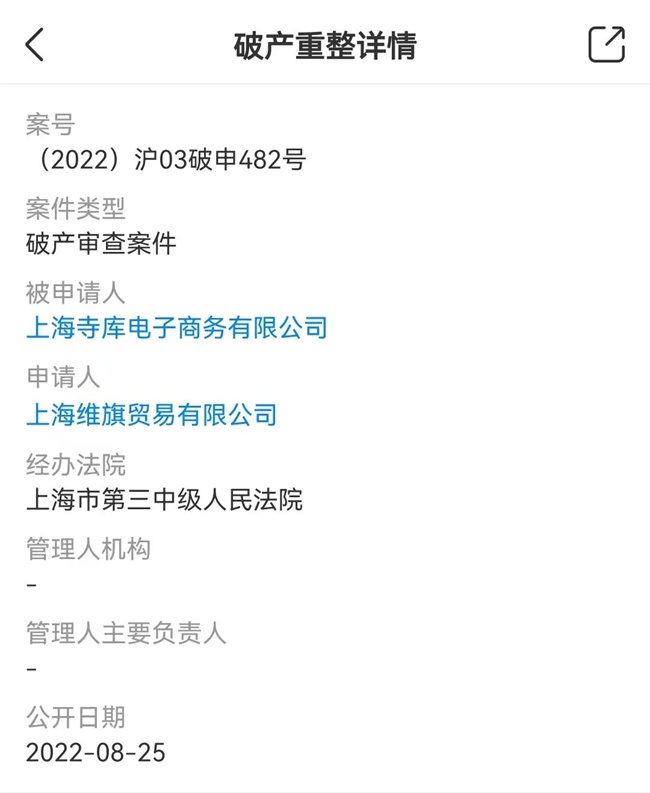

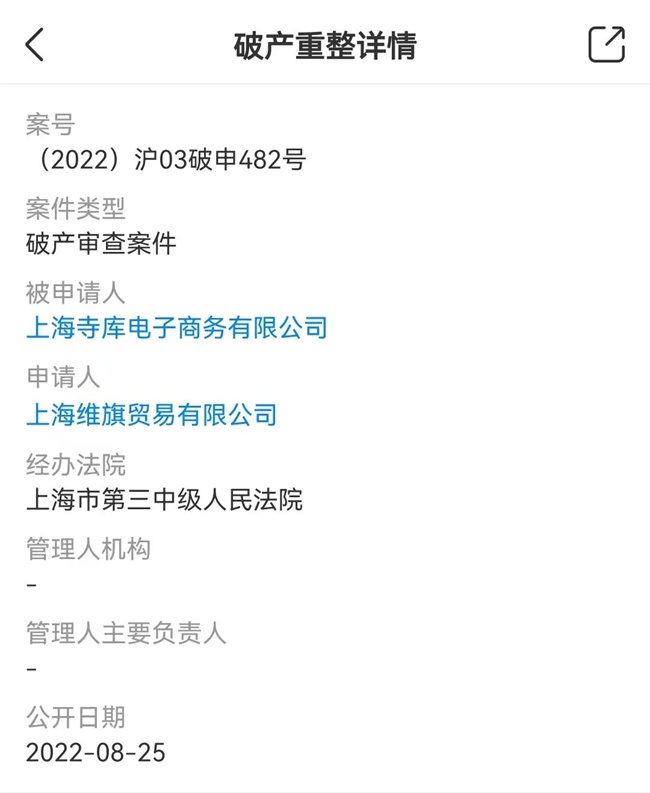

7 days ago (August 25), Tianyan Check reported a bankruptcy review.

It turned out that Shanghai Siku E-Commerce Co., Ltd. added a bankruptcy review case. The applicant was Shanghai Weiqi Trading Co., Ltd. and the Measures Court was Shanghai Third Intermediate People's Court.

It is worth mentioning that this company is wholly owned by Beijing Siku Trading Co., Ltd.

The news of this bankruptcy review means that Shanghai Seku E-commerce Company has been filed for bankruptcy.

In fact, this is not the first time Secoo has filed for bankruptcy review...

1. 5 years of listing, 3 bankruptcy reviews

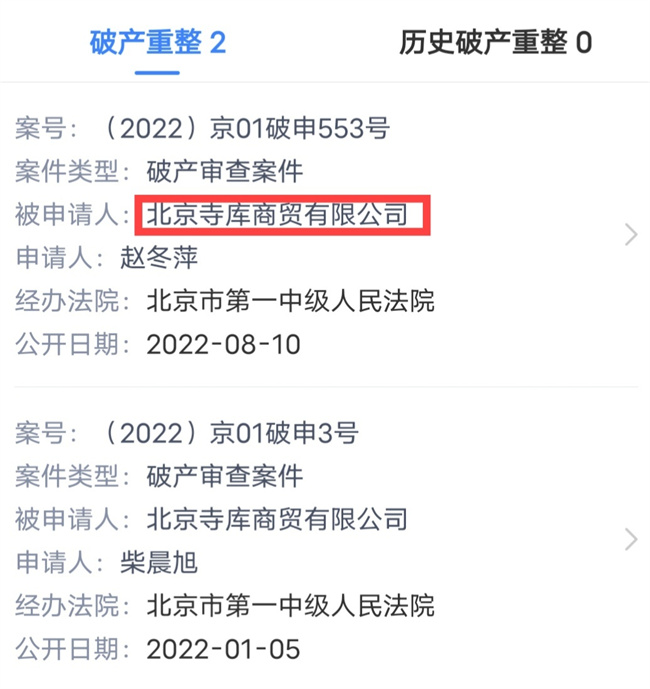

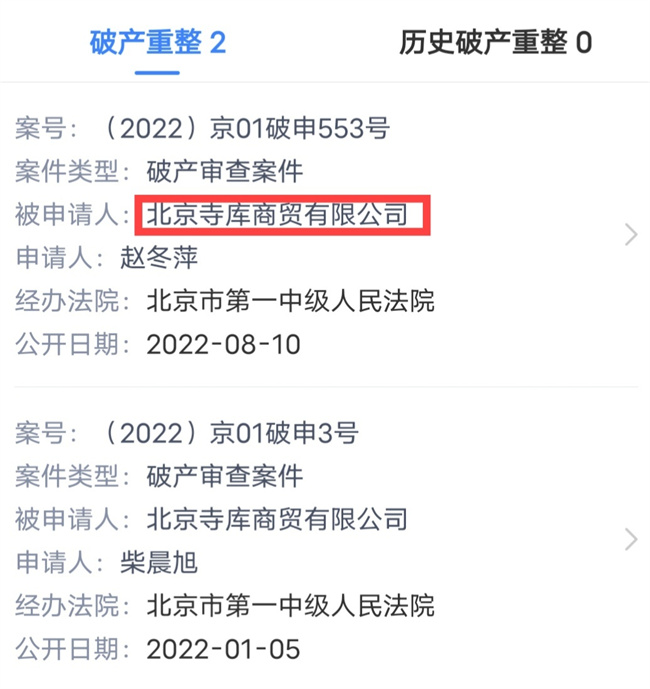

According to existing news, Beijing Seku Trading has had two records of being filed for bankruptcy and reorganization.

Once in January 2022, the applicant was Chai Chenxu, and the Court of the Measures was the Beijing No. 1 Intermediate People's Court, but this bankruptcy review was quickly taken back by the applicant.

Once, it was in early August 2022, which was a bankruptcy reorganization proposed by Beijing Siku Trading Co., Ltd., a subsidiary of Siku. The applicant was Zhao Dongping, and the Court of the Measures was the Beijing No. 1 Intermediate People's Court. Siku did not respond to this bankruptcy.

The third bankruptcy application was on August 25, and Shanghai Seku E-Commerce Co., Ltd. added another bankruptcy review.

2. China's first luxury goods platform to be listed

After reading the information, I found that Secoo is an e-commerce platform that makes its fortune by luxury goods.

It was founded in 2008 and was initially positioned as a second-hand luxury e-commerce, but with the strong development momentum, Secoo expanded its ambition from second-hand luxury goods to new luxury goods sales.

In the end, Secoo became a "high-end luxury goods sales platform".

It mainly sells luxury goods, and has four core sectors: Secoo Commercial, Secoo Finance, Secoo Intelligence and Secoo Community. Seco.com focuses on luxury goods, and its products cover bags, watches, clothing, jewelry, etc.

The luxury goods market in 2008 can be said to be blank. The emergence of Secoo not only satisfies the needs of consumers, but also meets the needs of capital.

At the end of 2010, Secoo received a Series A financing from IDG Capital.

From 2011 to 2015, Secoo maintained the annual financing rate and received investment from companies such as Shenzhen He Investment, Pangu Chuangfu, and Ping An Innovation Investment.

With the joint support of capital and consumers, in September 2017, Secoo successfully rang the bell on the Nasdaq in the United States, successfully landed in the US stock market, becoming the "first stock of luxury e-commerce".

It then received an investment of US$175 million from JD.com and L Catterton, with a market value of more than US$500 million.

3. Poor management, owing supplier money

So why did Secoo go public for 5 years and file for bankruptcy three times?

In 2018, Secoo's development went downhill, and its stock price began to continue to fall. Compared with the issue price of US$13, Secoo's stock price has fallen by more than 98%, and its total market value has dropped from US$770 million at its peak to US$22.49 million today.

For Secoo, the turning point in fate occurred in 2020, because in the previous years, Secoo's revenue continued to grow.

Taking 2018 and 2019 as an example, revenue in the past two years increased by 44% and 27%, respectively, and net profits were RMB 152 million and RMB 154 million, respectively.

In 2020, Secoo ushered in its first loss since its listing, with revenue of 1.005 billion yuan in the first quarter of that year, a year-on-year decrease of 14.5%, and a net loss of 42.5 million yuan.

Faced with losses, Secoo attributed the crisis to being affected by the epidemic. Later, the epidemic situation improved slightly, but the losses did not improve, but instead became larger and larger.

In 2021, Seku's revenue was 3.132 billion yuan, a year-on-year decrease of 47.98%; a net loss of 566 million yuan, a year-on-year increase of 618%.

So three bankruptcy reviews followed one after another.

Behind the poor management, there will inevitably be voices from consumers and partners. Today, Secoo is facing a situation where a large number of complaints and suppliers are unwilling to ship to them.

On the Black Cat Complaint Platform, there are more than 17,000 complaints in Seco, and most of the complaints are "no delivery, no refund, and it is always displayed for delivery."

Secoo not only deceives consumers, but also owes suppliers payments. Seku and Zhuhai Guoquan Trading Co., Ltd. (hereinafter referred to as "Zhuhai Guoquan") had a trade dispute and were sued by Zhuhai Guoquan.

From October 1, 2020 to May 31, 2021, Secoo owed a total of 400,000 yuan to Zhuhai Guoquan.

Zhuhai Guoquan collected accounts many times, but Seco has not paid the money.

In addition to Zhuhai Guoquan, some suppliers have also sued Seco for defaulting on payments for goods, and some suppliers even owed more than one million yuan.

4. Being attacked from both sides, life and death

The situation in Secoo today must be related to its own operations, but it is also related to the overall market environment. In addition to the impact of the epidemic on demand, there is another more important reason, that is, the increase in competitors.

Because many luxury brands either build their own e-commerce systems or cooperate with traditional mainstream e-commerce platforms with more stable traffic and stronger user stickiness.

As a luxury vertical e-commerce platform, Secoo's living space has been continuously weakened by factors from all parties, and it has lost the hearts of suppliers and consumers, making it difficult to make a comeback.

Secoo has also taken self-rescue. At the end of 2020, Secoo tried to live streaming and sell goods. The first luxury live streaming base built in Beijing officially opened, and live streaming was carried out in various forms such as "playing" + independent live broadcast room", but it did not improve and failed to save it successfully.

Secou’s bankruptcy can’t help but make people think of what kind of products consumers need and what business model they can withstand the test of time.

In the same sentence, all business is ultimately about products and users. The intermediate links, such as live broadcasts, videos, e-commerce platforms, online and offline stores, are just channels to link products and users.

Perhaps, Secoo's bankruptcy only shows this simple truth. There is no way to take advantage of business. You must deepen your product and users and build your own core competitiveness in order to gain a foothold.

![[Taobao Operation] Taobao keyword optimization, how to do it specifically?](/update/1532677448l022777364.jpg)

EN

EN CN

CN