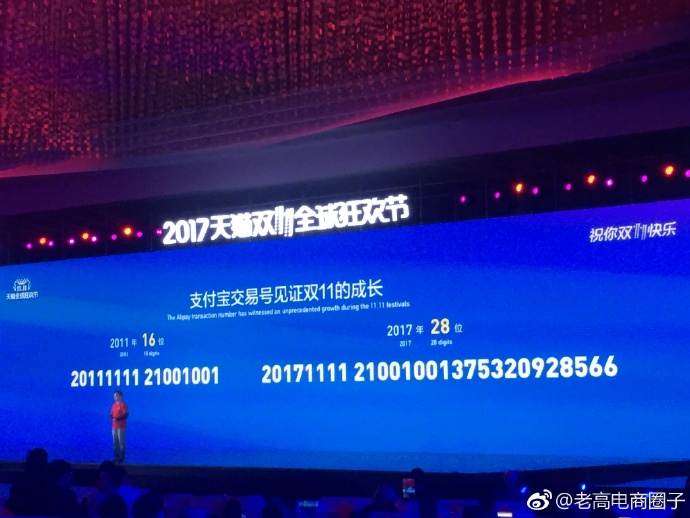

[Laogao E-commerce Club] Laogao E-commerce Club received news on the spot. Alipay Ant Financial Ceo said at the evening party on the 11th: Alipay transaction code witnessed the growth of Tmall Double 11!

Learn more >

Retail changes are the general trend, and new retail may also be the future trend. When talking about new retail, we need to know what new retail is; how giants practice new retail? How can entrepreneurs "decode" new retail and other issues.

In 2017, "new retail" was still a high-frequency word, and I haven't heard much about it in the past two months. The person who smelled the wind was already chasing the third or fourth wind in the past two months. The people who stayed behind have faith: what we are doing is a real big thing. Whether the tide is ebbing or not, what we are concerned about is not the ever-changing tides that people talk about, but the adherence to the essence of business. We firmly believe that retail changes are the general trend, and in the next few years, new retail will continue to have great opportunities.

When talking about new retail, we have to answer these questions first:

What is new retail?

Under the impact of online retail, it is difficult for traditional pure offline retail to make new breakthroughs after going through development stages such as real estate integration, channel upgrading, and brand rise. Online retail has gradually reached the ceiling of traditional traffic mode. "New retail" was "forced" against this background.

Try to define new retail in one sentence: the integration of all factors and scenarios in the retail value chain. The integration of online and offline, technology and data empowerment, online and offline traffic are directed and superimposed on each other, bringing the popularity of traffic, the popularity of square footage, and the optimization of the supply chain.

How do giants practice new retail?

The concept of new retail was first proposed by Alibaba. Alibaba's practice in the new retail field is of great significance to our in-depth understanding of new retail. In Alibaba's ecosystem, we see the following obvious trends:

1. Data-driven personalization, and user activity has gradually become the focus : the accumulation of massive data in multiple dimensions has allowed Alibaba to stand at a higher starting point, and personalization of content and products has become possible. Since 2016, as a Taobao user, my experience seems to have reached a turning point. Taobao understands me more and more, and it feels very obvious when I browse "Weidao". In addition to GMV, Taobao pays more attention to user activity, participation and usage time.

2. It reaches users through omnichannel and competes in multiple dimensions. With mobile payment as the fulcrum, users' consumption nodes from offline to online are fully accessible. In addition, Alibaba's business has also expanded to other fields, including finance, entertainment, local services, etc., further covering users from different angles, increasing penetration rates, and ultimately consolidating and enhancing the competitiveness of the retail field.

3. Continue to focus on supply chain and back-end systems. Alibaba, including JD.com, has invested a lot of resources and capital to improve supply chain management capabilities and upgrade back-end systems such as logistics. User experience continues to improve and platform costs continue to decrease.

Speaking of the new retail practice of giants represented by Alibaba, Hema is almost a typical case that cannot be avoided. Its benchmark significance for new retail is self-evident, but at the same time, it should be noted that Hema has great requirements for capital, and the cost of opening a store is tens of millions. Behind these advantages driven by scale and capital accumulation are incomparable to startups.

How do entrepreneurs "decode" new retail?

People (target consumers), goods (consumer goods), and places (consumption environment, scenarios and channels) are the three major elements of retail. Regardless of the times and technological development, they will never be separated from their roots. Entrepreneurs should look for "light" opportunities in the combination of people, goods and markets, seek breakthroughs and differentiation, avoid the sharp edge of giants, and increase coverage and establish barriers at relatively low cost and relatively fast speed.

We sort out one by one by one according to the elements:

1. Product: The following aspects are all companies trying to make differences

Supply chain: For example, NetEase is selected and necessary, traditional home furnishing brands are scattered, the quality is difficult to measure, and the price cannot be compared. Strictly select high-quality factories, optimize the supply chain, and select home furnishing products with reasonable cost-effectiveness.

Source: Whether it is import or export, cross-border e-commerce provides consumers with a source of goods that are different from local products. Xiaohongshu helps users discover and buy good things from all over the world, while the new unicorn JollyChic brings cost-effective Chinese products to Middle Eastern consumers.

Category: Second-hand products, furniture, etc. are all categories that are difficult for general e-commerce to operate well. Xianyu has grown into a relatively independent architecture and operation system within the Alibaba system, and 58 Zhuanzhuan has also grown into a considerable platform. Furniture, a category with high unit price, high decision-making threshold, high experience-oriented and high return costs, may also have innovative opportunities.

品牌:新品牌层出不穷,品牌就是最显著的差异点。

2. Field: The "field" of traditional e-commerce is mainly traffic business. How to buy low and sell high traffic , how to monetize the value of traffic well-known, and how to appear in the most conspicuous and high traffic are the key.

Now the methods of micro-business and distribution have redefined the traffic acquisition method and redefined the "field". Most of them have fast volume in the early stages, and the suitable products are generally: a. High gross profit, balancing channels and agency interests, b. Low after-sales service, reducing the difficulty of channel and agency operations, c. Non-standard products, not easy to compare prices, d. Wide audience, conducive to dissemination, and high conversion rate.

3. People: The key lies in how to improve users’ differentiated experience in the consumption process, thereby locking in users’ purchasing power.

There are fewer and fewer opportunities for low-cost traffic, and it is becoming increasingly important to firmly grasp users. For example, Xiaohongshu has moved the "shopping" experience online to meet users' needs to obtain consumer information, greatly increasing user activity and stickiness.

4. People + Goods: The integration of "people" and "field" has been widely used in social e-commerce, which also includes WeChat group buying, social e-commerce and other models. The specific discussion will be carried out below. We also look forward to more interesting patterns appearing.

The integration of "people" and "field" affects consumption processes on the one hand and helps consumers make consumption decisions. On the other hand, consumers themselves act as the scenarios and channels of the platform. Social e-commerce not only refers to social platforms, but also exists in various social scenarios, including offline social relationships and influence. In a social environment, users are the channels, and they can endorse products, share products, and help promote and convert products. It is worth mentioning that social e-commerce and micro-business are not the same. In social e-commerce, consumers are evangelists and are the platform's customer acquisition channels, while most of the promoters of micro-business are not consumers.

Looking back at the many e-commerce attempts in 2017, we have also seen some new trends: socialization, subscription-based, experiential, scenario-based and personalized consumption.

Social Commerce

Social platforms help users make consumer decisions, which is essentially another form of word-of-mouth marketing. "My neighbor often uses it", "My friend has bought it", "XX Internet celebrity recommendation", these do not seem to be advertisements, but are indeed the best-effect advertisements. When users see these, the purchase conversion is very natural. Social e-commerce solves three problems: natural scenes, natural trust, and low traffic.

Compared with the in full swing of social e-commerce on the WeChat platform, Facebook proposed and implemented Social Commerce earlier, but it was not successful. WeChat has natural advantages, and WeChat groups, circle of friends, and mini programs fully occupy users' time and sight.

I won’t buy today, and I will continue to push it tomorrow. I will cancel the WeChat group, and I will block the Moments, push the mini program, delete the APP, and follow the official account. After I cancel the clearance, I can also bubbling in the WeChat group from time to time through group buying, so that you can’t forget it even if you want to. As long as the user still uses WeChat, there is a chance to constantly awaken the user. Social e-commerce is even worse. Even if it is offline, users can still be awakened through offline social activities and other means. In addition, the purchase conversion process on WeChat has no additional jumps and interruptions, the experience is smooth and the conversion rate is greatly improved.

For example, Pinduoduo, low prices are the most important competitiveness and consumer awareness of the platform. The product is low-priced and has obvious non-standard characteristics. Using WeChat’s traffic dividends and order-sharing methods, we have obtained a large amount of low-cost traffic, and through the traffic advantages, we have formed negotiation capabilities with merchants, winning the compromise of the lowest price on the entire network, which has greatly improved the purchase conversion rate, further reduced the traffic cost, and formed a positive cycle. The decision-making time on Pinduoduo is very short and the process is very fast. The positioning of "absolutely low-price" lowers the user's decision-making threshold and eliminates the motivation to compare prices. Without a shopping cart is a successful innovation. Users no longer have the opportunity to worry about the shopping cart. Click to buy a group, click to pay, and complete the purchase in two steps. In addition, the "pin" itself also urges and hints to the user, hurry up, one is still missing, and the group is formed immediately!

For example, the big V store provides mother users with a platform for courses, products, and social activities through the dissemination of mother community. Mom members are both consumers and communicators. They discuss parent-child topics in WeChat groups, participate in online courses, share high-quality products, and organize various online and offline interactions. They can invite friends to become members, or they can become mom consultants, providing products and course consultations to other moms and earning corresponding income. The platform has handed over the work of maintaining user relationships and promoting user activity and stickiness to ordinary users. Users are gradually exposed and converted in online and offline social activities.

The WeChat platform has indeed made great progress in the full process funnel of e-commerce users (acquisition, conversion of Conversion, repurchase of Repurchase, and recommendation of Referral). Mini-program e-commerce has flourished in the past few months. While a large number of startups are pouring in, various e-commerce companies also regard mini-programs as an unmissable position, including JD.com, Mogujie, etc., which have also made many moves.

We continue to pay attention to the opportunities of mini-program e-commerce and look forward to seeing the next opportunity of 10 billion US dollars in this vibrant new world, but we also see too many similar ways of playing. Today, everyone sees the huge Pinduoduo, and all the top mini program e-commerce companies that have mostly started to make layouts in the early 2017 or even earlier. The new e-commerce that has the opportunity to win in the future still needs to be positioned, differentiated, and has a model and ability to continue to positively cycle and expand scale.

The mini program is ultimately a carrier. Perhaps there are early traffic dividends here, which may help some old players break the deadlock of traffic bottlenecks, and also help new players to quickly increase volume and open up the situation. Taobao's logic is naturally different from WeChat, but looking back at the history of Taobao's development, the early traffic dividends also made a group of merchants, and where are most of these merchants now?

Service Commerce

The core of service-oriented e-commerce is also to improve users' purchase conversion rate and repurchase rate through differentiated services.

1. Membership system: E-commerce platforms provide members with exclusive benefits, including product discounts, free shipping, free video and audio content, etc.

Amazon Prime is the most classic and successful membership case. Copying Prime is not suitable for domestic e-commerce. Domestic e-commerce needs different localized member benefits. Taobao members and JD Plus are also trying, but how to give users cannot be rejected and difficult to ignore. The member value that is willing to spread word of mouth, seems to be a while before.

Costco is also a benchmark for the success of the membership system, providing members with high-quality and low-priced products, making centralized SKUs, well-known supply chain capabilities, and even controlling the gross profit limit of the product, and profits rely on membership fees. This also endorses the price of the product to a certain extent and locks in the user's purchasing power. This is also the direction many retailers are learning, not just e-commerce.

2. Subscription system: Through subscription, cultivate users' consumption habits, increase consumption frequency, and lock in users' purchasing power.

Flowers and spend some time are good examples. Originally, flowers were a low-frequency consumer category. Through the once-a-week flower subscription service, it greatly increased the frequency and ARPU value of users purchasing flowers. Yi Ersan is similar. Users can change their clothes once a week, and they can wear more than 10 clothes provided by the platform in a month. Imagine which clothing e-commerce can maintain product interaction with users once a week, allowing users to try on more than 10 clothes on the platform in a month.

3. Experiential consumption: After seeing and trying it, users have established trust, have a real perception of the product, and the purchase conversion rate is higher.

Take Clothes II and San as an example. The user wears the platform's clothes, which fits well and is praised by friends. In this scenario, the purchasing behavior will naturally occur. In addition, large consumer goods with high decision-making thresholds, such as furniture, cars, and even houses, are always indispensable for most consumers to take a look and touch before buying. This is also why offline furniture stores such as JuRen Home have been difficult to be subverted for so many years. The new model "I'm at Home" meets user needs and provides users with a more economical choice to experience furniture offline.

In essence, social e-commerce and service-oriented e-commerce have more interactions with users, and have more opportunities to collect a large amount of user data to make personalized better.

More Information

More Information

[Laogao E-commerce Club] Laogao E-commerce Club received news on the spot. Alipay Ant Financial Ceo said at the evening party on the 11th: Alipay transaction code witnessed the growth of Tmall Double 11!

Learn more >

After announcing his hand with Zhejiang Satellite TV, on August 16, 2016, the "2016 Tmall Double 11 Carnival Night" once again came the important news: Shanghai Jahwa won the exclusive naming rights of this year's Double 11 Gala in one fell swoop, which also marks that the battle for resources for "super IP" is becoming more intense.

Learn more >

![#Laogao E-commerce Newsletter# [E-commerce Evening News on January 4]](/update/1634637709l862528272.jpg)

E-commerce News: Douyin Goods New Year Festival launches a national anchor event; Meituan flash sale: instant retail channel shopping has become a holiday habit for users; JD Logistics and Guangdong Foshan Municipal Supervision Bureau signed a strategic collaboration agreement; Amazon responds: Consumers can purchase Kindle through third-party online and offline retailers; Egypt's B2B fashion e-commerce company Gahez received a seed round of financing of US$2 million...

Learn more >

Platform Information Submission-Privacy Agreement

· Privacy Policy

No content yet