Two months ago, Qudian relied on 10 cents to exchange for 250 million GMV for the live broadcast room.

Qudian, which has topped the top 1 in the sales list with its "money ability", has become a well-known pre-made dish brand nowadays.

However, as time goes by, Qudian has not ushered in further development, and is replaced by a signal of retreating...

1. Loss of 60 million yuan

On September 6, Qudian, which was listed in the United States, released its unaudited second-quarter financial report.

Qudian's total revenue in the second quarter was 105.4 million yuan, a year-on-year decrease of 74.4%; net profit attributable to shareholders was -61.3 million yuan, from profit to loss, a year-on-year decrease of 122.71%.

Qudian's main business loan business revenue fell by 47.6% to 6.6 million yuan; financing revenue was 66.2 million yuan, a year-on-year decrease of 78.8%.

As of the end of June 2022, the total outstanding loan balance of Qudian was 700 million yuan, a decrease of 54.4% from the previous quarter.

Therefore, this Qudian pre-made dish project, which once declared "no cap on investment" and "comprehensive transformation", decided to streamline its QD Food business after evaluating the current market conditions, which may have an adverse impact on its financial status and operating performance.

Currently, affected by the QD Food project, Qudian's operating costs increased by 53% in the second quarter to 136 million yuan; sales and marketing expenses increased by 82.6% to 53.2 million yuan.

Qudian CEO Luo Min said in an interview with the media:

In the supply chain link alone, Qudian has invested more than 100 million in pre-made vegetables. Previously, major traffic platforms have spread the screen, with a daily increase of 4 million fans and a GMV of 250 million (according to the statistics of the third-party data platform Xin Dou), Douyin live streaming, including low-priced subsidies and advertising, is a "loss of money and profitable publicity."

While streamlining the pre-made dish project, Qudian claimed to continue to explore new business opportunities and protect long-term value for shareholders.

Does this mean that Qudian will "hide" the pre-made dishes depending on the situation? We don't know.

Is the "failure to Maicheng" of Qudian's pre-made dishes a track problem or a brand reputation?

Maybe the market can give the answer...

2. The giants cross borders

A pre-made dish track with a scale of 100 billion has also made Gree Electric, one of the leading electrical appliance companies, eager to try it out.

Dong Mingzhu, Chairman and President of Gree Electric Appliances, said on September 7:

Gree Electric will combine the company's own advantages to establish a pre-made vegetable equipment manufacturing company to provide technical support for the development of the pre-made vegetable industry.

With its own advantages and local policy support, Gree Electric will connect with Zhuhai Doumen Prefabricated Vegetable Industrial Park, the only provincial prefabricated vegetable industrial park connected to Hong Kong and Macao by land.

Using this as a platform, we will strengthen investment promotion, attract enterprises to gather, and build a full industrial chain system for the research and development, production and operation of pre-made vegetable equipment.

In fact, as early as 2015, Gree launched the "ready-to-eat meal" smart delivery cabinet. In May this year, Gree launched the concept and products of the "new light kitchen" again, providing scientific data support for ingredients cooking to solve the problems of kitchen "novice" in the cooking process.

In terms of experience, Gree has a certain industry experience, and it is time to enter the prefabricated cuisine track at this time.

Coincidentally, at the end of August, logistics giant SF Express suddenly announced that it would launch a supply chain solution for the pre-made vegetable industry and comprehensively deploy the pre-made vegetable industry.

Although it only helps the pre-made dish track to open up the supply chain, it also proves that the pre-made dish track has become a popular industry.

Moreover, SF Express launched the "Feng Food" project long ago, aiming at the takeaway market, attracting nearly 100 chain brands including Dicos, Pizza Hut, Ashichina Ramen, Xibei, Zhen Kung Fu, South Beauty and other chain brands.

Like Gree, SF Express has the same experience. In terms of technical difficulty, it is very likely that SF Express will enter the pre-made dishes in person.

In addition to Gree and SF Express, e-commerce platform giant JD.com also formed a special operation team to manage pre-made dishes in 2017.

In September this year, Zhao Yu, the head of JD pre-made dishes, said that in the first half of 2022, the transaction volume of pre-made dishes on JD platform increased by 170% year-on-year. In the next three years, JD will build 20 pre-made dishes with sales of 100 million yuan and 5 pre-made dishes with sales of over 500 million yuan.

3. Pre-made vegetables at the upper air outlet

It seems that under the influence of factors such as "lazy economy" and home stay in the epidemic, the pre-made dish model has emerged and has become a hot commodity in the eyes of giants from all sides.

Tianyan Check data shows that at present, there are more than 72,000 domestic pre-made vegetables, mainly concentrated in six provinces: Shandong, Henan, Jiangsu, Hebei, Guangdong and Anhui, accounting for a total of 49.78%.

Last year alone, there were 4,031 newly registered pre-made dishes related companies.

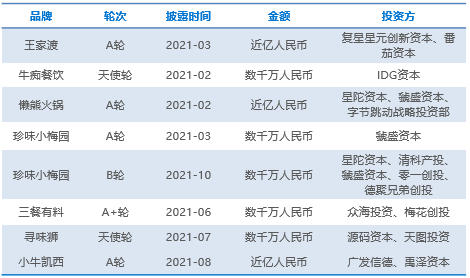

According to the "2022 China Pre-made Vegetable Industry Insight Report", from 2013 to 2021, there were 71 investment and financing events in the pre-made vegetable industry, with a total financing amount exceeding 1 billion yuan; what's even more crazy is that there were 40 investment and financing events from 2021 to March 2022 alone, and many single investment scales have exceeded 100 million yuan.

At the same time, according to research data from iMedia Consulting, in 2021, the size of China's pre-made vegetable market was 345.9 billion yuan, a year-on-year increase of 19.8%. It is expected that China's pre-made vegetable market will maintain a high growth rate in the future. By 2026, the size of the pre-made vegetable market will exceed one trillion yuan.

Behind these lively and jumping data is a stronger endorsement...

In recent years, relevant state departments have issued a number of policies, including "Outline of the "14th Five-Year Plan for the Green Food Industry", "Guiding Opinions on Promoting the Healthy Development of the Food Industry", "Opinions of the General Office of the State Council on Accelerating the Development of Cold Chain Logistics to Ensure Food Safety and Promoting Consumption Upgrade", etc.

In March this year, Guangdong Province issued the "Ten Measures to Accelerate the High-Quality Development of Guangdong's Pre-Made Vegetable Industry", which proposed to accelerate the construction of an influential pre-made vegetable industry highland across the country and even the world, and promote the high-quality development of Guangdong's pre-made vegetable industry to be at the forefront of the country.

With this support, the track that seems to be difficult to do can be blown to the front end of the air vent.

There is no doubt that pre-made dishes have become a star track.

Laogao E-commerce Investment strategically invested in the new domestic pre-made dishes quasi-unicorn company "Red Xiaochu" in January this year.

At present, "Red Chef"'s annual GMV has exceeded hundreds of millions. It has cooperated with more than 1,000 anchors such as stars Chen He and Jia Nailiang, and sponsored popular variety shows on TV, becoming a new star brand in the new consumer pre-made vegetable industry.

其创始人周啟坤周总是我们金冠俱乐部的会员,他认为

At present, pre-made dishes are still in a market cultivation period in the minds of consumers. The past year has been a testing stage, understanding user needs and promoting the improvement of the industry's supply chain and cold chain logistics levels.

Pre-made dishes will become a new trend in food consumption in the next few years. At that time, post-00s graduated from college and started working, and post-95s generally entered the age of 30 and became the backbone of society. Generation Z, represented by them, has shown unprecedented reduction in cooking ability and willingness for young people. The existence of pre-made dishes provides such people with solutions to eat at home.

For the C-end market, pre-made dishes are a kind of accumulation and development, which requires consumers to gradually adapt to the usage habits of pre-made dishes, to meet the tastes of consumers, and to ensure the efficiency of cold chain logistics.

For the B-side, customers have clear customer needs. Enterprises only need to do a good job in customized R&D and respond quickly through channels to become a continuous business.

Therefore, merchants who want to join the pre-made dish track need to have the ability to reach channels and complete supply chains at the same time, and even have certain brand differentiation.

The track is a good track, but not everyone can easily get a piece of the pie.