plan" to support individual sellers and open up the C2C market.

After the preparation, JD.com immediately launched the "10 billion plan".

The launch of JD.com’s 10 billion subsidy channel is just the beginning for JD.com’s low-price mindset. In the future, JD Retail will also focus on the goal of "low price" in every link, improve capacity building, and achieve "low price every day" through the improvement of supply chain efficiency and technology upgrade.

JD Retail CEO Xin Lijun sounded the clarion call to the market for the "low price" strategy at the opening ceremony of JD Retail in 2023.

However, relying on subsidies is definitely not the best choice for long-term combat.

JD.com once explained that the "10 billion subsidy" is not to squeeze upstream merchants to achieve low prices, but to significantly reduce costs for brands and merchants, accelerate turnover, and increase profits through the improvement of supply chain efficiency. At the same time, through the capabilities of the supply chain, it can smooth out short-term price fluctuations and solve the problem of merchants not promoting or selling.

The supply chain is precisely one of JD's advantages for many years of hard work.

In this way, even if the price is not satisfactory, it can increase user stickiness by relying on the word of mouth accumulated over the long term.

If Pinduoduo is the ceiling of low prices, then JD.com's strategy is to leverage the advantages of the supply chain while having low prices, reduce the time for goods to be put into place, lower the threshold for monetization, and form a virtuous cycle.

- 03 - "10 billion subsidies" are only one part of the long-term strategy

Xu Lei once said at the earnings call: "10 billion subsidies" are by no means a short-term tactical move.

This means that the "10 billion subsidy" is only one part of JD's "low price" strategy, and there will be more actions around low prices in the future.

Even in the near future, we can see the feat of JD platform achieving "low prices every day".

Behind this regaining the "low price", what JD really wants to achieve is to regain users.

Using low prices to attract extremely price-sensitive users, and then using JD.com’s own supply chain and services to retain users, should be one of the foundations for JD.com to continue to deepen its market.

At the same time, JD.com is also trying to integrate into live e-commerce and seek new growth directions.

On March 1, JD Live launched the "SUPER New Star Plan", a new content-type account that premiered in March. During the 30-day pilot period, the platform will provide high-commissioned goods and new star goods pools, as well as support for traffic and account weight.

Similarly, this plan is also part of JD's "low price" strategy.

The New Star Product Pool will focus on low-priced products, including 1 yuan and 9.9 yuan drainage products, expiration fast-moving consumer goods, platform subsidies, double-dollar compensation products for buying expensive products, and 10 billion subsidies.

In addition, JD.com also chose to enter the live broadcast field from other dimensions.

JD Logistics joined hands with Douyin to become the first logistics companies to access the "Yinhuida" service of Douyin e-commerce, and before the end of last year, it served more than 20,000 Douyin e-commerce platform merchants.

During the Spring Festival, JD Logistics became the official logistics partner of Kuaishou e-commerce. With its service advantages, it continuously links Kuaishou merchants and consumers during the festival.

And all this is just as mentioned above, "just begin."

JD.com, which has "self-operated + supply chain + service", now has a "low price" weapon. We will wait and see where the e-commerce landscape will usher in the future!

EN

EN CN

CN