A well-known fresh food e-commerce platform - MissFresh

Now it's like walking a tightrope on a cliff

...

1. Close business in 9 cities in 3 days

It is reported that on the first anniversary of its listing at the end of June this year, MissFresh closed its business in nine cities in three consecutive days.

At present, MissFresh has forward warehouse sites in only 13 cities across the country, which means that nearly 70% of its business has been abandoned.

The closed city sites are:

On June 30, Suzhou and Nanjing will be closed;

On July 1, Hangzhou, Qingdao and Shenzhen will be closed;

On July 2, Guangzhou, Jinan, Shijiazhuang and Taiyuan will be closed.

The remaining sites are Beijing, Shanghai, Tianjin and Langfang, of which Langfang only has one forward warehouse point.

In 2019, at its peak, Daily Youxian business covered about 20 cities and had about 5,000 forward warehouses at its peak.

Now the business has shrunk significantly, which is a pity.

Some industry insiders said that MissFresh previously owed suppliers payments (about 1.6 billion yuan), which caused many suppliers to choose to stop cooperation, while suppliers willing to cooperate significantly increased the purchase price.

As a result, the platform SKUs are getting fewer and fewer SKUs, and the order volume also declines. At the highest, the order volume in one week has dropped by more than 30%.

And these problems may just be one of the many troubles that troubles Daily Youxian...

2. Delisting crisis! Receive 2 warning letters in a row!

Since its listing, MissFresh, known as the "first stock of fresh food e-commerce in China", has been as steep as a disaster.

The stock price fell 98% from the issue price, and the stock price has been below US$1 for 50 consecutive trading days.

Daily Youxian stock price from July 2021 to the present

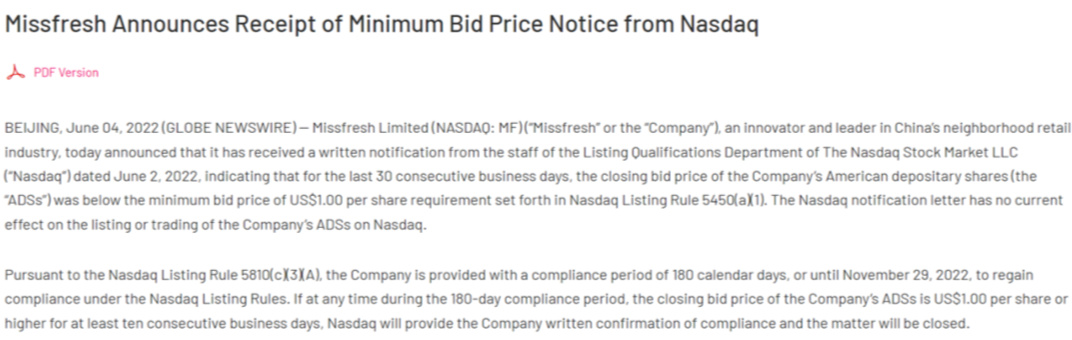

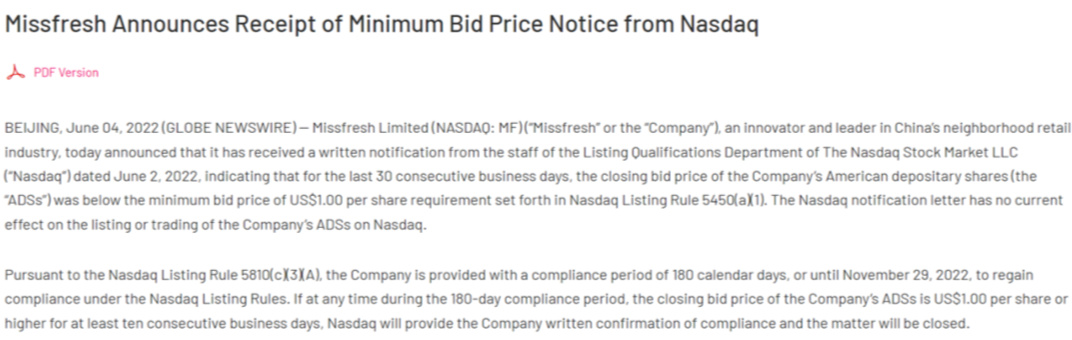

Therefore, in early June this year, MissFresh received a delisting warning from Nasdaq:

MissFresh has 180 days after receiving the notice, or will re-comply with the minimum stock price requirements by November 29, 2022. The company ADS will continue to be listed on Nasdaq during the period.

MissFresh said that this notice will not affect the company's business operations, and the company will take all reasonable measures to resume compliance within the prescribed grace period.

And on May 24 this year, not long ago, when I received the Nasdaq delisting warning.

MissFresh received a notice letter from the Nasdaq Listing Qualification Department for failing to submit its 2021 annual performance report on time.

For MissFresh, the stock price is less than US$1 and there is still time and way to solve it. However, as a listed company, the problem involved will be more serious.

3. Falling into "performance cloud"

Recently, MissFresh issued an announcement stating that the company cannot submit its 2021 annual report before the final deadline of April 30, 2022.

The reason may be that there is a problem with the company's financial data.

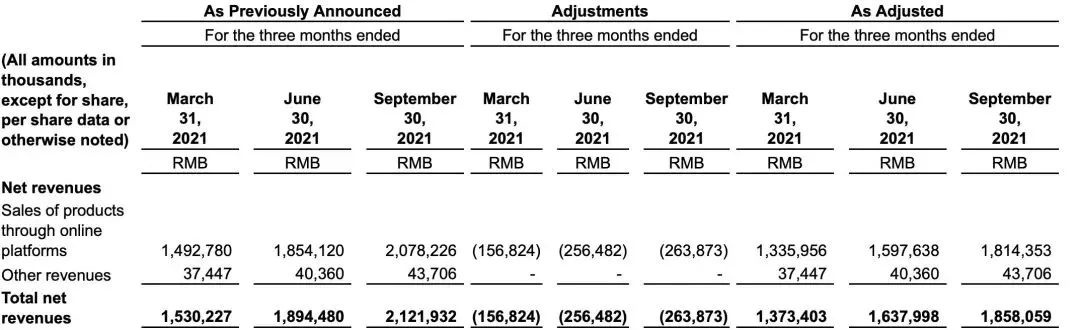

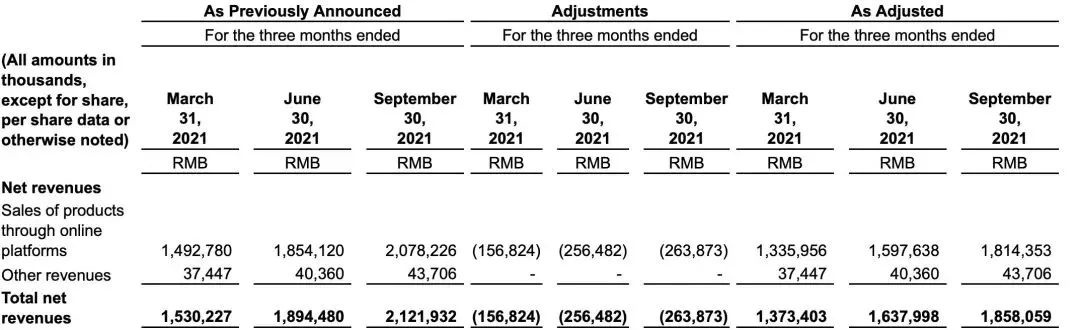

Regarding the "problem", MissFresh has now determined that some of its "next-day delivery" business units have suspicious transactions in 2021.

For example, there is an undisclosed relationship between suppliers and customers, different suppliers and customers use the same contract information, and lack of supporting logistics information.

Employees involved in "suspicious transactions" have submitted their resignation before the end of the review.

Regarding this incident, MissFresh has proposed two rectification measures:

1. Disciplinary punishment shall be issued to relevant employees involved in or responsible for suspicious transactions;

2. Improve internal control and risk management of the next-day delivery department, including subsequent employee training.

At the same time, the platform has terminated its partnership with suppliers and customers involved in suspicious transactions.

It is this "suspicious transaction" that has led to the delay in submitting financial reports for MissFresh.

It is understood that the "suspicious transaction" has increased the platform's net income in the first three quarters of 2021, namely from the original 1.53 billion yuan, 1.894 billion yuan, and 2.122 billion yuan to 1.373 billion yuan, 1.638 billion yuan and 1.858 billion yuan.

In addition, the above figure shows that MissFresh expects to lose 3.737 billion yuan to 3.767 billion yuan in 2021.

This figure has once again broken the loss record of MissFresh from 2018 to 2020 (2.232 billion yuan, 2.909 billion yuan and 1.649 billion yuan). In addition to the expected losses in 2021, MissFresh has accumulated a cumulative loss of at least 10.5 billion yuan in the past four years.

4. Is fresh food e-commerce a false proposition?

In 2022, there have been constant news that "Missue Youxian has defaulted on supplier loans", and the 1.6 billion mentioned above is one of them.

Although the court finally made a judgment, enforcing 5.3295 million yuan for MissFresh, it is undeniable that this exposed the current situation of MissFresh, or fresh food e-commerce industry - the financial situation is not optimistic.

According to statistics from the China E-Commerce Research Center, there are about 4,000 participants in the domestic fresh food e-commerce field , of which only 4% of them have the same revenue, 88% have fallen into losses, and only 1% have achieved profitability in the end.

As one of the "two heroes" of fresh food e-commerce, Dingdong Maicai, from 2019 to 2021, the company's net losses were 1.873 billion yuan, 3.177 billion yuan and 6.429 billion yuan respectively.

The increasing results have caused its cumulative losses of nearly 11.5 billion yuan in three years.

It is generally believed in the industry that the losses of fresh food e-commerce are related to the forward warehouse model of heavy asset operations.

Although the forward warehouse solves the problem of the "last mile" of fresh food and improves the user experience, the resulting profit problems are the pain point of the "difficult" of fresh food e-commerce.

After all, the forward warehouse model is a heavy asset operation. The terminal delivery cost will lead to higher fulfillment costs, and advertising marketing and preferential subsidies are also a cost that is difficult to abandon.

According to media data, the performance fee of the forward warehouse model is as high as 10-13 yuan per order, which is about 3 times that of traditional central warehouse e-commerce, about 2 times that of platform-based e-commerce , and about 6 times that of community group purchases.

Source Northeast Securities

Therefore, if you want to maintain the entire supply chain system well, you have to face problems such as low gross profit margin, high cost rate, weak profitability, and difficulty in obtaining and converting traffic.

At present, fresh food e-commerce can only make profits in first- and second-tier cities, and the layout of the whole country may be like a luxury for the present.

At the root of this, the forward warehouse model has become the original sin.

![#Laogao E-commerce Newsletter# [February 26 E-commerce Morning News]](/update/1519779573l517616211.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Morning News on January 18]](/update/1516237655l196024123.jpg)

![#Laogao E-commerce Newsletter# [E-commerce Morning News on August 8]](/update/1691456921l578135090.jpg)

EN

EN CN

CN